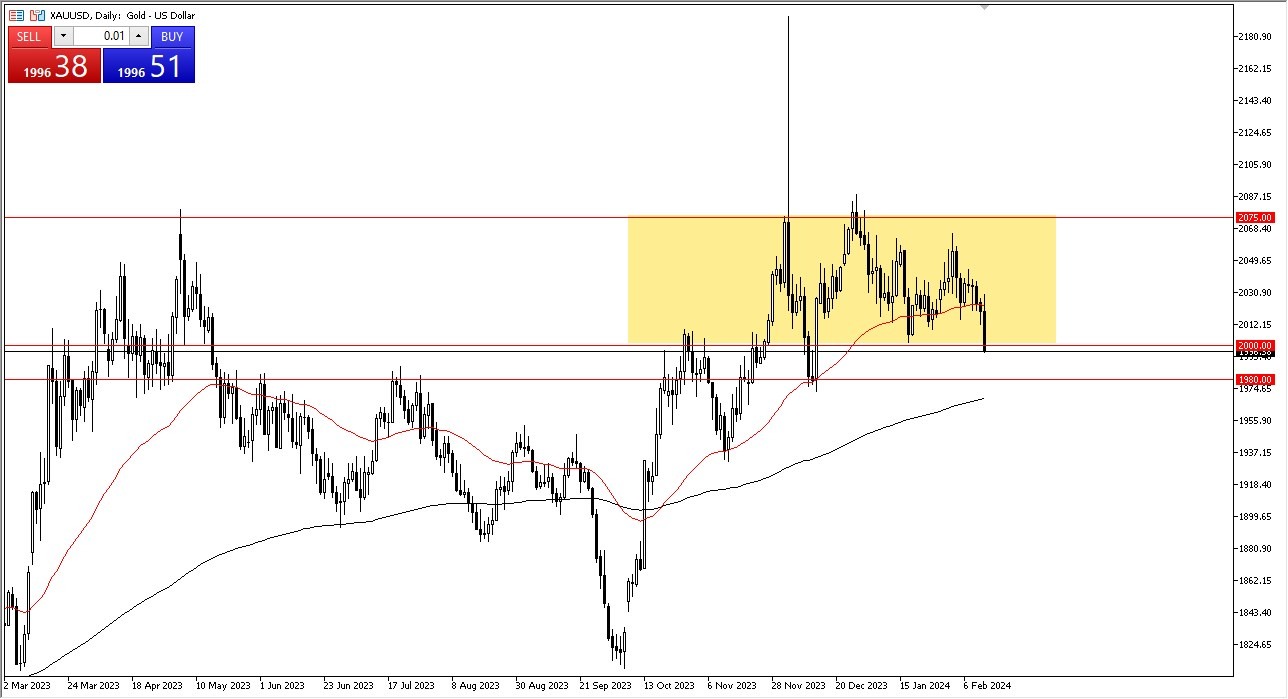

- You can see gold has pretty much collapsed during the session as we have seen higher than anticipated consumer price index numbers coming out of the United States.

The question now of course is, will this region of support hold? We are below the $2,000 level as I write this, but there is a zone of support that extends down to the $1,980 level that I think you need to be cognizant of. As long as we can stay above the 200 day EMA, technically we are still in an uptrend, but it's probably worth noting that this is a rather ugly candlestick, so I think the idea of breaking out to the upside might be on hold for a moment, which is neither here nor there.

Top Forex Brokers

But ultimately, I do think you have to look at this through the idea of finding value. If we get some type of bounce back above the $2,000 level, that would solidify the idea of this support. And I think a lot of traders would take advantage of that. I do think that there are a lot of arguments out there to be made for gold going forward.

After all, this is a situation that we find ourselves in where we have a lot of central banks around the world probably cutting rates despite the fact that CPI was so strong. But furthermore, we also have to pay attention to the fact that there's so much in the way of geopolitical concern. Sooner or later, the banks are going to start printing again and that's going to drive gold higher. Also, something that is not talked about as much, central banks around the world are buying gold hand over fist. That of course means that there is a huge buyer in the market. Because of this, I suspect this pullback is a bit temporary, I'm going to be drilling down to the four hour, maybe even the one hour chart, looking for opportunities to start scaling back into a position.

Ready to trade our daily Forex signals? Here’s a list of some of the top 10 forex brokers in the world to check out.