- For the Euro, Wednesday was just like Tuesday; it's rating higher, but not necessarily by leaps and bounds.

- The market appears to be quite erratic and sideways right now, which makes some sense given that both central banks are probably going to be relatively dovish later this year.

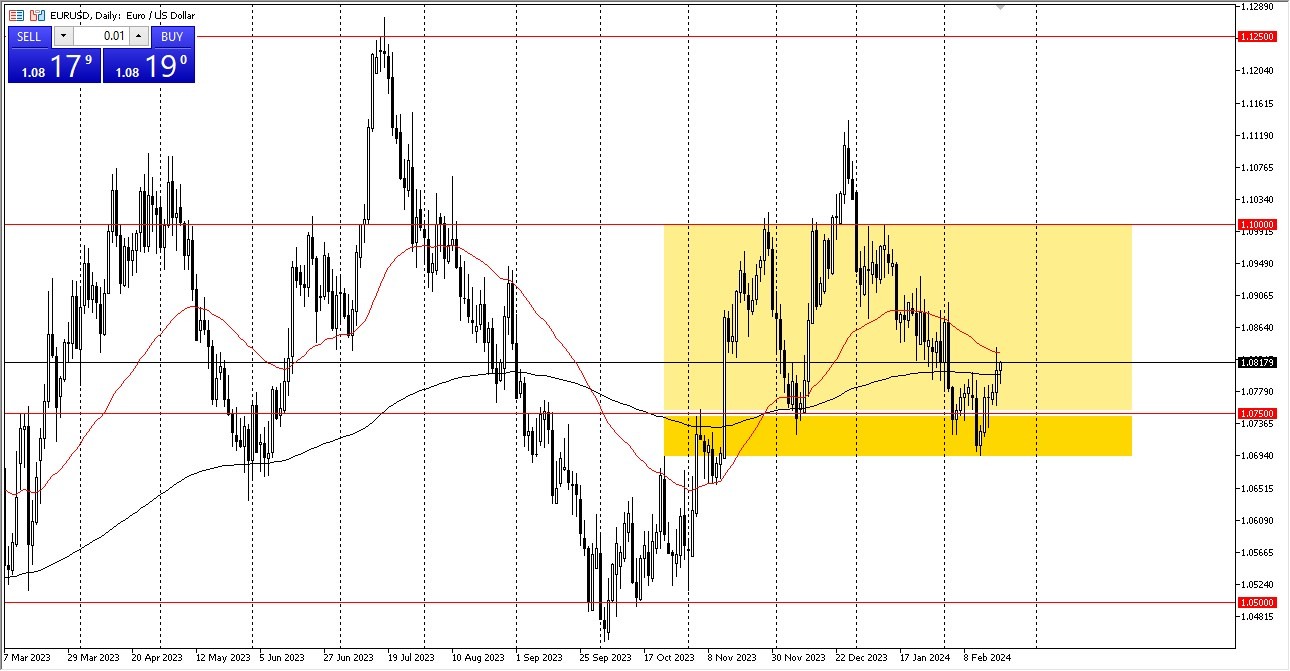

If you compare the euro to the US dollar, you can see that we are trading close to the 200-day moving average, which is situated at the 1.08 mark. Although I'm intrigued by the price action on Tuesday, when the euro surged to the 50-day EMA before giving that up, it's the enormous round figure that has my attention.

I believe that the market is only circling the 200-day EMA, attempting to figure out what to do with itself. As a sort of price pivot, the 1.0750 level is located underneath. Furthermore, bear in mind that we have experienced strong support from that level all the way down to 1.07. It appears that we don't really have much momentum to the upward at this point. But even if we do manage to keep moving forward, there will probably be a lot of obstacles. Given that, we need to consider that this market might be attempting to stabilize in a certain range. Furthermore, I believe that 2024 will witness a significant increase in range-bound trading. And the primary cause of this is the likelihood of rate cuts by central banks globally.

Top Forex Brokers

Boring Currencies? Yes.

That makes both of these currencies a little boring. The Federal Reserve and the European Central Bank will most likely be two of them. Having said that, I believe you need to see this through the lens of short-term swing trading. If, on lower timeframes, you are a range-bound trader, then this pair is probably going to be a good fit for you. Simply put, the daily chart shows that there is simply not enough room for significant movement without a significant announcement or other event. We just don't have it at the moment. Therefore, even though we could mill harder, the key word here would still be grind, and I believe 1.09 will be a challenging hurdle to overcome. A major selloff in what would likely be an overall pro-US dollar move would occur if we were to reverse course and close below the 1.07 mark.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.