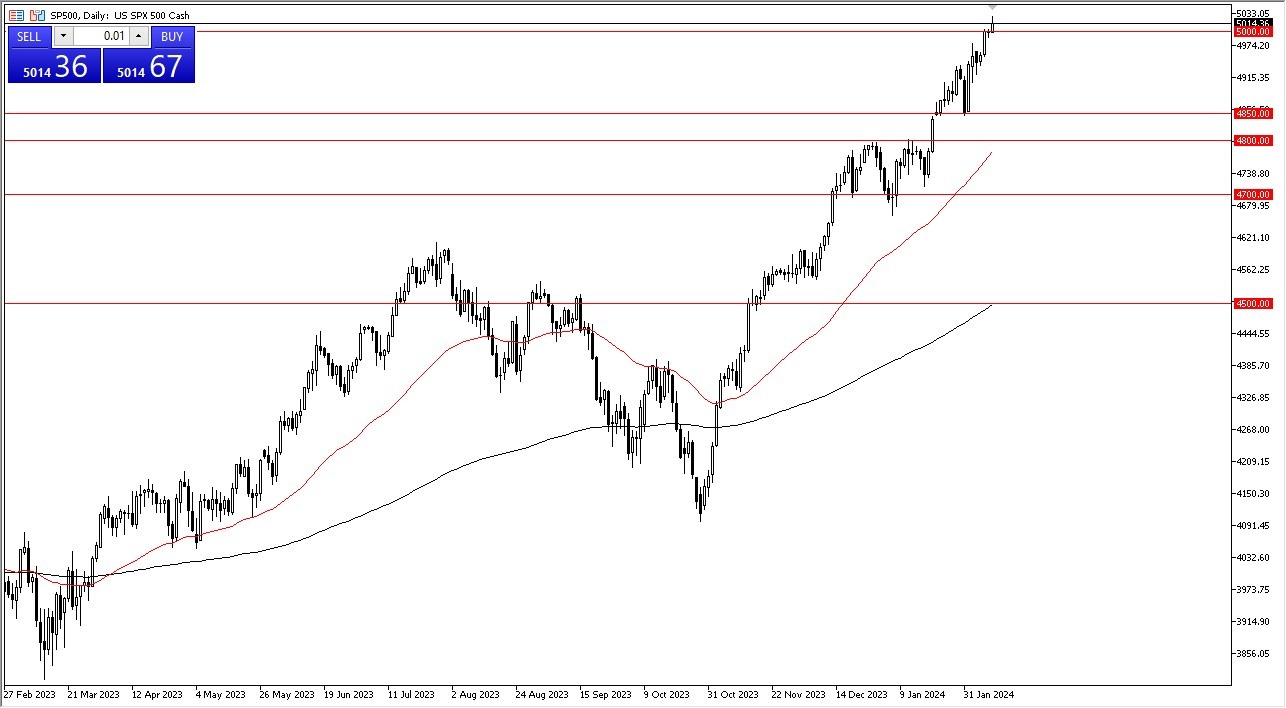

- The S&P 500 index continues to exhibit strong bullish momentum, hovering around the critical 5000 level.

- This level garners significant attention from investors, indicating the potential for heightened volatility in the market.

- After all, the market loves these big figures, and it doesn’t get any bigger than 5000 when it comes to this.

During Friday's trading session, the S&P 500 experienced an initial rally, surpassing the 5000 level early in the session. Despite this surge, there remains ample demand from buyers looking to capitalize on any downward movements. Support levels are identified at 4900 and 4850, reinforcing the likelihood of buyers stepping in during pullbacks. Consequently, a strategy of buying on dips is favored, with expectations for sustained momentum in the market.

Top Forex Brokers

A potential upside target lies at the 5100 level, although achieving this milestone may require substantial effort given the current bullish momentum. Given the prevailing bullish sentiment, shorting the market is not advisable. Instead, investors are advised to remain vigilant for opportunities to capitalize on temporary pullbacks.

The Same Handful of Stocks

It is worth noting that the performance of the S&P 500 is heavily influenced by a select group of stocks, such as Apple and Tesla. Consequently, rallies in these key stocks can propel the index higher. Despite the concentrated influence of these stocks, opportunities exist for investors to exploit value during pullbacks.

Technical indicators, such as the 50-Day Exponential Moving Average, provide additional support levels, with the 4800 level serving as a significant point of potential support. While profit-taking may occur intermittently, these instances are likely to be viewed as opportunities to buy the contract on some kind of value, as is often the case, as the market isn’t even set up to fall longer-term. (It is not equal-weighted, and therefore it’s somewhat designed to rise over the longer-term.)

At the end of the day, the S&P 500 index remains firmly bullish, with the 5000 level serving as a key focal point for market participants. Investors are encouraged to adopt a buy-on-dip strategy, leveraging support levels and technical indicators to identify favorable entry points. While short-term fluctuations may occur, the overarching trend suggests continued upward momentum in the market, presenting opportunities for value-driven investors.

Ready to trade the Forex S&P 500? We’ve made a list of the best online CFD trading brokers worth trading with.