- Despite being somewhat quiet on Monday, the crude oil markets appear to be in good general shape.

- In light of the fact that Monday was Presidents' Day in the US, you should keep a careful eye on any liquidity concerns, but overall, the market appears to be fairly optimistic.

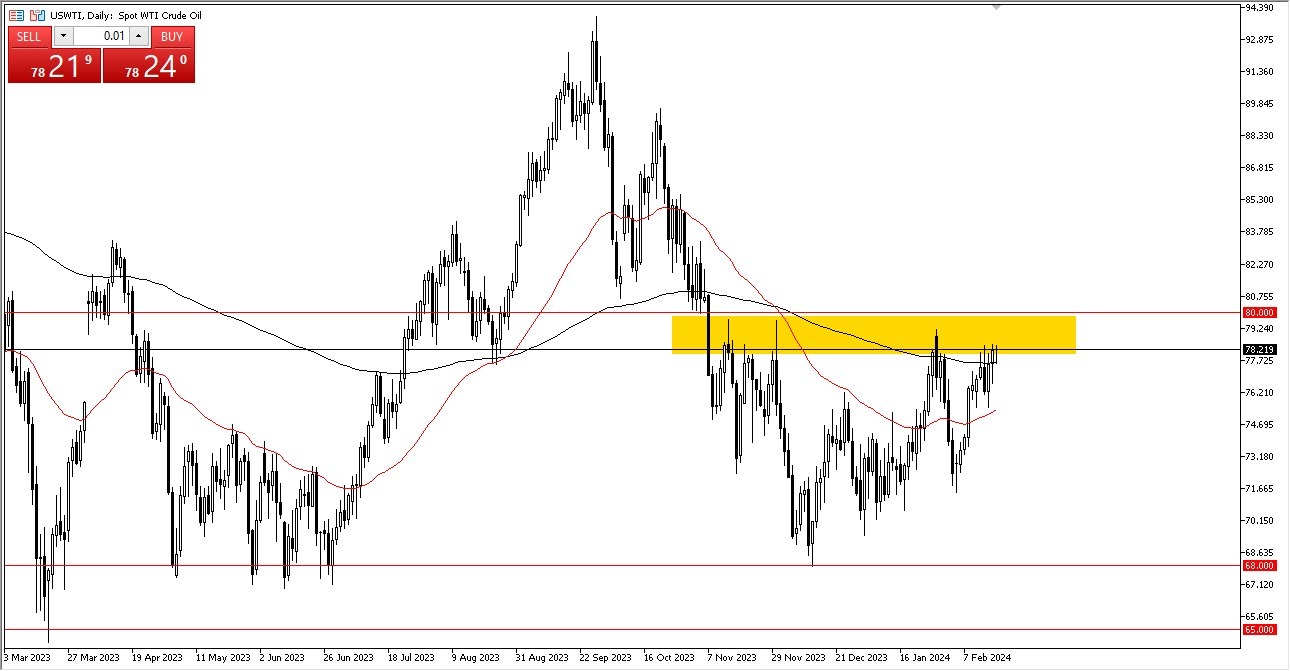

WTI Crude Oil

As you can see, the WTI crude oil market has somewhat retreated during Monday's electronic trading session. Let's wait and see how this develops, as the 200 day EMA has provided some support. However, there does appear to be a lot of selling pressure over the $80 mark. I do think that the $80 level offers up a move to the $82.50 level, maybe even the $85 level, if we can break above it. I believe we are beginning to see crude oil start to show its strength. Short-term pullbacks at this point in time continue to find a buying opportunity all the way down to at least the 50-day EMA, probably even lower than that in general.

Top Forex Brokers

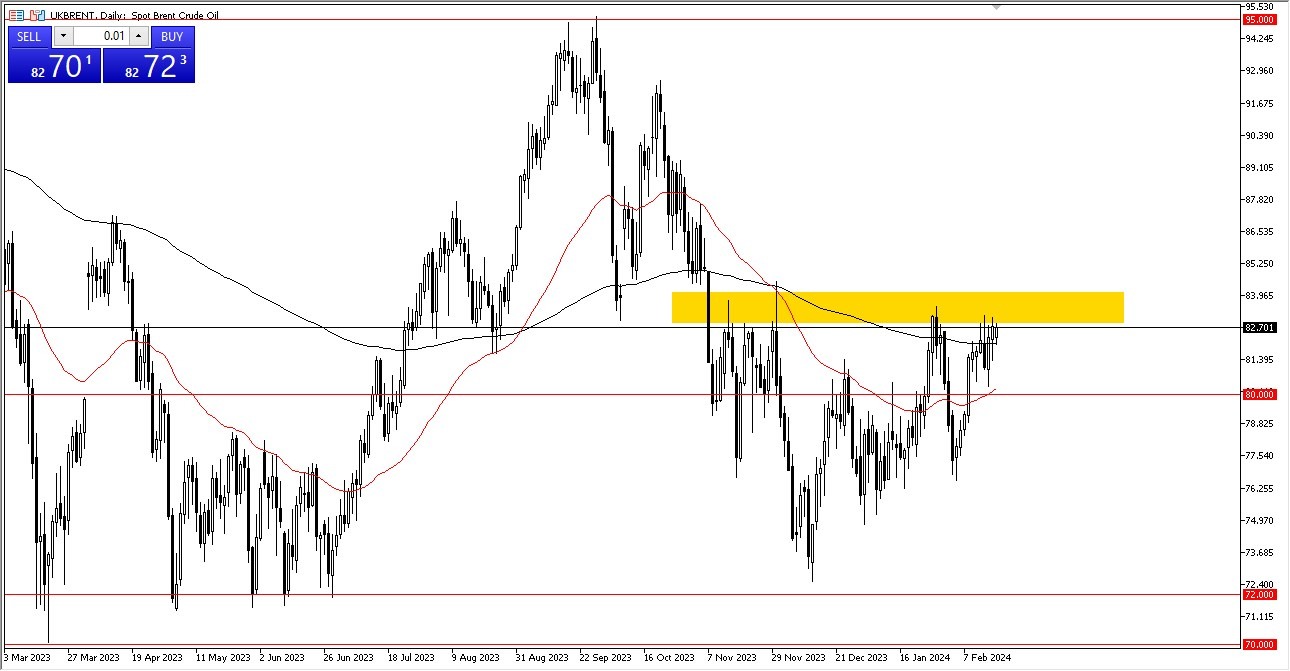

Brent

Brent finds himself in a similar predicament. If we can break over the $83.50 level, which I think will serve as a significant resistance barrier, we might be able to move up to the $87.50 level or perhaps $90. I believe that you are a buyer of dips overall. Moreover, the 50-day EMA is positioned exactly around the $80 mark. This obviously will capture the attention of a lot of different traders.

Furthermore, a lot of people are obviously aware of the 50-day EMA. Remember that there is a scenario in which it appears that global central banks would ease monetary policy, which many traders believe will spark economic growth. And in that event, there will be a greater need for crude oil. Additionally, this market exhibits seasonality as the driving and travel seasons begin. somewhat of a head and shoulders inversion. Though it's a messy one, I believe a lot of people are also focusing on it. Having said that, I believe it will only be a matter of time until we start fighting for the upside.

Ready to trade WTI/USD? Here are the best Oil trading brokers to choose from.