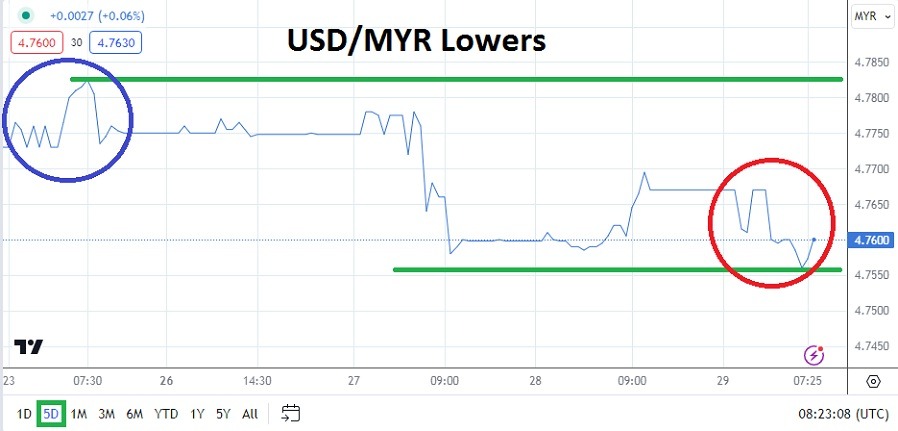

- The USD/MYR is near the 4.7560 ratio as of this writing.

- The Malaysian Ringgit has been able to muster another day of selling action, and has essentially continued its move lower since hitting a high around the 4.7980 ratio on the 20th of February.

- The high achieved a bit more than a week ago set off alarm bells for USD/MYR traders, financial institutions and members of the Malaysian Central Bank.

However the past week and a half of trading has continued to show a high correlation to the broad Forex market globally, and the ability of the USD/MYR to traverse near important support levels early today is important. The Malaysian Central Bank this morning announced through media sources that if needed it could and would intervene in the USD/MYR, but they also remained steadfast that the currency pair had been overbought. This public statement likely helped fuel additional selling of the USD/MYR this morning.

Calm Trading Conditions in USD/MYR

Even in the midst of the pronouncements from the Malaysian Central Bank the USD/MYR has traded in a calm manner. There has not been a serious spike. The move lower by the USD/MYR actually started in earnest on the 20th of February, and today’s central bank comments simply pointed out the government remains confident in the Malaysian Ringgit’s capacity to trade openly.

The 4.7560 mark which is now being traded is within sight of the important 4.7500 ratio which was last traded in the first week of February. The USD/MYR is not a heavily traded currency pair and speculators who are pursuing wagers need to understand their brokers will likely have a wide bid and ask on offer to pursue a chosen direction. Entry price orders should be used by day traders if they choose to bet on the USD/MYR.

Top Forex Brokers

U.S Data Correlations and Near-Term Value in the USD/MYR

Trading in the USD/MYR will be affected by the release of U.S inflation numbers via the Personal Expenditures Consumption Price Index later today. This means the USD/MYR will react when financial institutions in Malaysia become active again on Friday. If the inflation number is weaker than expected it could spur on weakness of the USD in the broad Forex market.

- The move downwards in the USD/MYR has the currency pair within sight of important support technically.

- If the USD/MYR challenges the 4.7500 level and proves that it is vulnerable the currency pair might produce some velocity downward.

- However, traders should not get overly ambitious and be willing to cash our profits should they materialize. Today trading in the USD/MYR and tomorrow’s will be insightful for the currency pair.

USD/MYR Short Term Outlook:

Current Resistance: 4.7590

Current Support: 4.7510

High Target: 4.7710

Low Target: 4.7380

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Malaysia to check out.