- The euro has been somewhat noisy during the month of February, and I think that continues during the month of March, as we have a lot of moving pieces at the moment that will continue to throw the US dollar around, as well as the Euro in general.

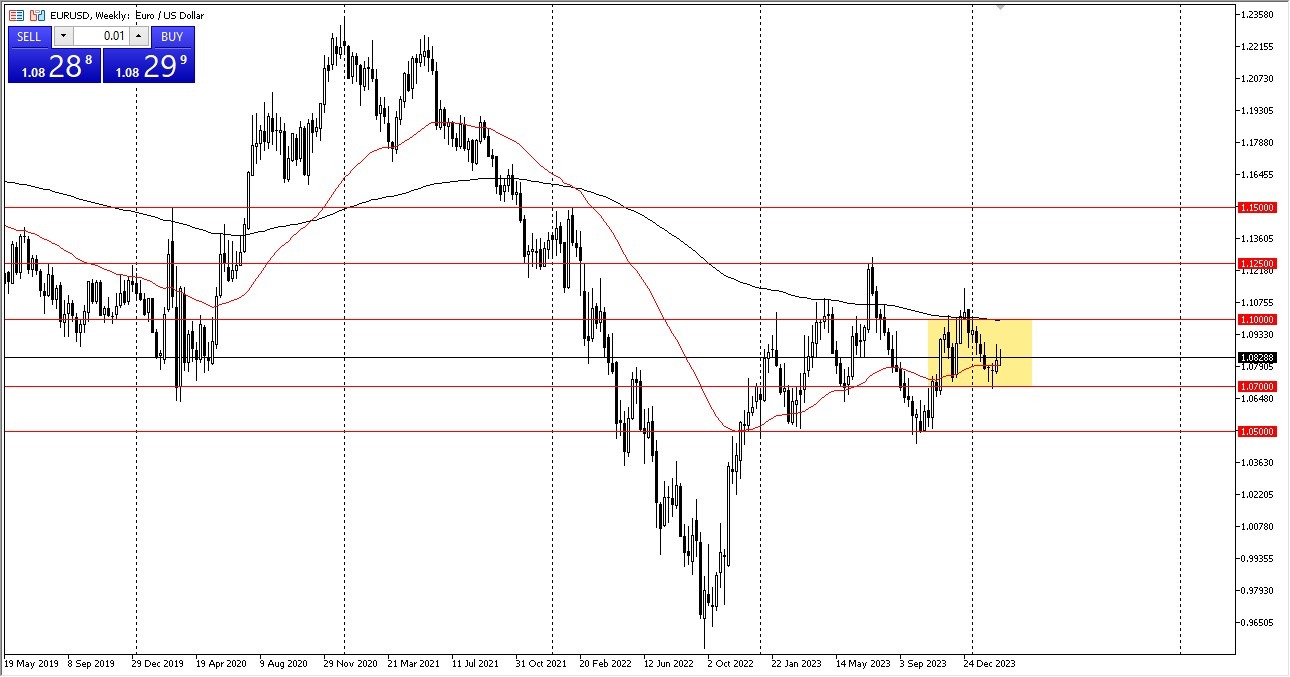

It’s worth noting that the euro dropped down to the 1.07 level, only to turn around and show signs of life. This suggests that there are buyers underneath, and therefore we could see a lot of support just waiting to happen. That being said, the 1.07 level is going to be an important level to watch going forward, and if we were to break down below there, I think it would open up quite a bit of US dollar selling pressure. On the other hand, to the upside we have the 1.10 level near the 200-Week EMA where the market has seen a lot of resistance previously.

Top Forex Brokers

That being said, keep in mind that the Federal Reserve is anticipated to cut rates 3 times this year, so that does have people thinking about the idea that the US dollar could lose a bit of strength, but at the same time the European Central Bank has to worry about the German economy heading into a recession, which of course would be very toxic for that economy and probably has the ECB cutting as well. In other words, it’s very likely that this market continues to be noisy as traders go back and forth.

The outlook

The euro continues to be very noisy, and I think that will be the case in the month of March. If we break down below the 1.07 level, it’s likely that the market will start to drop rather significantly and goes down to the 1.05 level. In that area, it makes quite a bit of sense of the US dollar would not only strengthen here, but against multiple other currencies as well. Alternatively, if we were to break above the 1.10 level, that would be very bullish for the euro, and perhaps signal that the US dollar is about to start falling apart, as we see a lot of noisy behavior in general. Ultimately, this is the market that I think will continue to be choppy and range bound so the month of March will probably be just as erratic as the month of February was.

Ready to trade our Forex monthly forecast? Here’s a list of some of the best Forex trading platforms to check out.