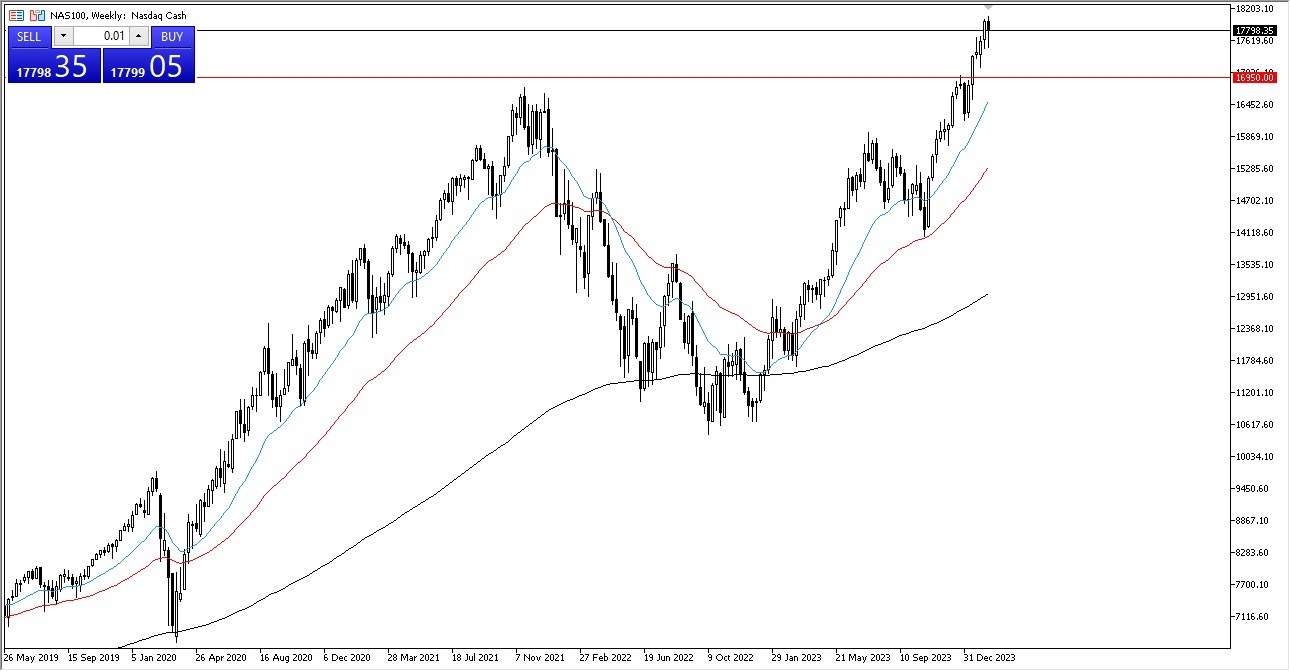

NASDAQ 100

The NASDAQ 100 continues to defy gravity overall, although we did see a significant pullback during the week. That being said, it looks like it is only a matter of time before we break above the 18,000 level for a sustained move, perhaps trying to get to the 20,000 level. Underneath, we have the 16,950 level is an area that was previous resistance, and it should now be massive support. I have no interest in shorting this market, because quite frankly everybody is piling into the same stocks.

