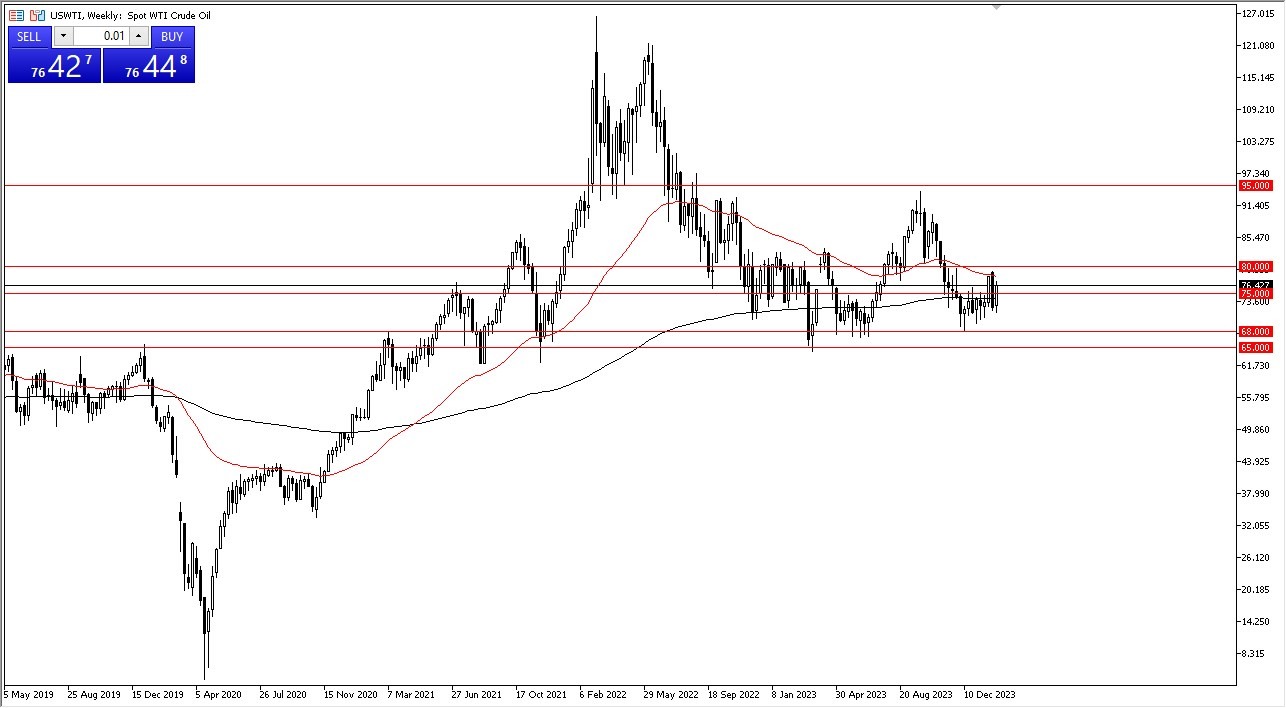

WTI Crude Oil

The West Texas Intermediate Crude Oil market has rallied significantly during the course of the week, breaking above the crucial $75 level. By doing so, it looks as if this market is likely to continue going higher, reaching the crucial $80 level. Short-term pullbacks continue to be buying opportunities, especially near the $70 level. The $70 level of course is a large, round, psychologically significant figure that will continue to attract a lot of attention.

