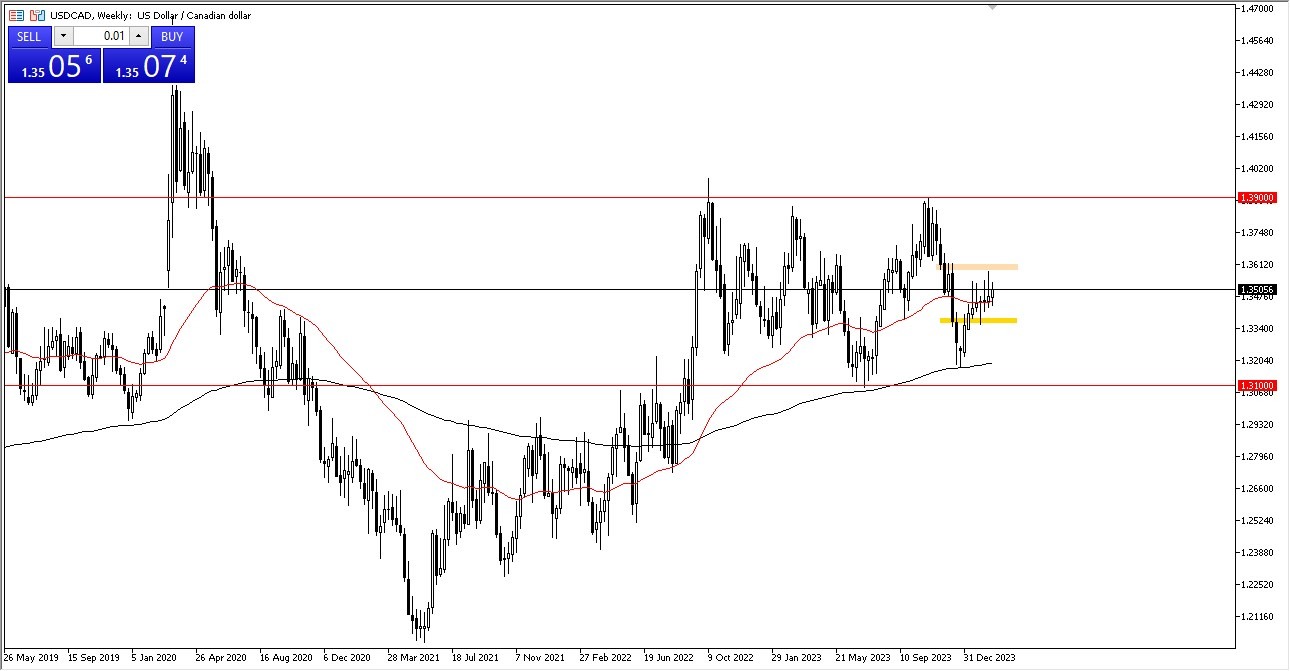

USD/CAD

The US dollar has been slightly positive against the Canadian dollar, but at this point in time we are sitting in the middle of an overall range. 1.35 level seems to be “fair value”, and therefore I think it continues to see a situation where we have no real momentum one way or the other, and I think that this market will continue to be very choppy and sideways.

