- The US dollar exhibited a subdued performance during Wednesday's trading session as market participants awaited the outcomes of the Federal Open Market Committee (FOMC) meeting, recognizing its potential to significantly influence the USD/JPY currency pair.

Throughout Wednesday's trading session, the US dollar displayed back-and-forth movements, reflecting the anticipation surrounding the FOMC meeting. The pivotal element of this event is the subsequent press conference, as the prevailing consensus does not foresee an interest rate cut. A deviation from this expectation could have a disruptive impact on the financial markets. The Federal Reserve has consistently demonstrated its inclination to maintain the profitability of Wall Street and, as a result, strives to avoid causing excessive market turbulence.

Top Forex Brokers

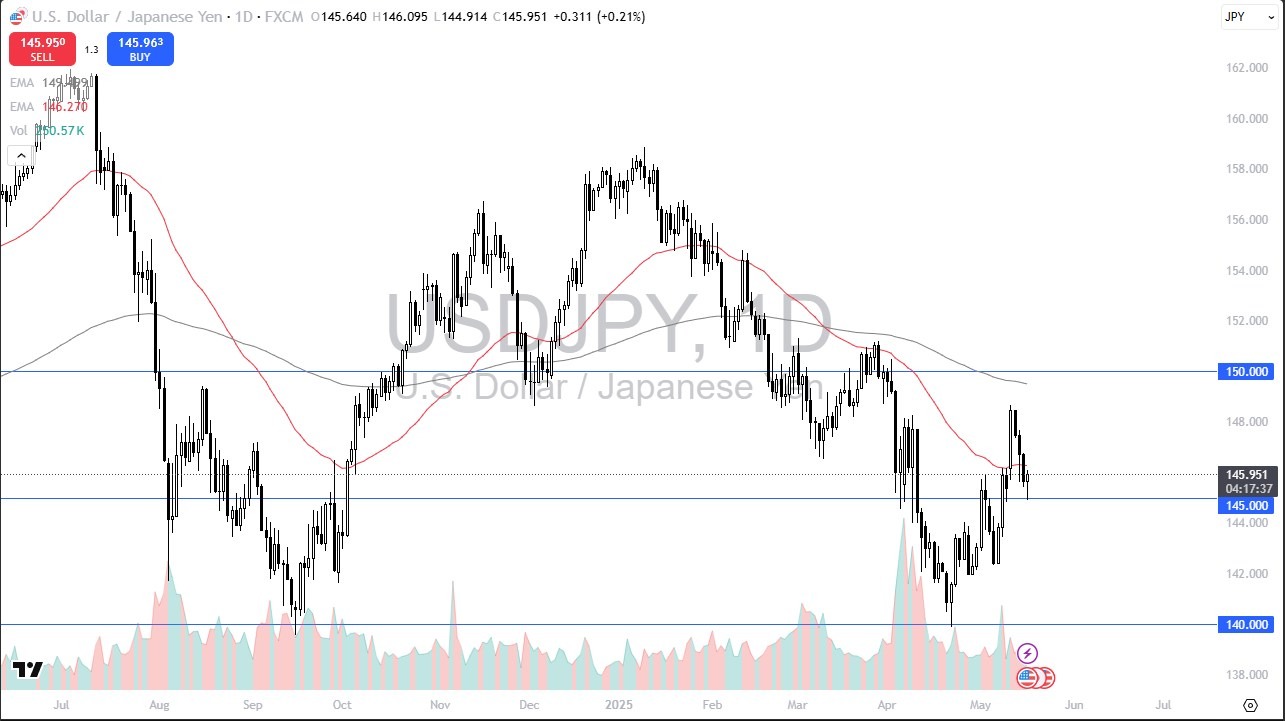

A glance at the chart reveals a notable consolidation zone just above the 147 yen level. This region is regarded as a short-term support level. If the USD/JPY pair breaches this level, it would bring into play the 50-day Exponential Moving Average and eventually the 145 yen level. The latter holds significance due to its historical relevance and status as a significant round figure that garners attention from market participants.

Conversely, on the upside, the currency pair encounters resistance at the 148.80 yen level, followed by the 149.80 yen level. In the absence of a clear catalyst, the market is essentially seeking direction from the Federal Reserve, which is anticipated to serve as the next influential factor. It is noteworthy that the Bank of Japan is unlikely to make any substantial adjustments to its monetary policy, implying that the Japanese yen may not experience a sustained rally in the near term.

Yen is Unloved

In fact, the Japanese yen appears to be an unattractive asset for investors, irrespective of whether they are actively trading the USD/JPY pair. Its performance serves as a valuable technical indicator, indicating broader sentiment in the market. If the yen fails to exhibit signs of strength, it is conceivable that higher alpha currencies such as the Australian dollar, New Zealand dollar, British pound, and others may exhibit favorable performance against it.

In conclusion, the US dollar's behavior in the USD/JPY pair is currently influenced by the anticipation of the FOMC meeting and the subsequent press conference. The Federal Reserve's cautious approach to monetary policy is expected to mitigate market disruptions. Key support and resistance levels play a pivotal role in shaping the market's movements, while the Japanese yen remains unattractive to investors, potentially benefitting other higher-yielding currencies in the absence of yen strength.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.