- The US dollar remains bullish against the Japanese yen, with upward pressure persisting and traders capitalizing on positive swap rates.

- This is a market that you get paid for simply holding it, and this is something that a lot of traders seem to miss in the retail world.

Friday Sees More of the Same Attitude

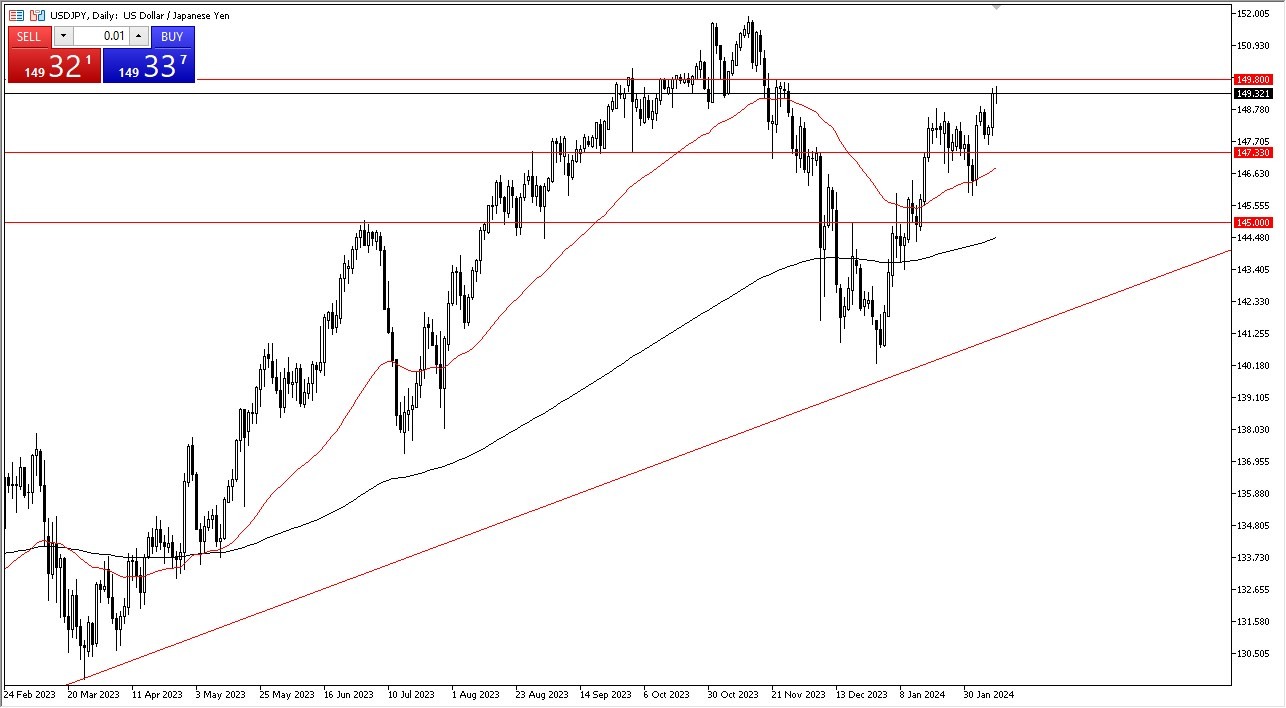

In the USD/JPY market, the dollar initially experienced a decline against the yen on Friday, but indications suggest a reversal to resume upward momentum. The target for the dollar appears to be the 149.80 yen level, which had previously acted as resistance for momentum traders. The prevailing bullish sentiment is driven by the Bank of Japan's reluctance to tighten monetary policy, resulting in the yen weakening against major currencies like the US dollar, British pound, euro, and Canadian dollar.

Top Forex Brokers

Conversely, the Federal Reserve's stance on monetary policy indicates a delay in potential rate hikes, providing traders with the advantage of positive swap rates by holding this currency pair. Support levels for the USD/JPY pair are identified at 147.50, 147.33, and reinforced by the 50-day Exponential Moving Average (EMA). Therefore, any pullbacks in the market are viewed as opportunities to acquire US dollars at lower prices.

The impulsive upward movement observed in Thursday's candlestick suggests a continuation of the bullish trend. Upon surpassing the 149.80 yen level, the next target is anticipated to be around 152 yen, representing a significant swing high. Further upward movement beyond this level may lead to a buy-and-hold sentiment among investors. The market recently formed a bullish flag pattern, yet to reach its projected target, indicating further potential for upward movement.

Ultimately, the US dollar remains on a bullish trajectory against the Japanese yen, with favorable swap rates incentivizing traders to maintain long positions in this currency pair. Support levels provide opportunities for strategic entry points, while the impulsive upward movement and formation of bullish patterns signal further potential for gains in the market. Overall, the outlook for the USD/JPY pair remains positive, with continued upward momentum expected in the near term.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.