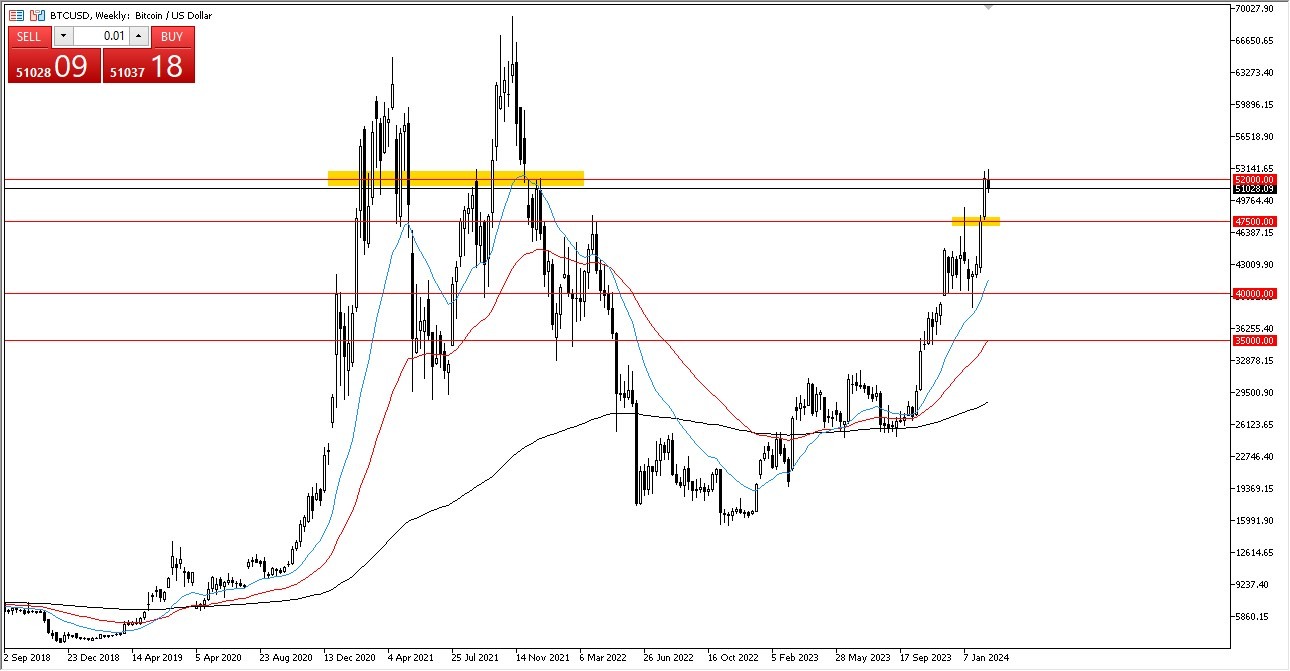

Bitcoin

Bitcoin has initially tried to rally during the course of the week, only to turn around and show signs of negativity. That being said, the market is going to continue to be very noisy and although bullish, also I think we have a situation where the 52,000 level is a major barrier that a lot of people will struggle with. If and when we can break above there, then the market is likely to continue to go much higher, perhaps reaching the $55,000 level. Underneath, the $47,500 level is what I think is the short-term support level.

Top Forex Brokers

USD/CHF

The US dollar initially fell a bit during the course of the trading week but continues to find the 0.87 level as important. This is an area that I think a lot of people will pay close attention to the idea of finding value. That being said, if the market were to break down below the 0.87 level, then it’s likely that the market could go down to the 0.85 level. On the other hand, if we can break above the high of the previous week, then we could send this market to much higher levels as it would be breaking above the 50-Week EMA, and the 0.89 level.

