- Gold markets have seen a little bit of negative momentum during the month of February but has also bounced rather significantly from a major support level, and I think that might be the theme going forward.

- While I am bullish of gold, I also recognize that it could be very noisy on the way up.

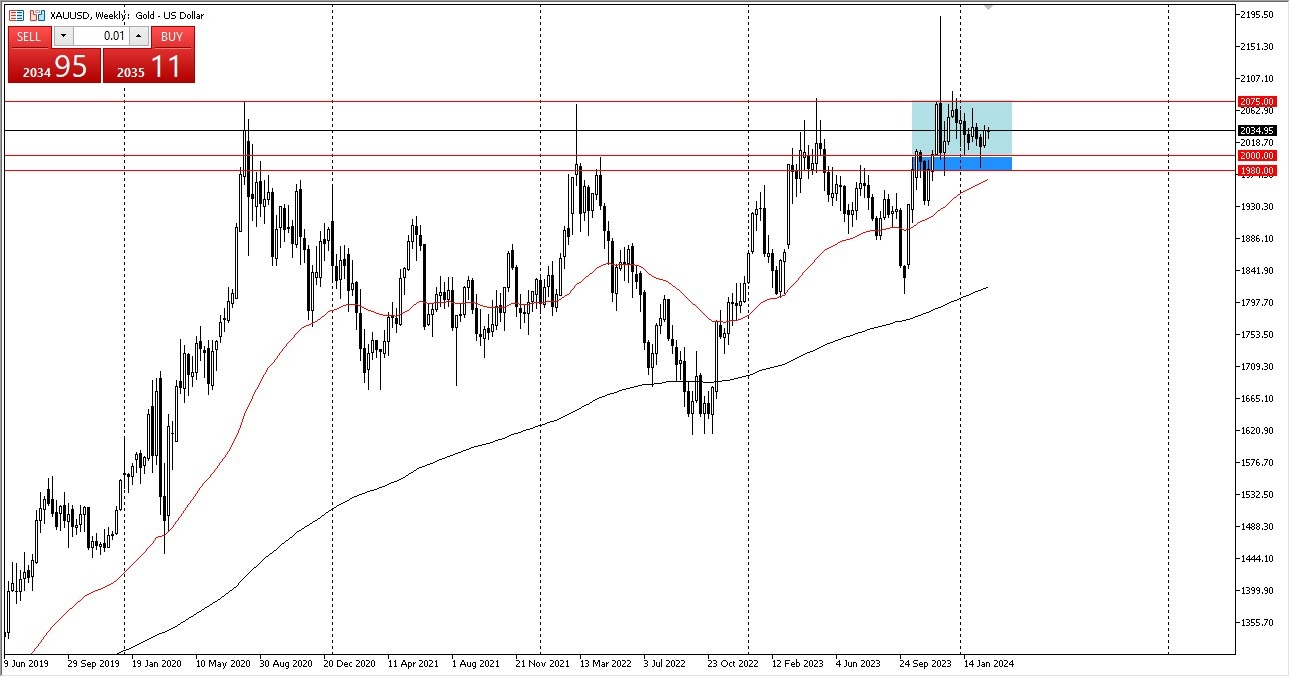

Looking at the gold market, I can see that there is an obvious support region that starts out at the $2000 level and drops down to the $1980 level. The $1980 level is also backed up by the 50-Week EMA, which is an indicator that a lot of longer-term traders will pay attention to. That being said, the market is very noisy, and I think that we have a situation where eventually buyers will continue to come back into the market and pick up “cheap gold.”

Central banks around the world are likely to cut interest rates this year, and I do think that given enough time gold will react to this. After all, as interest rates start to drop, it makes holding gold a little bit more palatable for the “big boys” out there in the financial world. Remember, many of them actually have to pay some type of storage fee, as they hold physical gold.

Top Forex Brokers

Speaking of central banks, they are net buyers of gold and therefore it does make quite a bit of sense that there is a certain amount of support underneath for it as the central banks around the world are by far some of the biggest entities in the financial markets. Beyond that, we had a massive hammer that formed in the middle of the month on the weekly chart that shows just how important that support level underneath is. Furthermore, there are plenty of trouble spots around the world to keep gold viable.

The outlook

Gold will continue to be bullish overall, but I also recognize that there will be a lot of noise in general. This will remain a “buy on the dips” market, and I do think that eventually we get to the $2075 level. Anything above there could send this market rocketing higher, but I also recognize that we have a lot of geopolitical concerns out there that should continue to put at least a little bit of a short-term floor in this market. I remain bullish.

Ready to trade our Gold monthly forecast? Here’s a list of some of the best XAU/USD brokers to check out.