- Silver has initially tried to rally during the trading session on Tuesday but got crushed as soon as the CPI numbers in the United States came out.

- The CPI numbers were hotter than anticipated, so now everybody is panicking that perhaps the Federal Reserve won't be able to cut rates anytime soon.

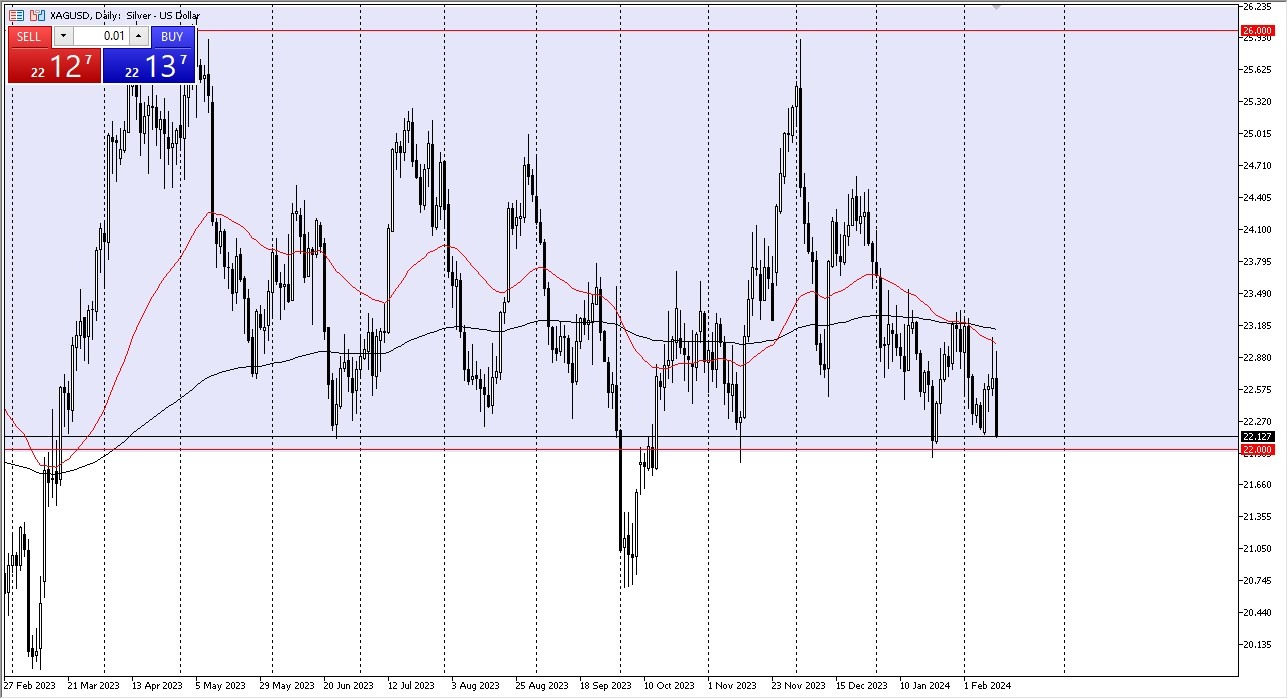

Whether or not that's the case remains to be seen, but all things being equal, I think you have to look at this through the scenario that you are perhaps finding a bit of value. The $22 level, of course, is an area that's been important multiple times. And I think at this point, the market will continue to see a lot of back and forth, noisy behavior.

Top Forex Brokers

We are in the midst of a larger consolidation range that extends from the $22 level to the $26 level. If we were to break down below $22, then the $21 level could be a target, but we'll have to wait and see. That's an area that's been important a couple of times in the past, so not overly surprising if we were to get down there.

What would be surprising is if we broke down below that level and then fell apart. So ultimately, I think this is a situation where you're looking for signs of a bounce that you can take advantage of because silver is on sale at the moment. The question now is whether or not you are going to find your price now or if it's something that you're going to find a little bit down the road. Either way, I do think that selling silver is almost impossible. I just don't see the argument for it.

At this point in time, I'm looking for a little bit of a bounce. If we can close above the $22 level for the trading session, I think that would be a very positive sign without the wait and see whether or not that actually plays out, but right now that's my hope that would give me a little bit more confidence in buying.

Remember that silver is an extraordinarily volatile contract, so you need to be cautious with your position sizing. All things being equal, you need to pay attention to interest rates, the US dollar, and of course industrial demand. Because of this, we have a lot of push and pull in the silver market.

Ready to trade our daily Forex analysis? We’ve made a list of the best online forex trading platform worth trading with.