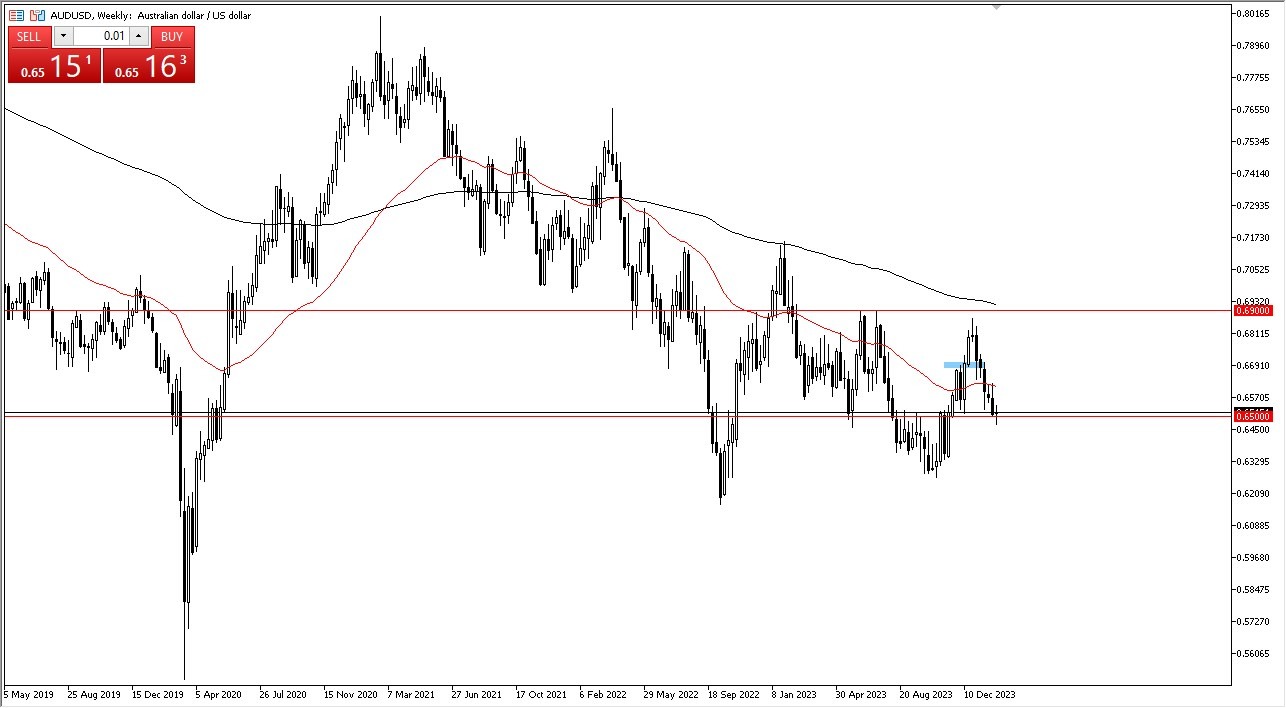

AUD/USD

The Australian dollar initially plunged below the 0.65 level during the course of the week but turned around to hang onto it. At this point, the market is likely to continue to rally from here and go looking to the 50-Week EMA, perhaps even as high as 0.69 level. On the other hand, if we were to break down below the bottom of the candlestick, then the market could drop down to the 0.63 level. Remember that the Australian dollar is highly sensitive to risk appetite.

