- Crude oil has been extraordinarily resilient during the month of February as every time we have pulled back, we have seen buyers jumping back into the marketplace to take advantage of “cheap crude.”

- I suspect this will continue to be the case going into the month of March.

WTI Crude Oil

The West Texas Intermediate Crude Oil market has been more of a “buy on the dip” market during the month of February, and as I write this article at the end of the month, it’s currently testing the 50-Week EMA. When I look at the chart, the most obvious level to pay attention to at this point in time is going to be the $80 level, and I think that’s the gateway to much higher pricing. If and when we can break above the $80 level, and I do think that happens, it’s very likely that this market will pick up another $8 per barrel in a relatively short order.

Top Forex Brokers

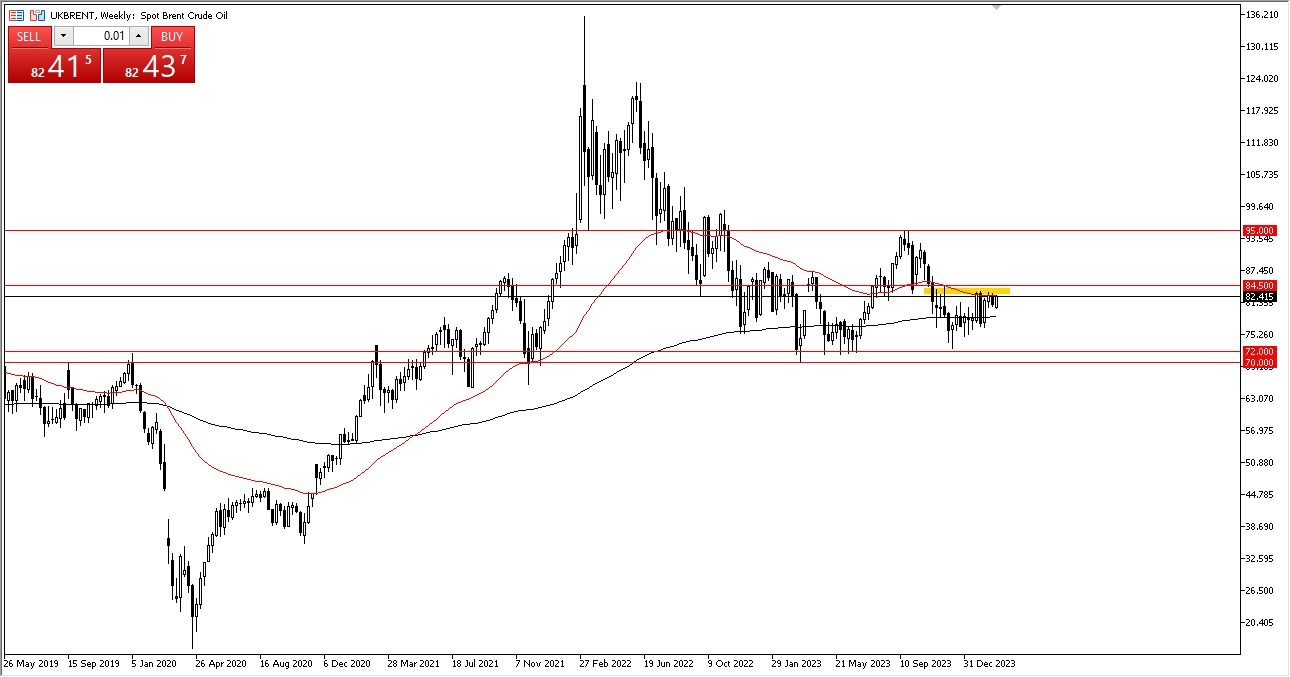

Brent

As per usual, the Brent Crude Oil market, or the UK Oil market if you are using CFDs, is following right along with WTI Crude Oil. The $84.50 level in this market is the gateway to higher pricing, and I think that gets broken as well. In that environment, I could see Brent going all the way to the $92 level rather quickly, and eventually reaching the $95 level. That being said I don’t think it reaches the $95 level in the month of March, but I do think that’s coming given enough time.

The outlook

At this point, I think that crude oil is simply very much like a beach ball being held under water. What I mean by this is that eventually we will break the surface, and when we do there should be quite a bit of follow-through. There are a lot of reasons to believe that crude oil will continue to go higher eventually, not the least of which will be the Houthi attacks in the Red Sea, and other geopolitical tensions in the Middle East.

Furthermore, supply is starting to dwindle, and of course we are starting to head into the time of year where demand picks up anyway. With that being the case, I think you have got a situation where the market is eventually going to explode to the upside, if for no other reason than seasonality.

Ready to trade our Forex monthly forecast? Here’s a list of some of the best Forex trading platforms to check out.