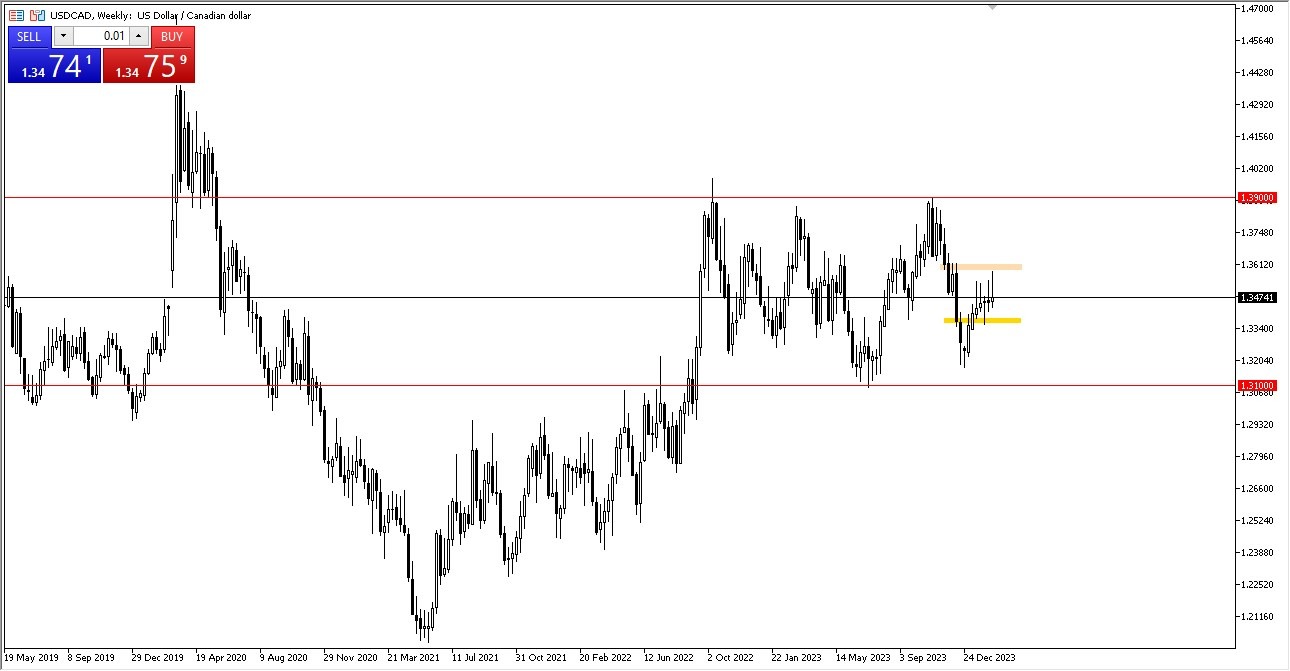

USD/CAD

The US dollar initially tried to rally during the week but gave back gains near the 1.3650 level as the crude oil market continues to be very noisy. At this point, it looks as if we are comfortable hanging around the 50-Week EMA, so I don’t have any desire to put on a huge position. I think at this point, we are just simply going to continue to bounce around between 1.3350 below and 1.36 above.

