- The Euro exhibited minimal activity on Thursday, maintaining its position within a defined range.

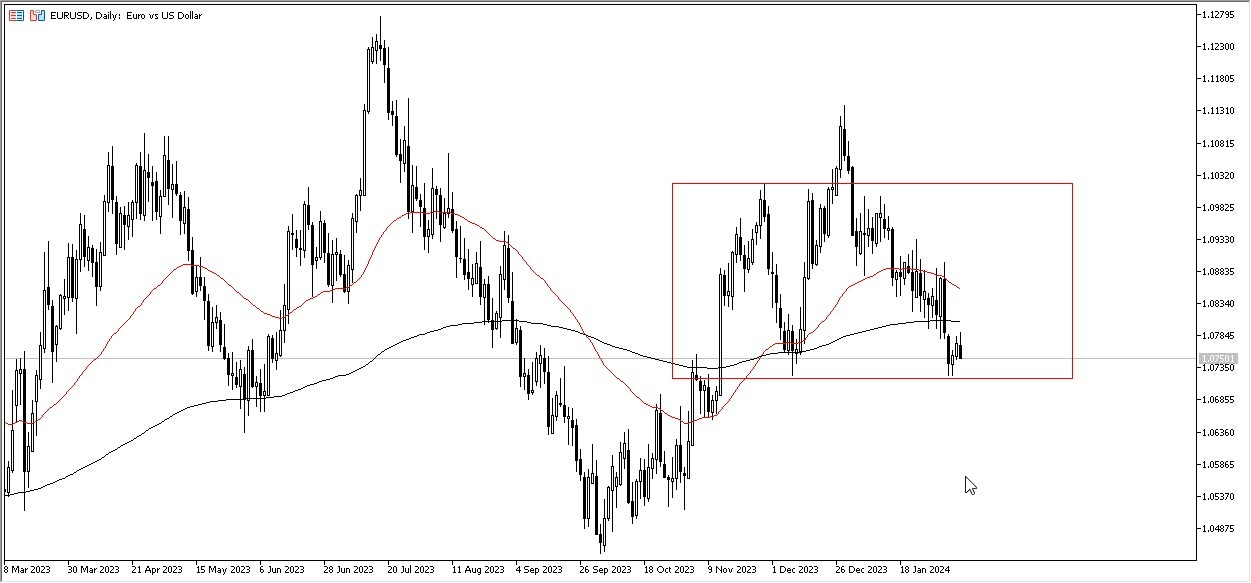

- There's a notable emphasis on testing the lower boundary of what appears to be a significant consolidation zone.

- Specifically, the 1.07 level is drawing considerable attention, warranting observation for potential shifts.

- This is an area that I will be watching closer at this point in time. The market is paying close attention to it, so we could see a lot of action there.

A breach beneath the 1.07 level could signal a pathway towards the 1.05 mark. Notably, this figure holds significance as a prominent round number, likely prompting heightened market scrutiny and potentially providing substantial support. Conversely, a breakout above the 200-day Exponential Moving Average may lead to further advancements towards the 50-day EMA. Such a movement would signify a weakening of the US dollar, resulting in a broader decline in its strength.

The current market dynamics reflect an ongoing effort to reconcile the Euro's annual range. Trading the Euro inherently involves navigating within established ranges, a characteristic defining its behavior. This range is something that you almost always see every year, as the EUR/USD pair isn’t necessarily known for its longer-term volatility.

Top Forex Brokers

Fed Rate Cuts

Looking ahead, the Federal Reserve's anticipated rate cuts in 2024 have already influenced the US dollar's trajectory. Conversely, the Euro has faced recent downturns attributed to mounting expectations of similar measures by the European Central Bank (ECB). This sentiment is exacerbated by looming concerns over the German economy's descent into recession.

Given these circumstances, the prospect of considerable fluctuation throughout the year is apparent. However, indications suggest a proximity to the lower end of the spectrum rather than its peak. Consequently, observers remain vigilant for signs of a notable rebound in the near future.

In the end, the Euro's recent performance reflects a cautious approach within a defined trading range. With global economic factors and central bank policies shaping its trajectory, the currency's movements are likely to remain dynamic. As market participants monitor key levels and anticipate potential shifts, the Euro's journey within the trading landscape continues to unfold.

Ready to trade our Forex daily analysis and predictions? Here's a list of regulated forex brokers to choose from.