- The silver market experienced a modest uptick during Monday's trading session, with investors closely monitoring the lower end of the price range for potential upward momentum.

- All things being equal, this is a market that I think will continue to pay close attention to the overall consolidation area that we have been in.

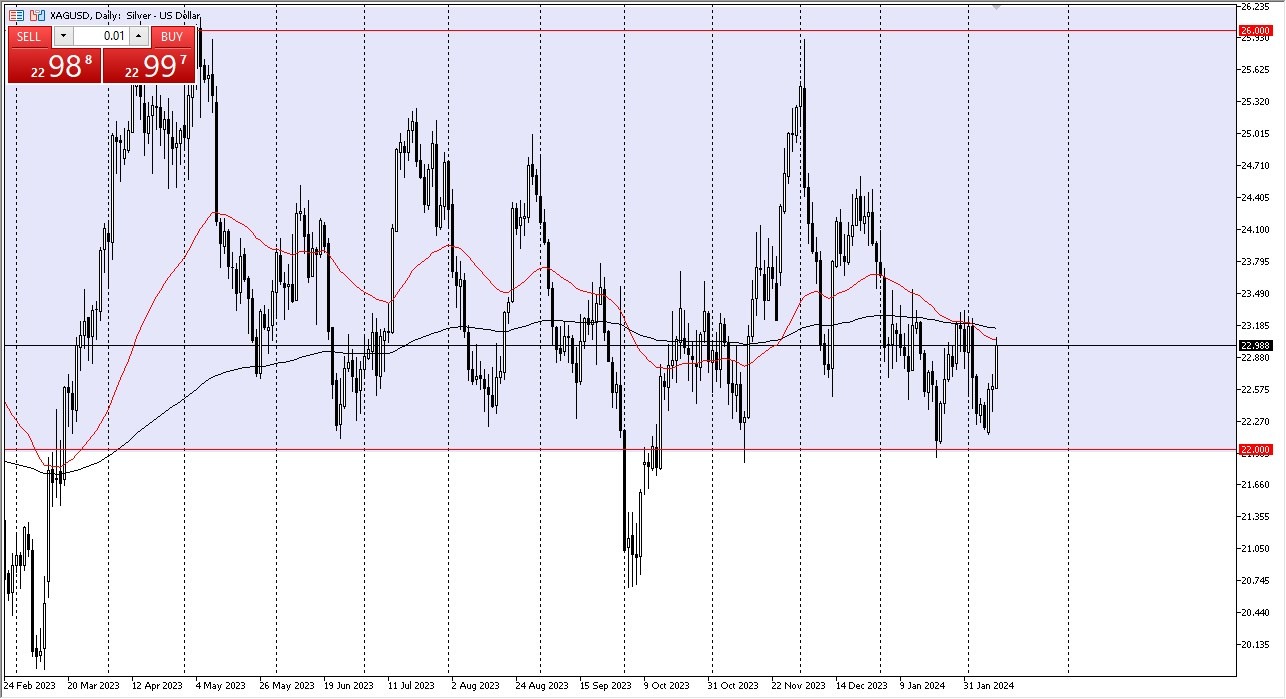

As prices rallied, they approached the 50-day Exponential Moving Average, a key technical indicator. However, despite this bounce, significant resistance levels lie just above, primarily represented by both the 50-day and 200-day EMAs, which could impede further gains. That being said, I think it’s only a matter of time before we blow through there as the value of the US dollar could come into play, and of course the idea of interest rates will as well.

While short-term retracements may present buying opportunities, market participants remain keenly focused on the critical $22 level. This level holds considerable significance, serving as a major support zone for silver. A breach below $22 could signal further downside potential, with the $21 level emerging as the next key support level.

Top Forex Brokers

Broader Pattern of Consolidation

Recent price action reflects a broader pattern of consolidation within the silver market. Silver's sensitivity to a variety of factors, including interest rates, the US dollar, and industrial demand, contributes to its inherent volatility. Consequently, traders must exercise caution and prudence when navigating this market, avoiding overly large positions that could amplify losses in the event of adverse price movements.

Looking ahead, upside potential remains capped by resistance levels, with the $23.60 mark serving as a potential target for bullish momentum. Beyond this level, further gains towards $24.50 and eventually $26 could materialize. However, achieving these targets may require sustained bullish momentum and a break above current resistance barriers.

At the end of the day, the silver market's recent price action underscores the ongoing tug-of-war between buyers and sellers within the established price range. Traders should remain vigilant and adaptable, utilizing a disciplined approach to capitalize on potential opportunities while managing risk effectively in the face of market volatility. All things being equal, you are going to have to be very cautious with your position sizing, because silver can be very dangerous at times and therefore you need to be cautious about going “all in” right away.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.