Top Forex Brokers

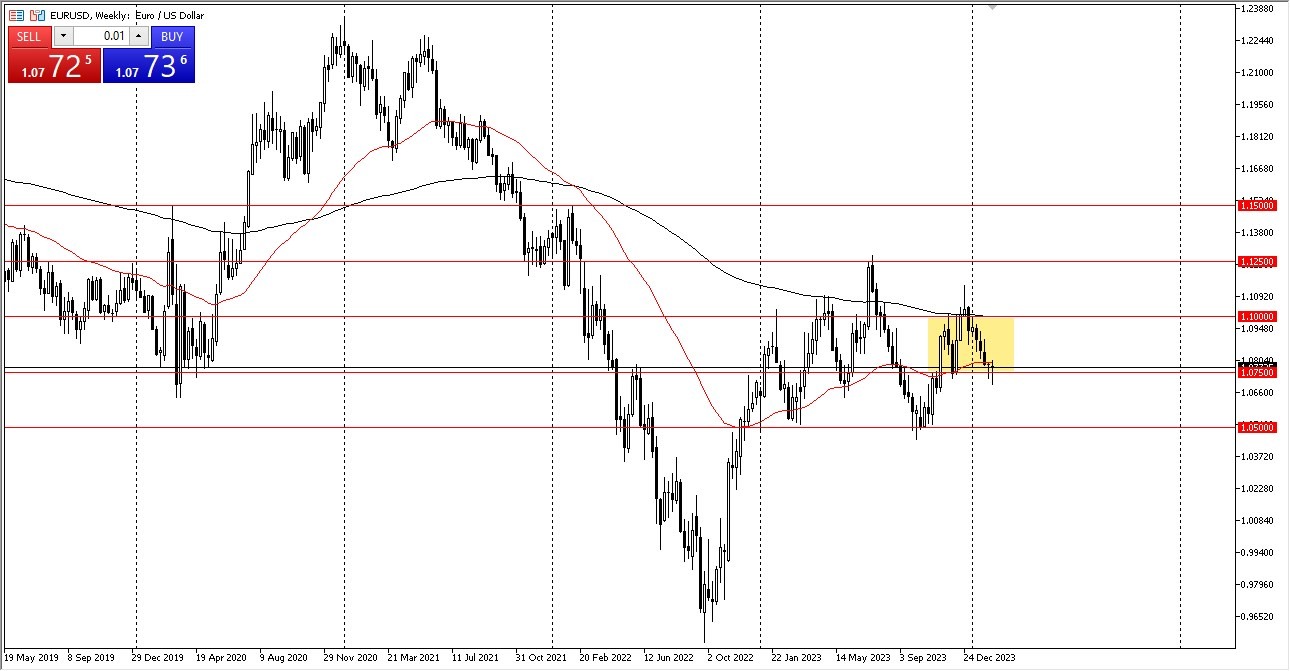

EUR/USD

The euro initially plunged during the trading week to break down below the 1.0750 level, only to turn back around and show signs of life. This is the second week in a row that we have formed a hammer, so this suggests to me that it is probably only a matter of time before the market turned back around and rallies. At this point, we could go as high as the 1.10 level over the next several weeks and still simply be somewhat range bound. However, if we were to break down below the hammer for the week, that could send this market down to the 1.05 level.

USD/CHF

The US dollar rallied to reach the 50-Week EMA, before pulling back rather significantly. At this point, it looks as if the market is trying to do everything, we can to turn things around, with the Swiss franc giving up quite a bit of momentum. However, the technical analysis will continue to dictate that we are in a downtrend, despite the fact that I think that the 0.87 level needs to be watched very carefully for signs of support. If we break above the top the candlestick for the week, that would obviously be a very strong sign as well.

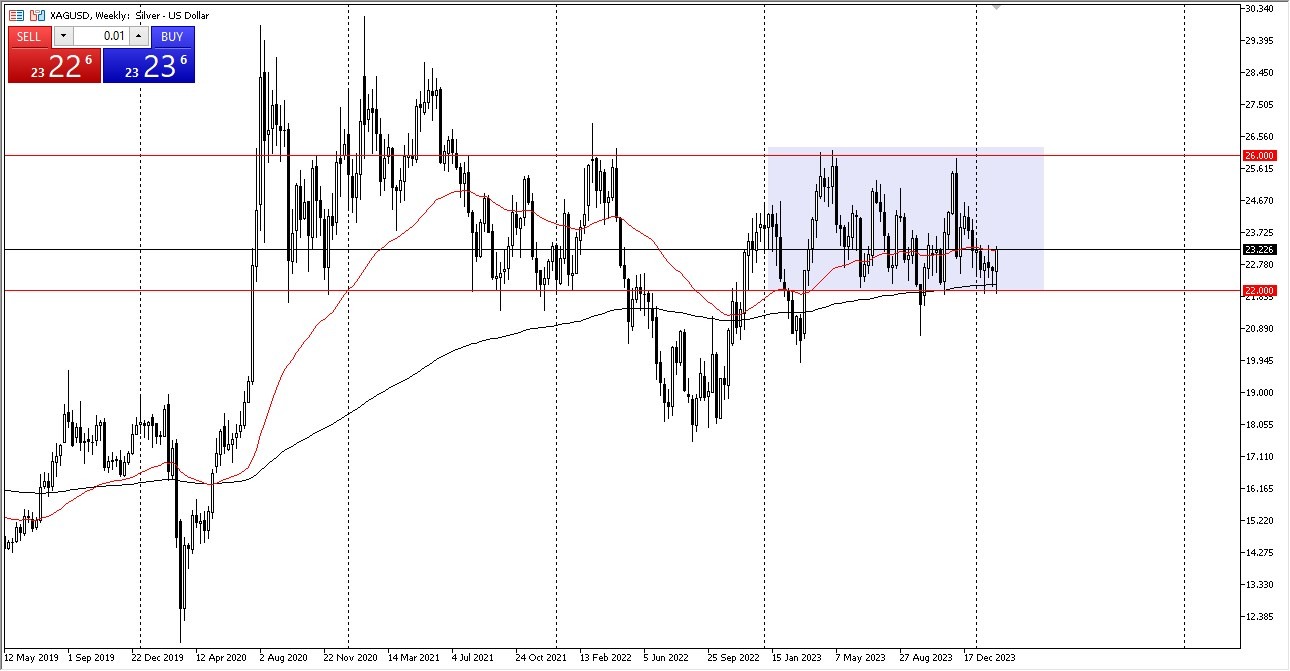

Silver

Silver fell to kick off the week but has found enough support near the $22 level to turn things around. By doing so, we ended up challenging the 50-Week EMA. At this point, I think the silver market is doing everything he can to turn around and break out to the upside, perhaps staying in the longer-term range between the $22 level on the bottom, and the $26 level on the top. That doesn’t mean that it’s going to be easy to get to the $26 level, but I think we do eventually.