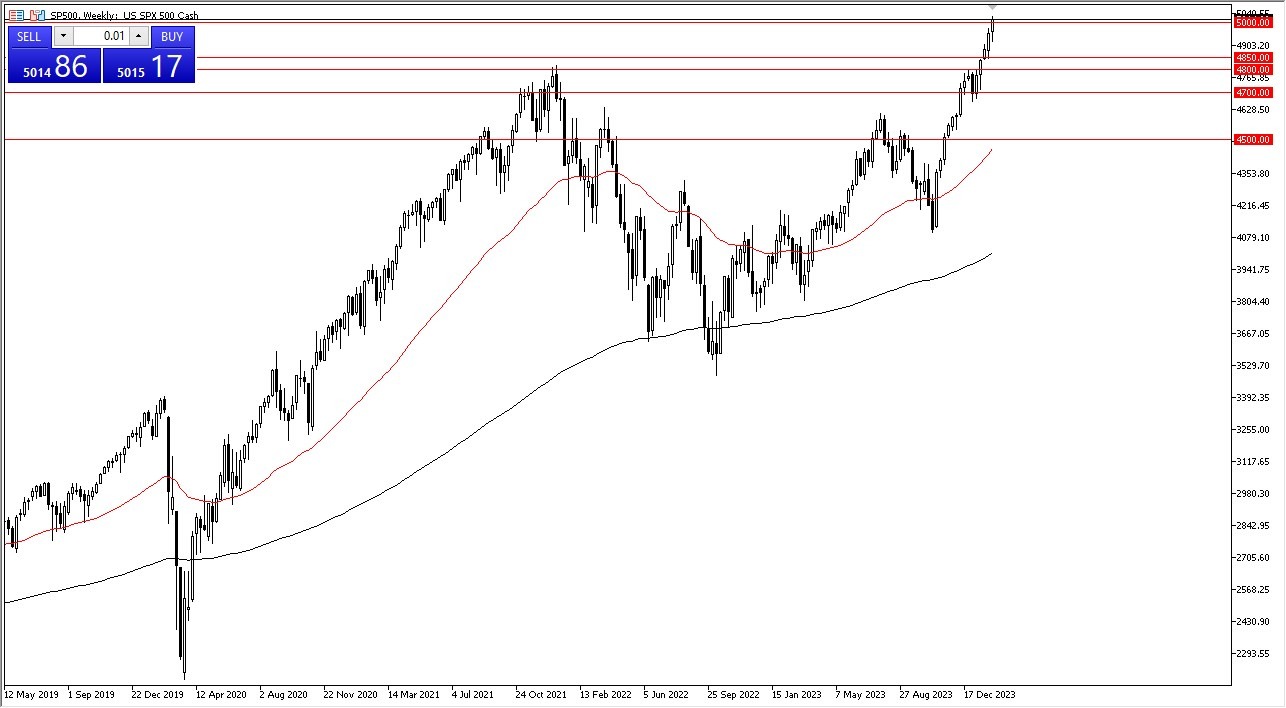

SP 500

The S&P 500 initially dipped a bit during the course of the training we, only to turn around and show signs of strength again. As we are breaking above the 5000 level, this is a sign that a lot of people would be looking to get long based on FOMO again. Short-term pullbacks should be buying opportunities and I believe that the 4850 level is going to continue to be a major floor in the market. We are overextended, but quite frankly I could have said that for the last several months.

USD/CHF

The US dollar has rallied significantly against the Swiss franc, breaking above the 0.87 level. At this point, it looks like the US dollar is ready to continue going higher, perhaps reaching toward the 50-Week EMA. The market pulling back from here does make a certain amount of sense, as it is more likely than not going to be a bit of a “bonhomie process”, so therefore it’s worth noting this and looking for some type of support opportunity to get long. On the other hand, if we were to break down below the candlestick from the previous week, then the market could go down to the 0.84 level.

