- It's nothing new in this market, but silver is still making a lot of noise.

- After all, a wide range of external factors, such as interest rates, geopolitics, the US dollar, and industrial demand, have an impact on the silver market.

- I would venture to say that you need to be cautious overall, but I think that there will be a buying opportunity coming soon.

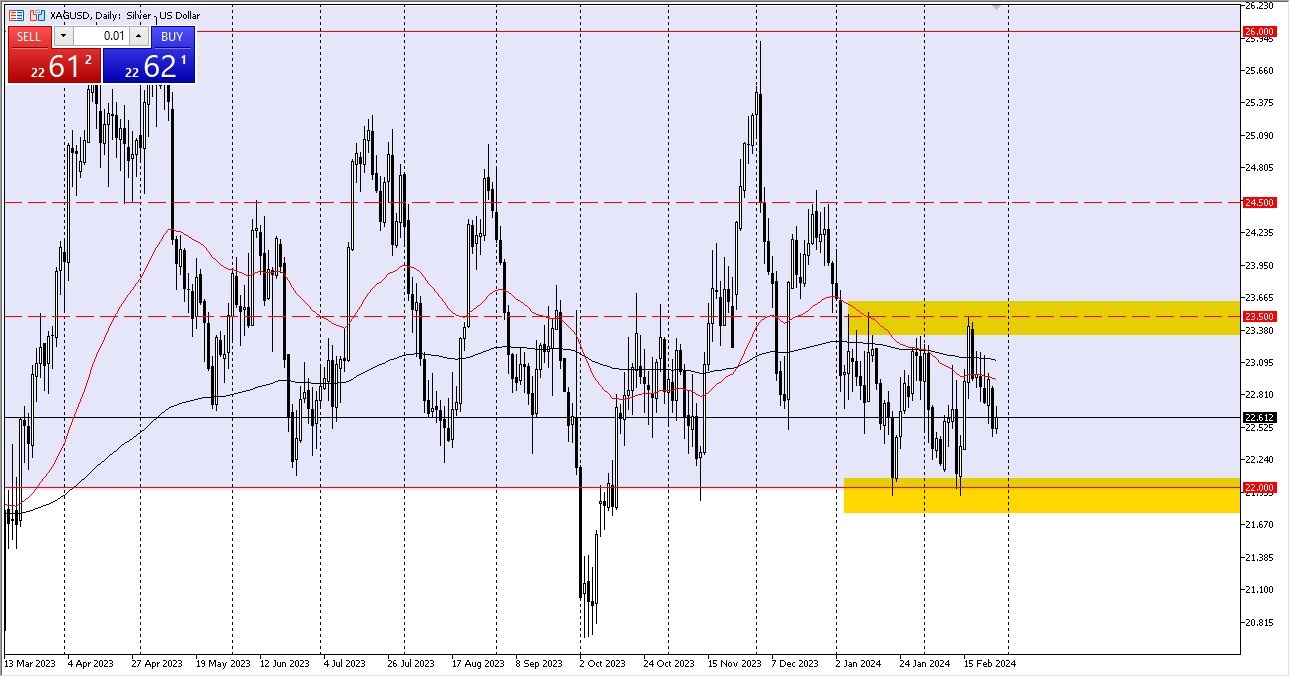

As you can see, we made a small rally throughout Tuesday's trading session to show some vitality. And as of right now, it appears that the market will remain fairly flat and sideways, but if we do start to see some momentum, I believe we should be asking ourselves if we can reach the $23.50 mark, which is, quite honestly, the top of the range we have been in.

Top Forex Brokers

However, if we reverse direction and fall below this point, the $22 level—which was, of course, a key support level earlier—might enter the picture.

Generally, we look positive

In light of that, I believe we're only in the midst of overall consolidation. Furthermore, even though I generally lean toward the positive, I don't really perceive a strong trend in either direction. I'm more likely to discover anything valuable here that I can use the farther we descend. In the end, this is a market where a break below $22 could potentially reveal a lot of support below the $21 mark. However, it's important to remember that $22 has been a pretty stable level for a while, so I'm using it as a point of entry. I'm willing to accept that downturn if it occurs. The $24.50 level may be the next target if we break above $23.50, but I also understand that this is a market that is greatly impacted by outside variables like interest rates and the value of the US dollar, among other things.

It will therefore become extremely noisy. But since this is nothing new in the market, the key takeaway is to maintain a modest position size at this time, which is usually a prudent idea given the potential for such volatility. Be cautious, but at this point, you should see that the buyers are more likely to have control going forward at this point.

Ready to trade our Forex daily forecast? We’ve shortlisted the top forex brokers in the industry for you.