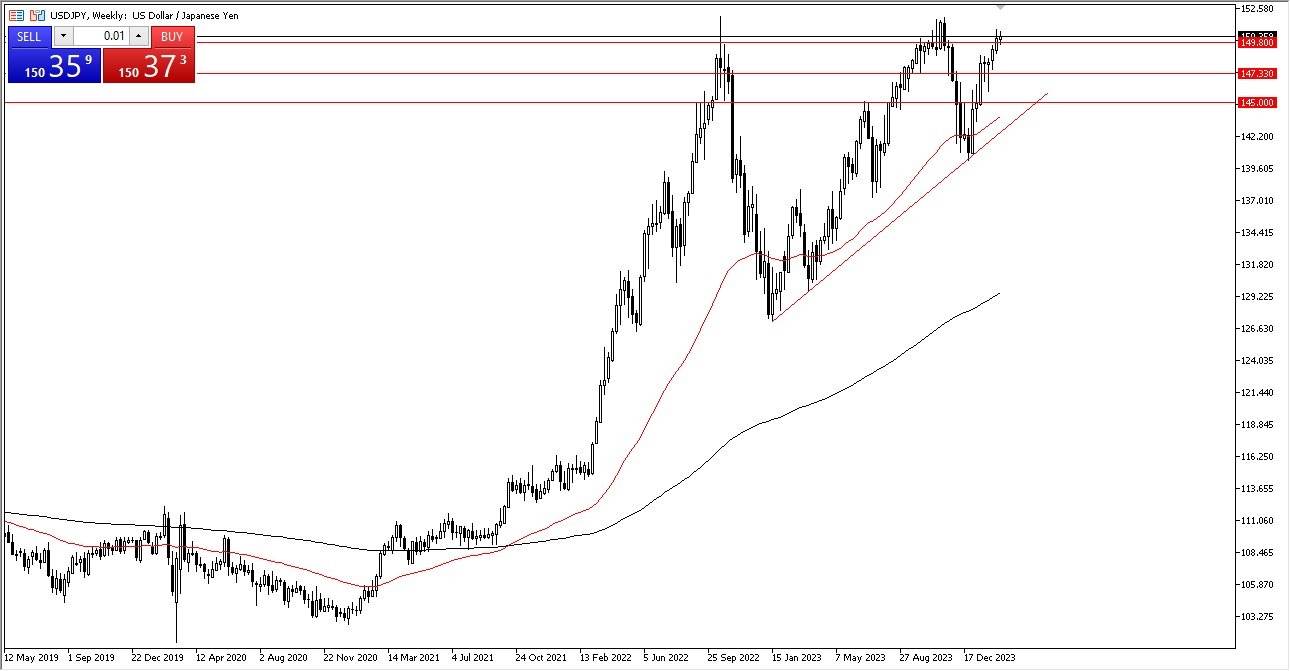

USD/JPY

The US dollar has been rather noisy against the Japanese yen during the course of the trading week, as we continue to try to sort out whether or not we can break out to the upside. If we can get above the ¥152 level, then the market is likely to continue to go much higher. On the other hand, if we turn around and fall from here, the ¥147.33 level is an area where I think a lot of buyers would be intrigued.

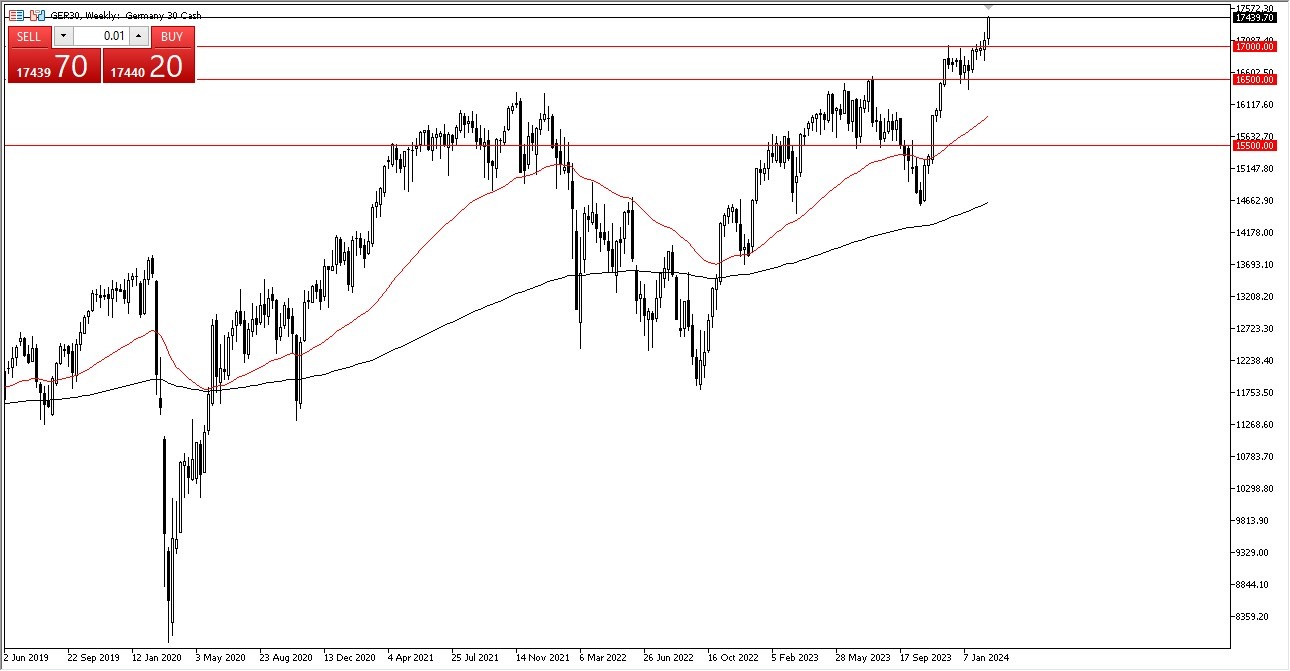

DAX

The German DAX shot higher during the course of the weekend it looks like at this point in time we are going to continue see buyers coming in to pick up bits and pieces of value every time we drop from here, and I do believe that the €17,000 level is an area that a lot of buyers will be interested in trying to pick up a bit of value. On the upside, the market could very well go to the €18,000 level, which is my short-term target.

