- The British pound has seen a boost in the past two trading sessions, signaling a potential upward breakout.

- However, it faces a crucial challenge as previous support now acts as resistance, marking a significant barrier to further gains.

- This is an area that could very well determine the next 200 pips in this pair.

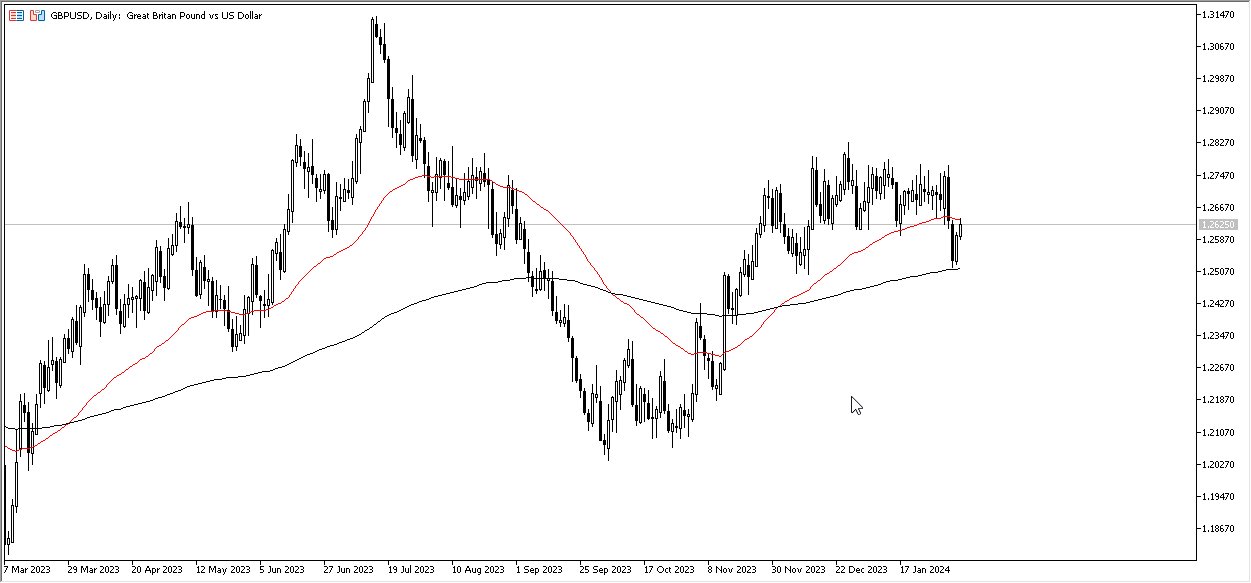

During Wednesday's trading, the British pound displayed strength, with the market eyeing the 50-day Exponential Moving Average as a key indicator. Notably, the area around this EMA holds significance as it represents a shift from support to potential resistance, a phenomenon often referred to as "market memory." This is something that I use a lot in my trading, so this chart now catches my attention as we see it forming.

Top Forex Brokers

The recent sell-off prompts scrutiny, with market participants questioning its longevity. A daily close above the 50-day EMA could pave the way for a retest of the 1.275 level, a historically resistant zone. However, breaking above this level may prove challenging, considering the prolonged resistance observed in recent months.

Jerome Powell and His Mouth

Jerome Powell's remarks last week regarding a potentially prolonged period of tight monetary policy have rattled traders, necessitating a reassessment of pricing. Below the market lies the 200-day EMA, offering robust support around the crucial 1.25 level. This underscores a broader trend of currency markets entering a consolidation phase, reflecting an environment of tightening monetary policies across central banks. This is going to possibly be a tough year for swing trading – we will have to wait and see how that plays out.

The prevailing sentiment suggests a potential return to a period of subdued currency market activity reminiscent of years past. Consequently, traders must adapt their strategies to accommodate range-bound trading conditions. The British pound exemplifies this trend, reinforcing the importance of closely monitoring key levels for potential trading opportunities.

In the end, the British pound's recent performance hints at a possible upward trajectory, albeit constrained by formidable resistance levels. Powell's remarks have added an element of uncertainty to market dynamics, emphasizing the need for vigilance and adaptability in navigating evolving conditions. As currency markets transition towards consolidation, traders must remain attuned to key levels to capitalize on potential trading opportunities amidst subdued market activity.

Ready to trade our Forex daily analysis and predictions? Here’s the best forex trading company in UK to trade with.