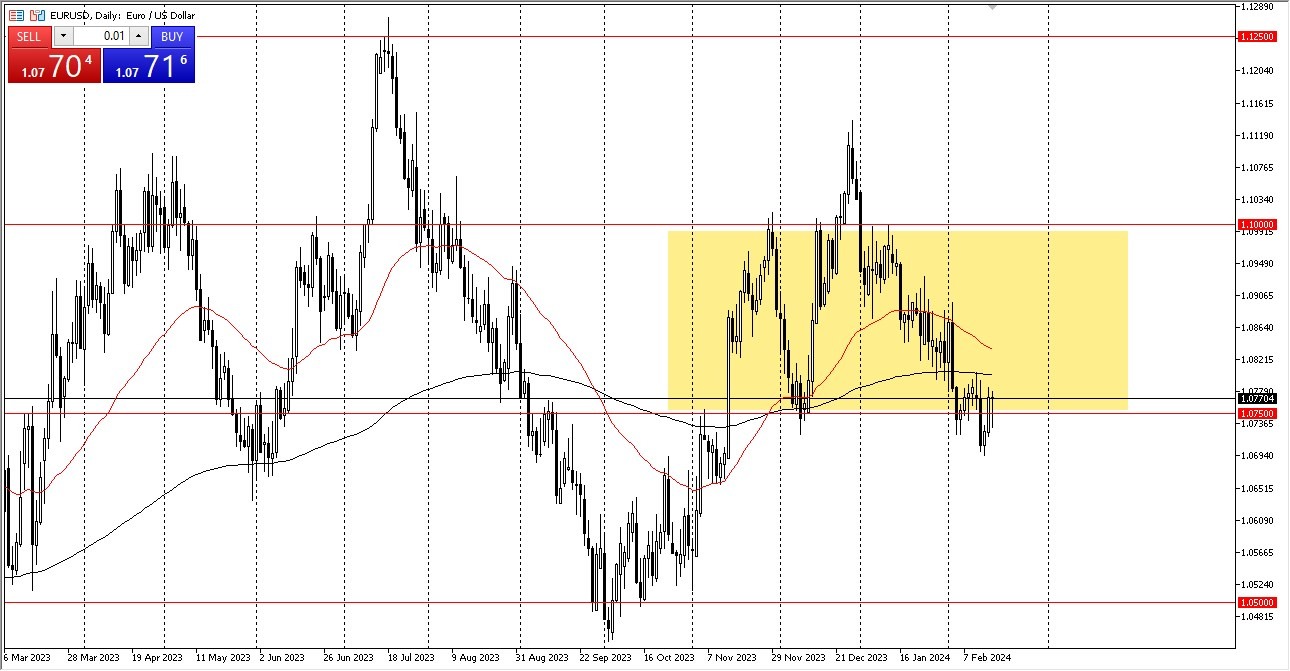

- In Friday's trading session, the euro initially experienced a minor decline but later displayed signs of recovery, bouncing back from the lower end of a substantial consolidation range.

- This will be the major factor when trading this market, as it does tend to be very rangebound over the long term.

The EUR/USD pair encountered a slight dip during Friday's session before regaining momentum. Notably, the 1.0750 level acted as a support level, garnering attention from market participants. A breach below this level could signal a move towards the 1.07 mark, representing the most recent swing low and potentially triggering significant selling pressure.

Top Forex Brokers

Despite this, the current market dynamics suggest that the euro may be attempting to establish a base, aiming to re-enter the previous consolidation range. Key targets for upward movement include the 50-day Exponential Moving Average, followed by the 1.09 and 1.10 levels, which are perceived as crucial resistance points. However, the upper limit of the euro's potential remains capped around the 1.10 mark.

Rangebound is the Norm

Given the euro's tendency to remain range-bound, it is plausible that the pair will stabilize within the broader consolidation area. This forecast is further supported by expectations of rate cuts from both the European Central Bank and the Federal Reserve, suggesting a continued balancing act between the two currencies.

In assessing market dynamics, it is essential to consider the prevailing geopolitical landscape, which often influences investors' risk appetite. The US dollar, being perceived as a safe-haven currency, tends to attract capital during times of geopolitical uncertainty. Consequently, short-term rallies in the euro may present selling opportunities for swing traders, while nimble short-term traders may find profit potential in the pair's fluctuating movements.

At the end of the day, while the euro exhibits signs of attempting a recovery, the broader market sentiment remains cautious. Investors are advised to closely monitor key support and resistance levels, alongside geopolitical developments, to navigate potential trading opportunities effectively. Ultimately, the outlook for the EUR/USD pair hinges on the interplay between economic fundamentals, central bank policies, and geopolitical factors, shaping its trajectory in the near term.

Ready to trade our Forex daily analysis and predictions? Here's a list of regulated forex brokers to choose from.