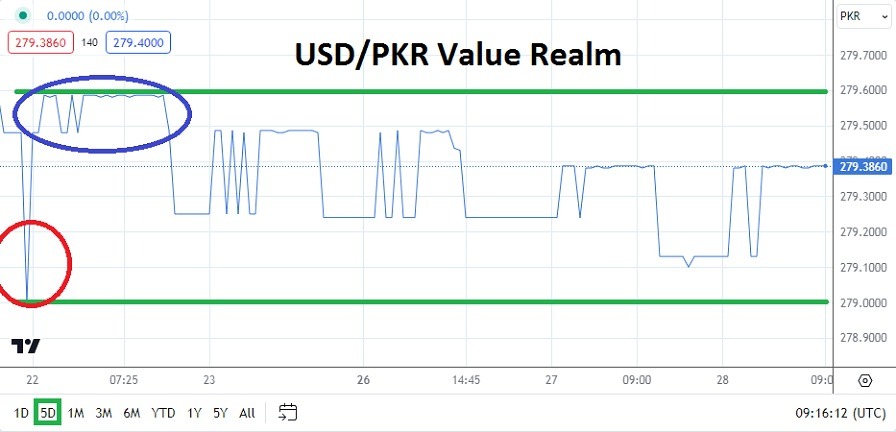

- The USD/PKR has a listed price as of this moment near 279.3800 which is very close to what the value of the currency pair was last week.

- Speculators who want to pursue the USD/PRK must use an entry price to get into the market, this to make sure they are not given a fill that doesn’t meet their expectation.

- The bid and ask of the USD/PKR is actually narrow, but a fill given at a price that wasn’t prepared for could lead to an unprofitable trade if the market direction has no intention of creating the desired value quickly.

Pakistan remains in the spotlight politically as its new coalition government gets situated and figures out how to move forward domestically and internationally. In recent days China and Pakistan have made rather conciliatory remarks about one another.

Yet there have also been reports that India and Pakistan have started to battle over the ‘branding’ of basmati rice exports in Europe. While the debate over the use of a ‘name’ regarding rice might not seem to be a major issue to most readers, any points of friction between India and Pakistan should always be given attention due to their strained historical relationship.

Economics of Pakistan and the USD/PKR Moving Forward

The tranquil price range of the USD/PKR is welcomed by financial institutions who would much rather deal with a stable currency pair compared to worries about rampant volatility. The Pakistani Rupee has produced a solid sideways trend during February even as concern about its government leadership was in question. The ability to produce a tight price range is good, but the question is if things will remain the same?

Economic concerns have not disappeared for Pakistan and there are many issues the current government must confront. For the moment however the USD/PKR is stable, and speculative interest in the currency pair should include a strict set of risk taking tactics if wagers are sought.

Top Forex Brokers

Near-Term Support Levels for the USD/PKR

The support level near the USD/PKR is of interest near the 279.2400 vicinity. Yes, the USD/PKR has traded below this mark, having hit the 279.0975 ratio only yesterday. But in the previous handful of days, the 279.2400 level has seemingly produced slight reversals higher towards the 279.3900 resistance ratio.

- Traders in the USD/PKR should not get overly comfortable with the very tight price range in the USD/PKR because there is always possibility volatility could rapidly develop. Risk management is needed.

- U.S economic data which will be released today and tomorrow should be watched to see if it causes any type of sudden reactions in the USD/PKR due to outlooks regarding the U.S Federal Reserve.

Pakistani Rupee Short Term Outlook:

Current Resistance: 279.3910

Current Support: 279.2500

High Target: 279.4980

Low Target: 279.1310

Ready to trade our daily Forex analysis? We’ve made a list of the best online forex trading platform worth trading with.