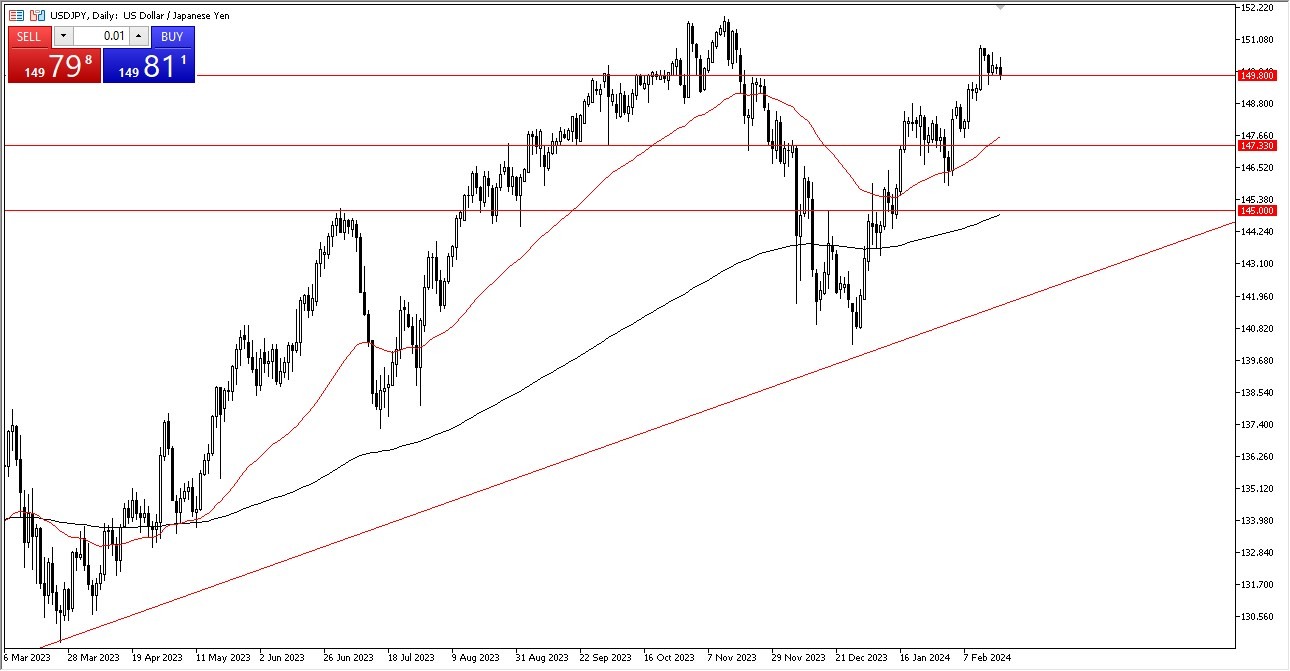

- As you can see, early Tuesday trading saw very little movement of the dollar compared to the Japanese yen as we remained close to the critical 150 yen mark.

- Naturally, there is some psychology associated with this sector, but I believe the 149.80 yen level beneath it to be the genuine support since, for whatever reason, the trading markets had previously determined that this was a substantial point of resistance.

- Since the interest rate disparity in favor of the US dollar is still very large, you are currently being compensated for holding onto this currency pair.

- Naturally, the Federal Reserve wants to postpone interest rate reductions.

Bank of Japan Cannot Do Anything

The interest rate gap will continue to heavily benefit the Fed even after they do decrease. I believe that this pair will rise in the long run as long as that is the case. Furthermore, I believe that the Japanese yen is the main factor at this time. Ultimately, the Japanese yen is backed by a central bank that is unable to increase interest rates because of the amount of national debt. This is the “open secret” that most professional traders know, so although there are a few people out there calling for the Bank of Japan to do something, the reality is they cannot do anything too extraordinary as it could cause a financial crisis with the massive amount of debt owed.

Top Forex Brokers

The 50-day EMA is located at roughly 147.50 yen, and I believe that is also a support level, should we drop down. The important 145 yen level, where the 200-day EMA is now located, is located beneath that. Positively, it turns into more of a buy and hold scenario if we can break out above the 152 yen mark, which I believe will eventually occur.

In that case, the first aim would be 155 yen, and maybe 160 after that. Though I believe that an economic justification would be necessary for purchasers to become that aggressive, I doubt that the US dollar's advantage in interest rates will be sufficient. Moreover, most traders are currently aware that later in the year, the interest rate disparity will narrow somewhat. Although I am optimistic, I am aware that the "easy money" has already been made.

Ready to trade our daily Forex forecast? Here’s a list of some of the best online forex trading platforms to check out.