- Gold has displayed resilience over the past few days, with the $1980 level emerging as a key determinant of its future trajectory.

- While technical factors play a role, there are multiple reasons to consider gold as an attractive investment option.

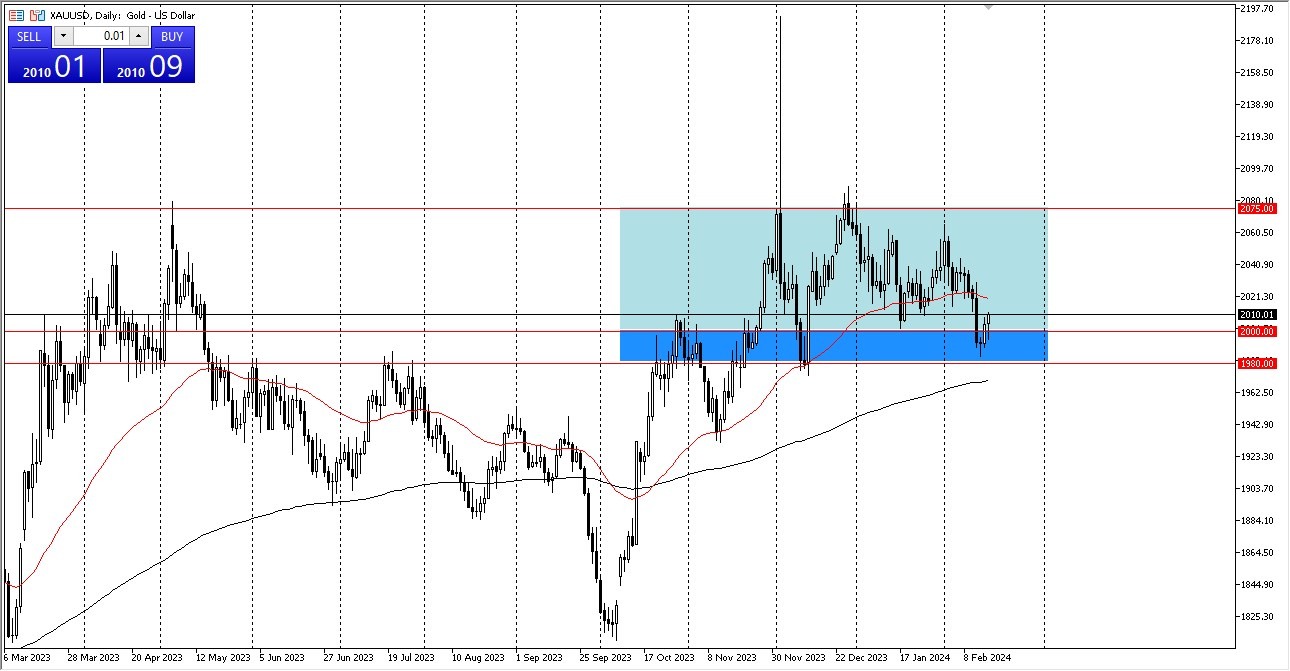

The recent bounce from the $1,980 level underscores its significance as a previous support zone. This area, extending up to $2,000, presents a crucial range for traders to monitor closely. The presence of the 200-day Exponential Moving Average near this level further reinforces its importance in the current market context.

The focus now shifts towards the 50-day EMA, located around the $2,020 mark. A successful break above this level could pave the way for further upside potential. However, the journey higher is likely to be met with challenges, and market participants are closely monitoring this development.

Top Forex Brokers

Breakout?

In the event of a sustained breakout, targets such as $2,060 and $2,075 become plausible. Conversely, a breakdown below the 200-day EMA could lead to a test of support around $1,940. Despite the market's inherent noise, well-defined support levels offer traders a reliable framework for decision-making for those that prefer rangebound trading and use such systems. I know that it can be difficult to deal with, but the reality is that the markets are still bullish, despite the recent pullbacks that we have seen.

Geopolitical concerns remain a significant driver of gold prices. Heightened tensions or geopolitical events have historically propelled gold higher as investors seek safe-haven assets. Additionally, the prospect of central bank rate cuts further bolsters the bullish case for gold. Quite frankly, I have a hard time thinking of a reason to short this market at this point in time. After all, this is a market that is about being safe, and this is something that is in short supply at the moment.

At the end of the day, the recent resilience of gold, coupled with technical and fundamental factors, underscores its appeal as an investment asset. While challenges lie ahead, the well-defined support levels and potential catalysts such as geopolitical tensions and central bank policies offer opportunities for investors to navigate the market effectively. As such, gold continues to be a focus for traders seeking to diversify their portfolios and hedge against uncertainty in the global economy.

Ready to trade our free trading signals? We’ve made a list of the top 10 forex brokers in the world for you to check out.