- Ultimately, I think that’s going to be a game in the crude oil market, people were going to be looking for “cheap barrels” to take advantage of before pushing the market much higher.

- With this being the case, pay close attention to the value trade, because I think that is what is going to be driving markets this year.

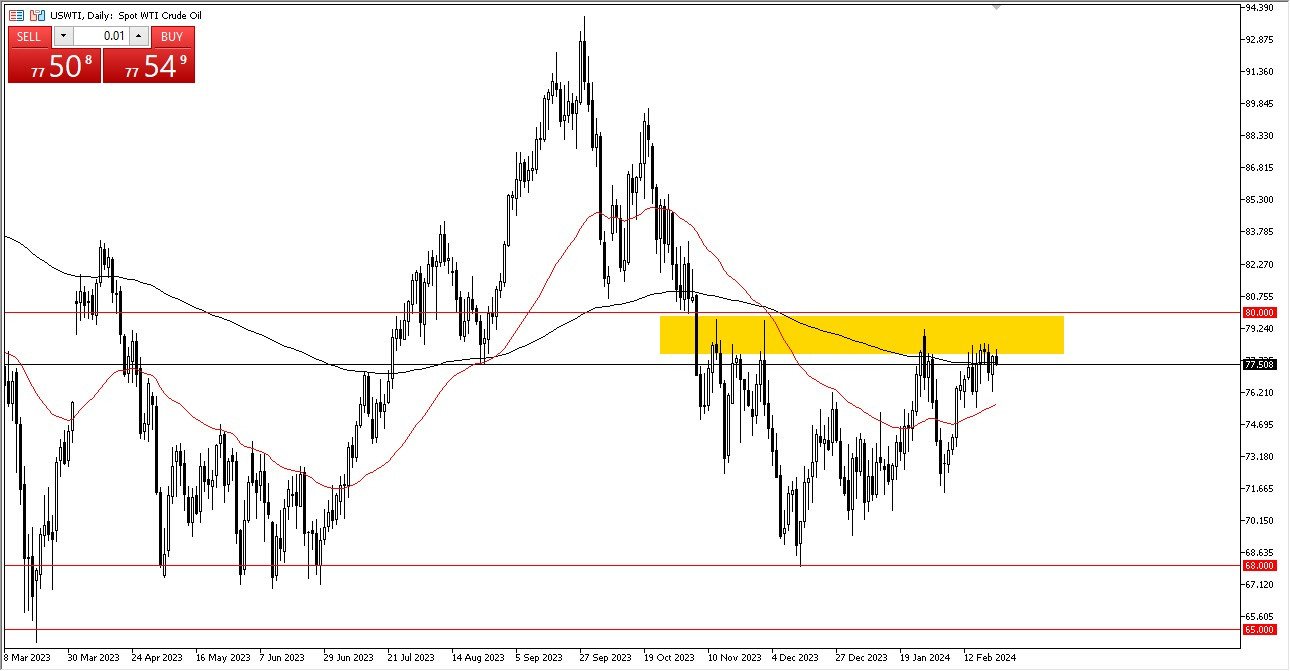

WTI Crude Oil

As you can see, we have somewhat dropped value in the WTI crude oil grade while we keep circling the 200-day EMA. Given that this has been a bottoming process, this is not a major surprise, the only thing that interests me right now is whether or not we can break above $80. The market will break through a lot of resistance there, and that will be the signal that we are ready to really take off to the upside. Indeed, I believe there will be buyers on short-term pullbacks, particularly in the vicinity of the 50-day EMA. Do keep an eye out for what may be the beginnings of a rounding bottom or possibly an inverted head and shoulders pattern. Naturally, there is also a shortage of supply and a global attempt by central banks to lower interest rates in an effort to boost the economy.

Top Forex Brokers

Brent

The Brent market is essentially the same, and we will be closely monitoring the $84 level above, in my opinion. And if things pick up from there, we might see a rise of roughly 10% and hit the $90 mark. My longer-term goal is to reach this, but we'll have to wait and see how long it takes. In the end, the 50-day EMA and the $80 mark should provide enough of support for any short-term decline. Once more, Brent and the WTI market are similar in that a gigantic, inverted head and shoulders is forming. And I do believe that, if for no other reason than the cyclical and seasonal aspects of the approaching driving season, it is probably just a matter of time before we set off. As spring approaches, the northern hemisphere—that is, the United States, Europe, etc.—will require more energy. All else being equal, I believe that there will be a lot of choppiness in this market, but I also believe that there will be short-term pullbacks since each bounce attracts more bargain seekers.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.