- The NASDAQ 100 showed signs of strength during Monday's session, with ongoing bullish sentiment prevailing in the market.

- However, alongside this upward trajectory, there are indications that the market may be reaching a point of overextension.

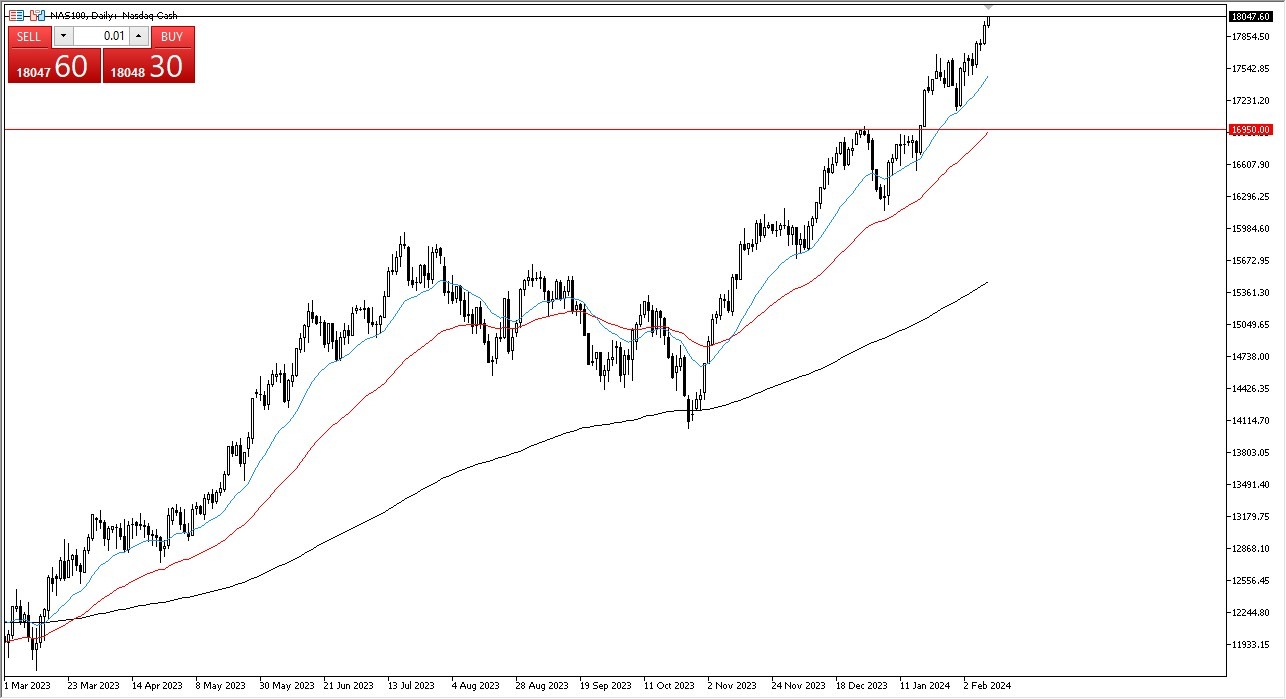

While the market began the day relatively subdued, there's a growing sense that it may have stretched beyond its sustainable limits. This suggests the possibility of a short-term pullback, which could present an opportunity for investors to identify value. Notably, the 17,500 level appears to hold significance as a potential support zone. The presence of the 20-day Exponential Moving Average in this area adds weight to its importance, while the 50-day EMA looms around the 16,950 level, further reinforcing potential support levels.

Top Forex Brokers

The 17,500 level has previously served as a notable resistance point, indicating the presence of market memory. As such, there's a reasonable expectation that buyers may re-enter the market upon revisiting this level. Meanwhile, the current focus lies on testing the $18,000 level, with a breakout above this point likely to encourage a buy-and-hold sentiment among investors. Such a move could potentially pave the way for a sustained push towards the psychologically significant $20,000 mark.

Trajectory to Hold Up? Maybe.

However, it's important to acknowledge that such a trajectory is unlikely to unfold without challenges. Each pullback should be viewed as an opportunity to assess and seek out value within the market. It's crucial to recognize that the NASDAQ 100 is predominantly influenced by a select group of stocks, often referred to as the "magnificent seven." This dynamic is expected to persist, meaning that while the market may continue its upward momentum, caution is warranted due to the potential for overextension.

Chasing the market with large positions could leave investors vulnerable to sudden reversals, which have the potential to erase gains accumulated by latecomers. Therefore, a prudent approach that balances opportunity with risk management is advised.

At the end of the day, while the NASDAQ 100's recent performance suggests ongoing bullish sentiment, there are indications of potential overextension. Investors should remain vigilant, seeking out opportunities to identify value while navigating the market's inherent volatility. By doing so, they can position themselves to capitalize on potential opportunities while mitigating risks associated with market fluctuations, which can be wild here.

Ready to trade the NASDAQ? We’ve made a list of the best online CFD trading brokers worth trading with.