Bitcoin

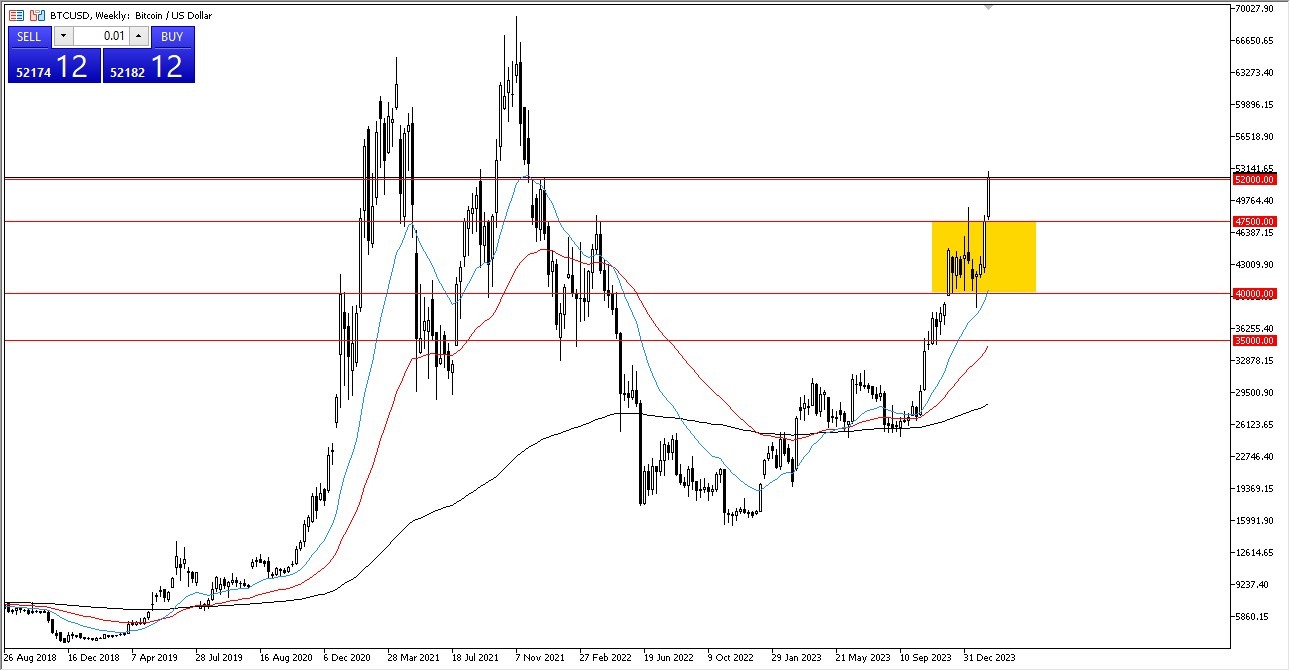

Bitcoin continues to rally, and it did find the $52,000 level in the middle the week. This is an area that previously had massive resistance, so it’s not surprising to see that the market has stalled in this general vicinity. Furthermore, you have to keep in mind that we have gained about 30% since the last move, so it is a little overdone to say the least.

However, it’s apparent that anytime we get a pullback, buyers come back in to pick up a bit of value. The ETF inflows of course are massive, and that will be a major factor in what happens next with Bitcoin. If we can break above the top of the candlestick for the week, I don’t see much stopping Bitcoin from reaching the $55,000 level. Underneath, I see the $47,500 level as a potential support barrier, followed by the $40,000 level.

Nikkei 225

The Nikkei 225 has been on fire for a couple of months, and of course this past week was no different. The Japanese yen continues to lose strength, and that is a major driver of where the Nikkei 225 will end up, as it has a massive amount of export based stocks represented. Ultimately, this is a market that continues to bite dips, with the ¥36,000 level underneath being a massive support level. At this point, there’s not much to stop this market from reaching the ¥40,000 level given enough time.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.