Top Forex Brokers

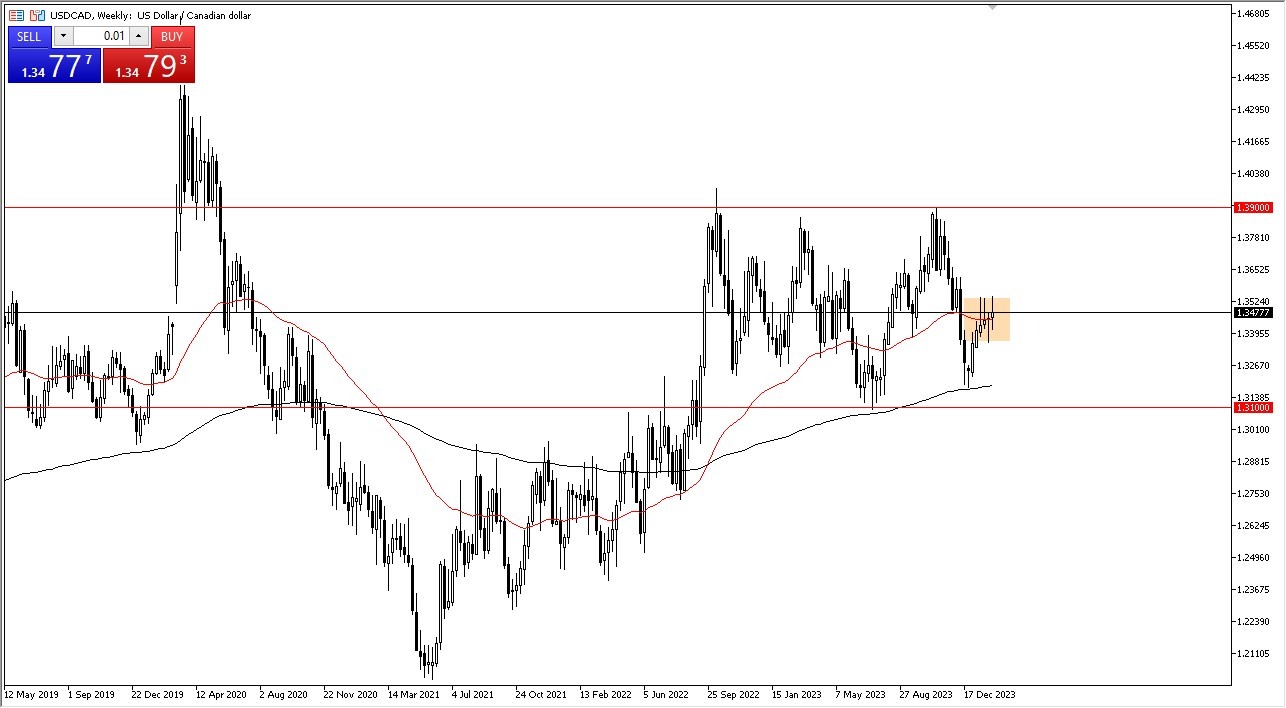

USD/CAD

The US dollar has been all over the place against the Canadian dollar during the course of the week as we continue to hang around the 50-Week EMA. Ultimately, the 1.3550 level is an area of short-term resistance, while the 1.3380 level underneath is significant support. If and when we break out of this range, we could see this pair move 100 pips in one direction or the other.

