- The NASDAQ 100 experienced a slight pullback during the early hours of Thursday, which was not unexpected given its recent surge.

- However, there remains a consistent pattern of buyers stepping in whenever the index dips.

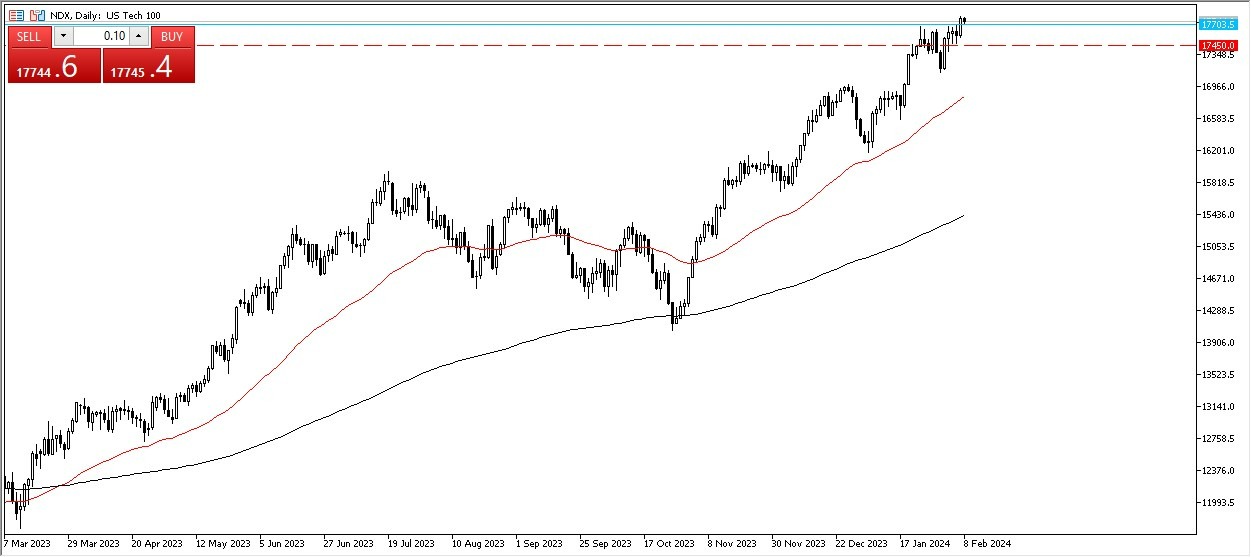

In this market environment, the prevailing strategy appears to be buying on the dip, rather than attempting to go against the overall trend. The target of 18,000 seems plausible in the near future, especially considering the momentum building in the S&P 500, which is on the verge of surpassing the 5,000 level. As such, any downturns in the NASDAQ are currently being supported, particularly around the 17,250 level, where the 50-day Exponential Moving Average (EMA) offers additional reinforcement.

It's worth noting that the market's upward trajectory has been largely driven by approximately seven key stocks, and as long as they remain bullish, the overall momentum is likely to persist. Looking further ahead, breaking the 18,000 mark and eventually aiming for the 20,000 level within the year wouldn't be surprising, though it will require significant effort.

Top Forex Brokers

Potential Short-Term Pullbacks – Potential Profits

Despite the potential for short-term pullbacks due to the market's current state of extension, such moments are viewed as opportunities for buyers rather than reasons to sell. The NASDAQ 100 has exhibited relentless upward momentum, leaving little room for scenarios where selling becomes favorable.

In the current market climate, there's a distinct lack of scenarios where selling the NASDAQ 100 appears prudent. While this could raise concerns in some contexts, it primarily underscores the overwhelming dominance of buyers in the market. As a result, the prevailing direction for the NASDAQ 100 seems to be firmly upward, with little indication of a reversal in the foreseeable future.

At the end of the day, the NASDAQ 100 continues its ascent, driven by a consistent influx of buyers on every dip. With key levels in sight and momentum firmly on the side of buyers, the path ahead seems to be one of continued growth for the index.

Ready to trade the NASDAQ 100? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.