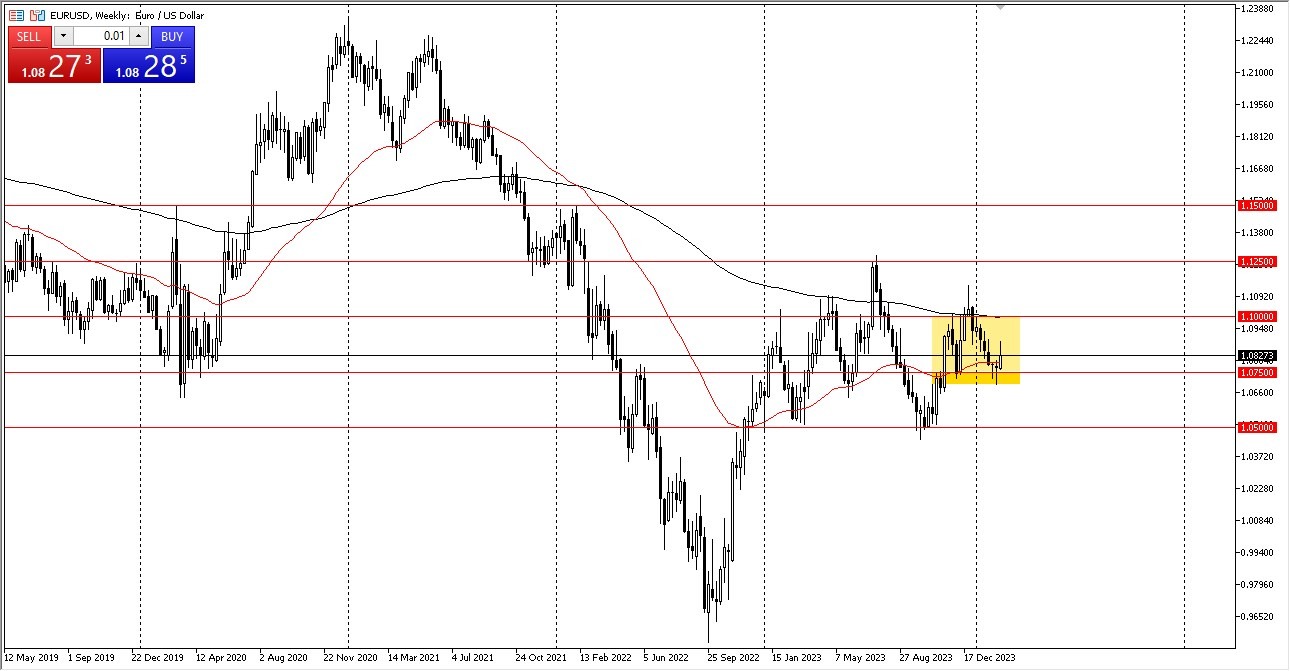

EUR/USD

The Euro has rallied significantly during the course of the week but has given back some of the gains for the week as we continue to see a lot of noisy behavior. Ultimately, this is a market that continues to see a lot of noisy behavior, and I think it does see a lot of support at the 1.07 level for a potential bounce. Ultimately, if we break higher from here, then we could go looking to the 1.10 level above, which is what I look at as a potential ceiling in the market, especially as there is the 200-Week EMA in that general vicinity.