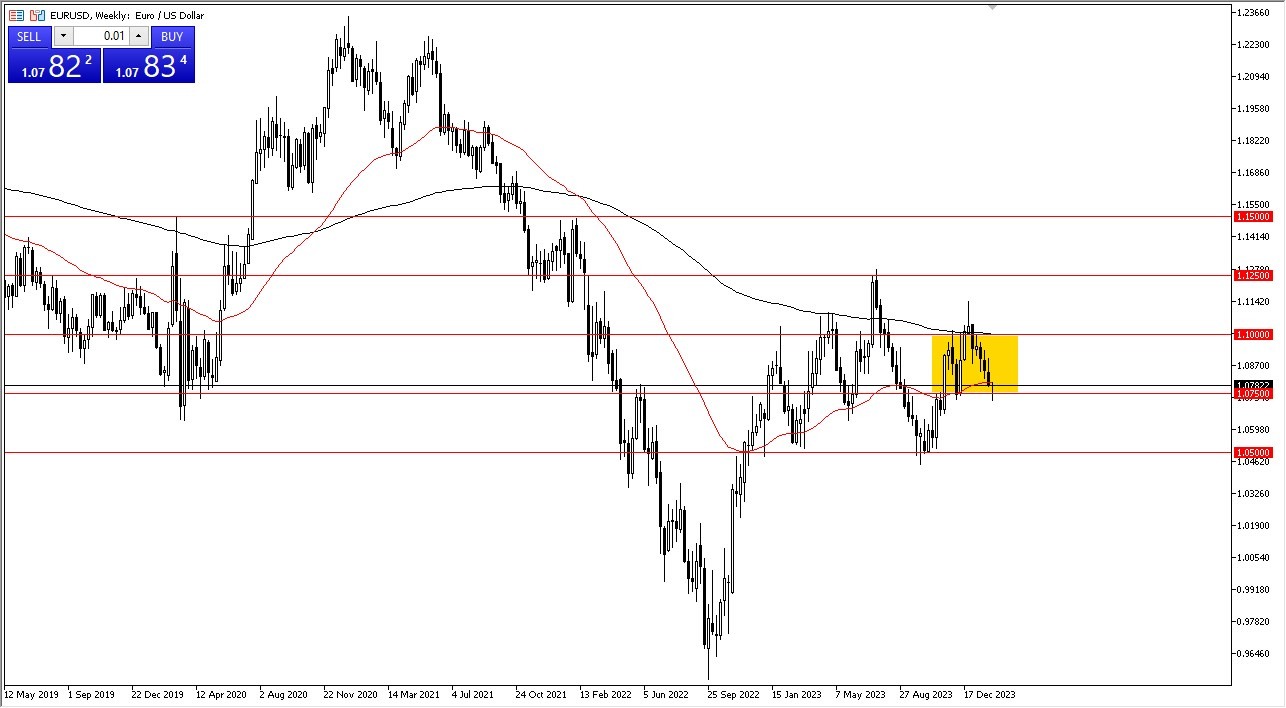

EUR/USD

The euro initially fell during the course of the week to break down below the 1.0750 level. This is an area that I think a lot of people would be paying close attention to due to the fact that it is a previous resistance barrier. It’s worth noting that the candlestick for the week is a hammer, so we break above the top of the 50-Week EMA, we could see the euro go much higher, perhaps reaching to the 1.10 level above. If we break down below the bottom of the can say, it’s likely that the euro will drop down to the 1.06 level, perhaps even the 1.05 level where see a massive amount of support.

