- The early hours of Thursday saw a large rally in the euro since there is still a lot of erratic behavior.

- But now that we've reversed course and started acting negatively, it appears that we're still figuring out where this currency pair seems to be heading at the moment.

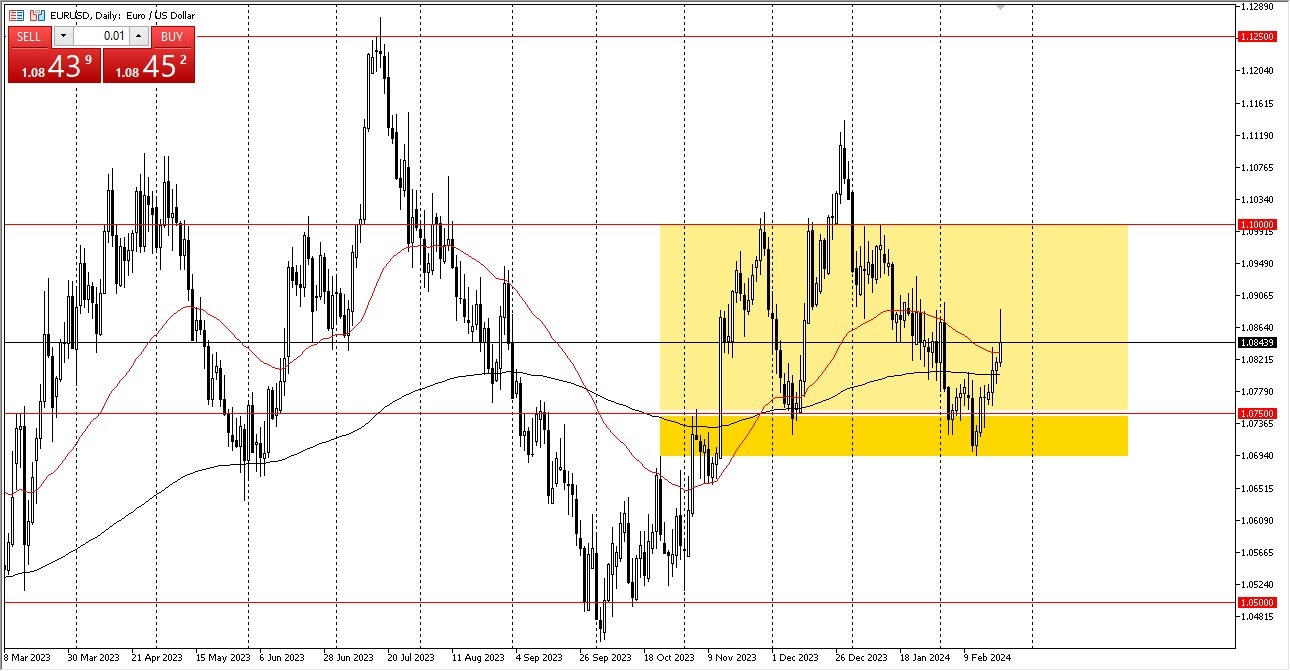

Thursday started out very wild for the Euro, as we saw a significant rally to hit the 1.09 mark. I believe that this market is really noisy, therefore it was a little unexpected that we came together in this way. Pulling back from the 1.09 level makes some sense because it has provided a lot of resistance, and it would be extremely unusual to just cut through it. In that scenario, the market is probably going to target the 1.10 level. I anticipate a lot of noisy behavior in this sector, and naturally, "market memory" will reappear since it was previously so resistant.

Top Forex Brokers

If everything else is equal, the market may retreat in the direction of the 200-day EMA. Below that area is the 1.0750 level. Given that the 1.0750 level represents a significant hard floor in the market, a lot of people will be closely monitoring this area. Remember that the markets are currently attempting to factor in the possibility that both of these central banks may ease monetary policy in 2024. As a result, we may be carving out a range for this asset for this year. We're not sure where the top is yet, but it appears that the 1.0650 level down is the bottom for the time being at least.

In light of this, we have a scenario where the market remains extremely erratic and loud. It will likely revolve around the state of the bond market as a whole and the direction of interest rate movements in the US. Since Germany is already experiencing a recession, the European Central Bank (ECB) will undoubtedly face pressure to loosen policy throughout the continent. Most likely, it's just a matter of time. Naturally, the Federal Reserve has previously declared that it will be making cuts later in the year.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.