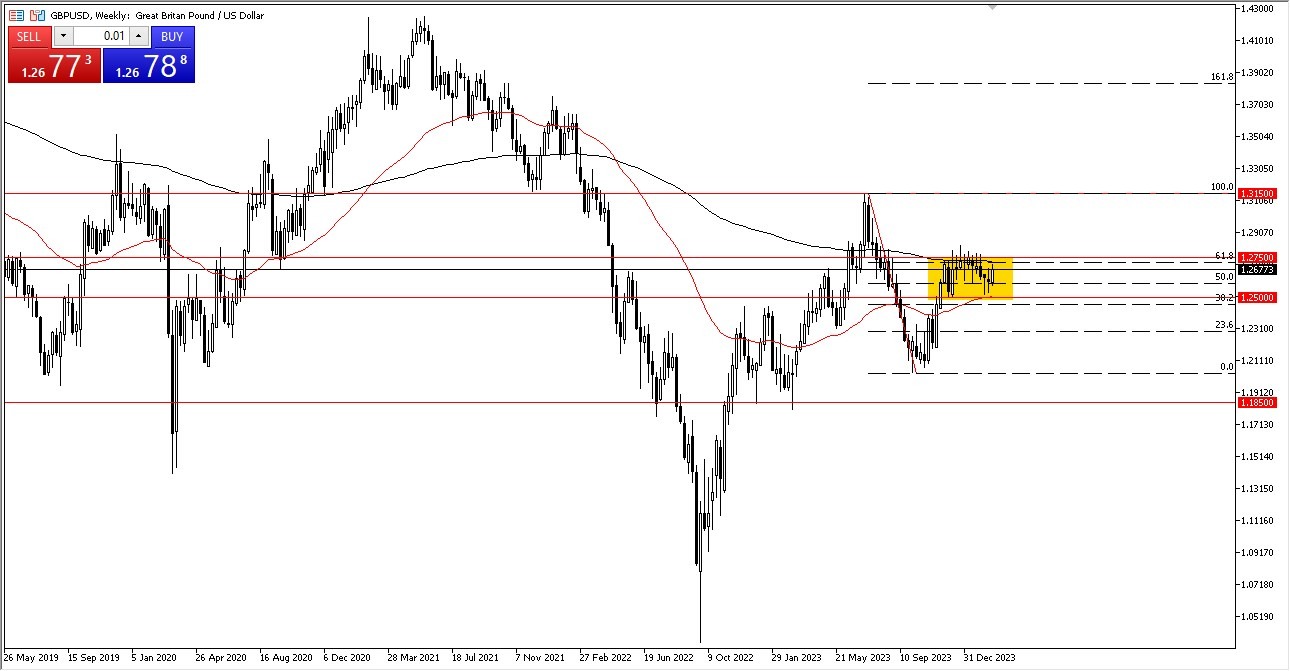

GBP/USD

The British pound had a strong week, but we are still very much in the midst of a consolidation area. The 1.2750 level above is going to continue to be a major resistance barrier, and of course we also have the 200-Week EMA. Underneath, we have the 50-Week EMA hanging around the 1.25 level, so I think at this point in time it makes quite a bit of sense that we continue to see a lot of noisy behavior. In general, this is a market that I think short-term range bound traders will continue to be interested in.

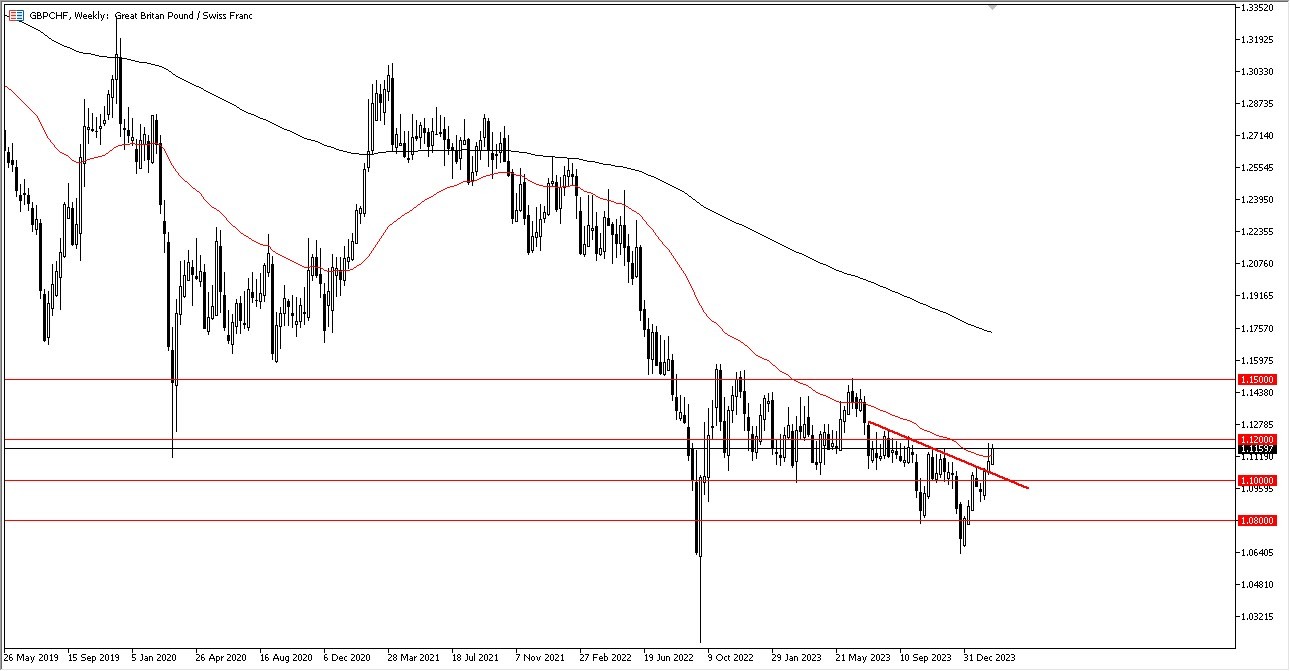

GBP/CHF

The British pound has rallied significantly against the Swiss franc, but it looks as if we are trying to go to the 1.12 level, an area that I think is a significant amount of resistance, and if we can break above there, then the market could go looking to the 1.15 level above. If we break above the 1.12 level, I think it will be a bit of a “foam of trade” just waiting to happen. Short-term pullbacks at this point in time will continue to be possible, with the 1.11 level underneath being a short-term support level.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.