- Silver experienced a slight rally during the early hours of Friday amidst ongoing market volatility.

- Attention remains focused on technical indicators, particularly the 50-day Exponential Moving Average, as traders seek cues for market direction.

- However, it should be noted that this is a market that continues to see massive support below.

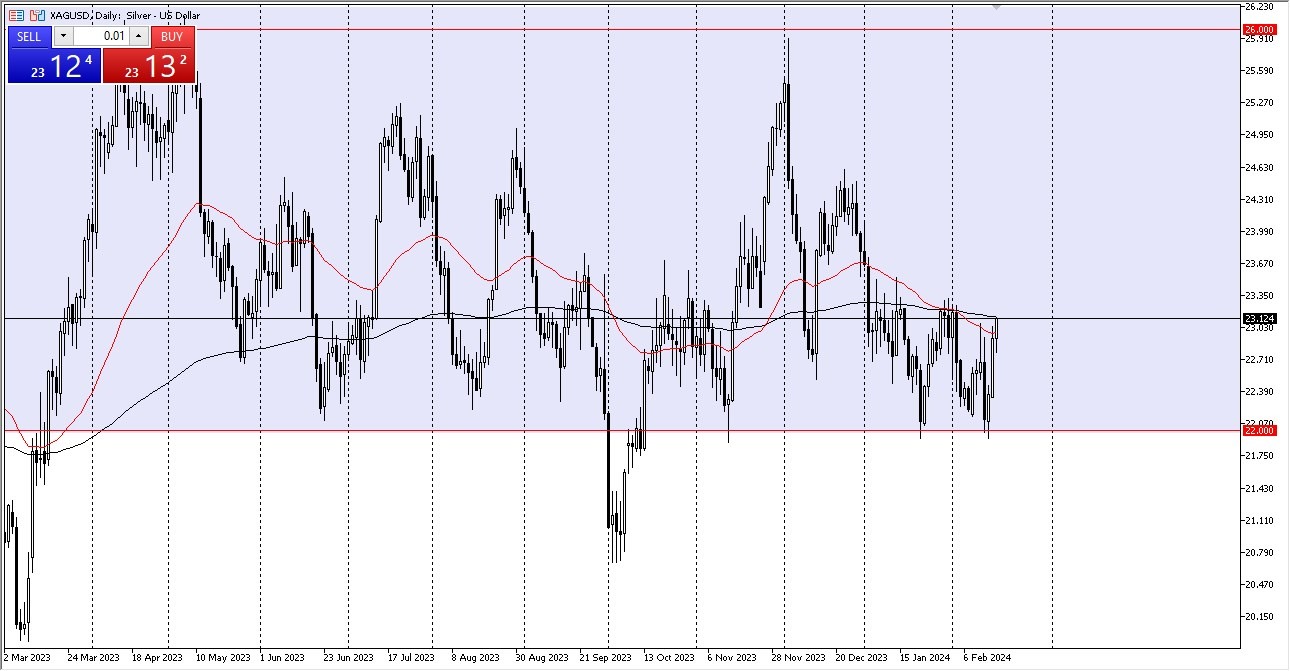

In recent sessions, the silver market has displayed limited activity, hovering around the $23 level and the 50-day EMA. Notably, the market has shown signs of attempting to establish a bottom, with a potential double bottom formation observed around the crucial $22 level.

Top Forex Brokers

Maintaining support above $22 suggests a continuation of the previous consolidation phase, with price movements confined between $22 and $26. While a brief dip to $21 occurred in late 2023, this is viewed as a temporary deviation rather than a significant trend reversal, highlighting the robust underlying support for silver. This should continue to be the case in this market going forward.

The 200-Day EMA

Attention is also directed towards the 200-day EMA, positioned just above current levels, which may act as a technical barrier to further upside momentum. Silver's price dynamics often exhibit an inverse relationship with the US dollar and interest rates, prompting traders to monitor these factors closely for potential market impacts.

A decline in interest rates and the US dollar could potentially bolster silver prices. In the event of a breakout, the $23.50 level represents a minor resistance point, with further gains potentially leading towards $24.50 before targeting the $26 region. This is an area that a lot of people would pay significant attention to.

Overall, the current market environment suggests a period of consolidation aimed at establishing a solid base for future price movements. While short-term pullbacks are anticipated, they are viewed as opportunities for investors to enter the market. Looking ahead, a return to the $26 level is anticipated over the course of the year, reflecting a bullish outlook for silver.

At the end of the day, despite fluctuations in the near term, the underlying trend for silver remains positive. Traders are advised to closely monitor key support and resistance levels, alongside broader market factors, to navigate potential trading opportunities. While caution is warranted, the overall trajectory points towards a gradual uptrend for silver prices in the coming months.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.