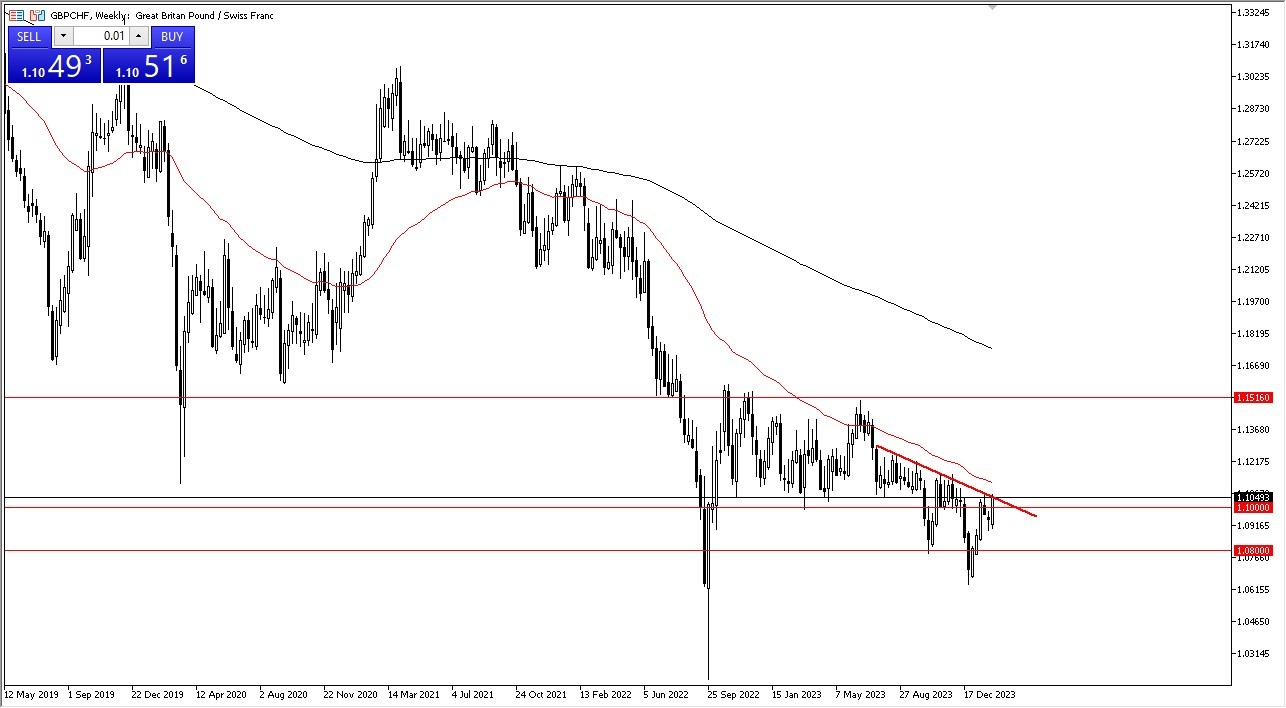

GBP/CHF

The British pound is testing a major downtrend line against the Swiss franc, as we are closing at the very top of the weekly candlestick. At this point, the 50-Week EMA comes into the picture as well, and if we break above there it’s likely that we could go looking to the 1.15 level over the longer term. On the other hand, if we fall from here, the market could go down to the 1.09 level as support. Keep in mind that the interest-rate differential continues to favor the British pound, and we have seen quite a bit of weakness in the Swiss franc against multiple currencies.

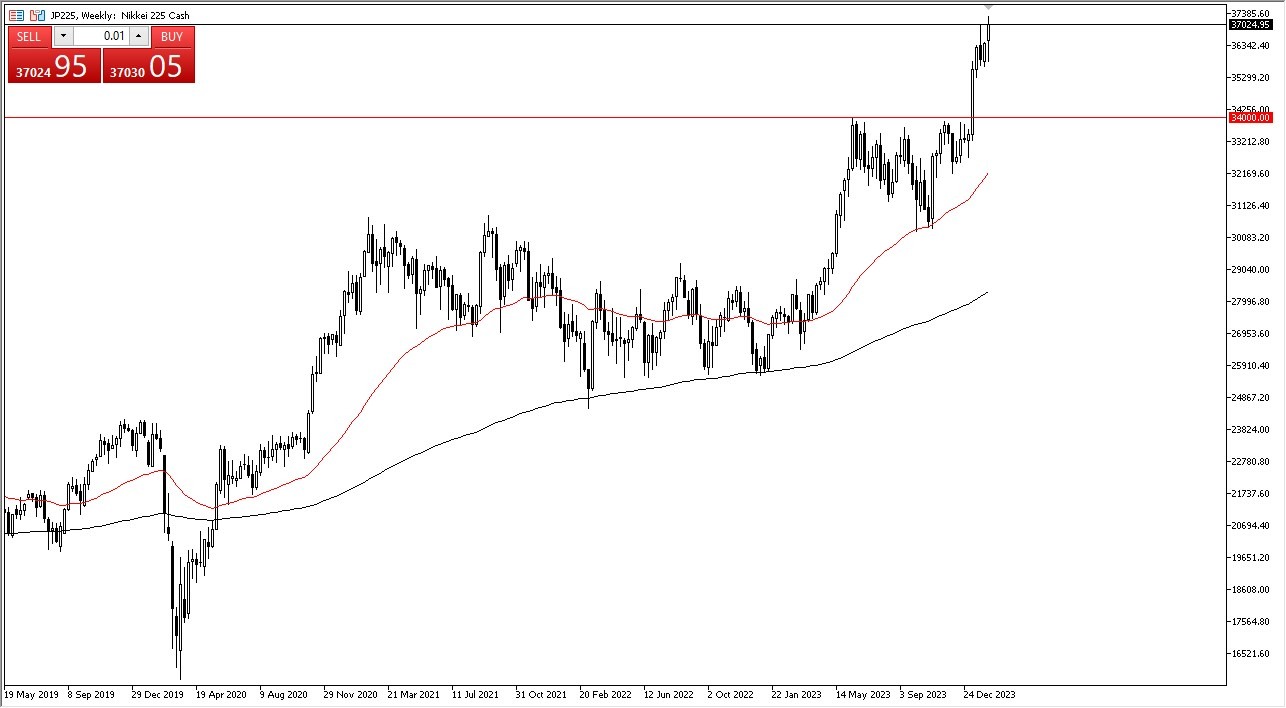

Nikkei 225

The Nikkei 225 has pulled back just a bit during the course of the trading week to test the ¥36,000 level. Short-term pullbacks will be buying opportunities, and I do think that the Nikkei 225 continues to go much higher. In fact, it looks like we are ready to go looking to the ¥38,000 level over the longer term. If we break down below the ¥36,000 level, then we could see quite a bit of selling pressure in that general vicinity. Overall, the Nikkei 225 continues to look very bullish.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.