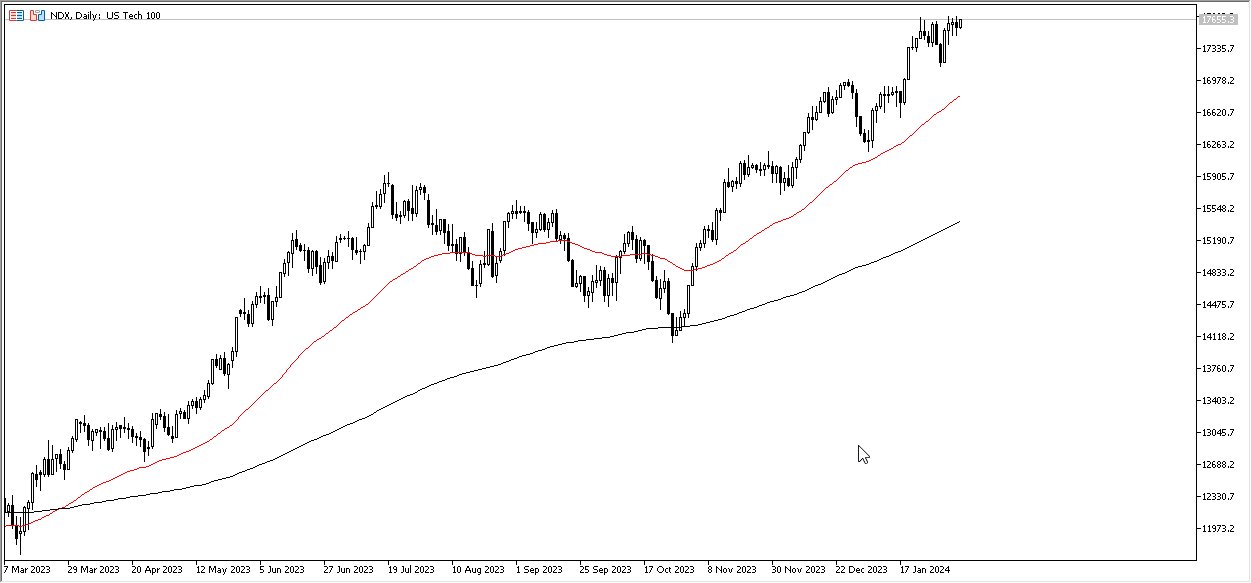

- The NASDAQ 100 appears poised for another surge as it inches closer to its all-time highs.

- This momentum is largely attributed to a select group of stocks dictating market movements, coupled with anticipation surrounding potential rate cuts by the Federal Reserve.

In recent sessions, the NASDAQ 100 saw modest gains, indicative of the prevailing upward pressure. The prevailing sentiment suggests a gradual buildup, hinting at an imminent breakthrough. Amidst this, the prospect of the Federal Reserve lowering interest rates has spurred optimism among investors. This is a correlation that people have been accustomed to, as it is all about “cheap money”, and not about the economy or profits anymore. It’s a casino at this point.

Forecasts point towards an eventual breach of the 18,000 mark, with market dynamics favoring buying opportunities on retracements. The 17,000 level is perceived as a significant support, underpinning market resilience amidst fluctuations. Conversely, the 18,000 threshold represents a psychological barrier, albeit one without historical precedent given the current all-time high.

Top Forex Brokers

Narrative Remains the Same

This narrative extends across other major indices such as the S&P 500 and the Dow Jones 30, reflecting a broader market sentiment. While recent sessions have seen sideways movement, the absence of pronounced downturns indicates underlying confidence among investors. This consolidation phase suggests a growing readiness among market participants to capitalize on impending upward movements.

The prevailing expectation of a Federal Reserve rate cut in 2024 further reinforces this bullish outlook. Over the past decade and a half, stock market trends have been closely tethered to Federal Reserve liquidity injections, underscoring the symbiotic relationship between monetary policy and market performance. This correlation remains steadfast, evident in both market charts and monetary supply data.

In essence, the current market trajectory points towards a continuation of the bullish trend, driven by expectations of accommodative monetary policy. While short-term fluctuations may occur, the broader outlook remains optimistic, with potential for further gains in the near future.

In the end, the NASDAQ 100 is primed for a resurgence, buoyed by positive market dynamics and anticipations of Federal Reserve intervention. As investors navigate prevailing uncertainties, the overarching narrative remains one of optimism, with the potential for sustained upward momentum in the coming sessions.

Ready to trade the NASDAQ 100 Index? Here are the best CFD brokers to choose from.