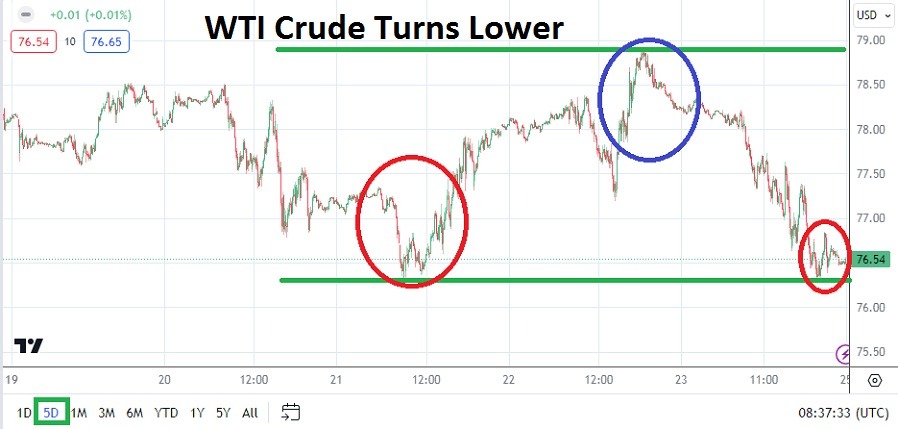

- WTI Crude Oil went into the weekend near the 76.550 price ratio, which may be viewed as a near-term bearish trend by speculators in the commodity.

- Recent trading in WTI Crude Oil has demonstrated higher prices since late January, but importantly the 80.000 level has seemed to continuously push the commodity lower when it has come into view via technical charts.

- The ability of WTI Crude Oil to touch its week’s high on Thursday, and then reverse quickly lower and remain near its short-term depths going into this weekend will intrigue speculative notions.

Supply once again via Crude Oil inventories in the U.S came in stronger than expected on Thursday. While it must be said the lower move in WTI Crude Oil may not have been completely based on the report, it certainly was curiously coincidental. Supply of energy remains abundant.

There are also legitimate reasons to believe global economic conditions which are lackluster regarding growth as a reason there is less demand via prices. However, the price of WTI Crude Oil challenging highs on Thursday and sinking to lows on Friday may have to do more with speculative forces testing price range. The price range which has become accepted as a norm by traders, may have more to do with the gyrations in WTI Crude Oil compared to other interpretations.

The 76.000 Ratio in WTI Crude Oil has become Technically Important

If WTI Crude Oil is simply trading based on sentiment being generated by speculative forces and the occasional noisy headlines regarding the Middle East shipping lanes, the 76.000 USD per barrel price may remain an intriguing factor.

The last time the 76.000 price level saw sustained trading below this technical ratio was in the first week of February. Yes, there have been outliers seen when the 76.000 ratio was penetrated below, but this has been brief and it has not happened since the 15th of February.

Top Forex Brokers

76.000 Support Levels Tests in WTI Crude Oil?

Having gone into the weekend near lows may signal speculators in WTI Crude Oil were not buyers based on fears of risks subsiding. The potential that traders are calmer regarding Middle East shipping, and the knowledge that supply is steady could also be factoring into the selling which was produced on Thursday and lasted into Friday. WTI Crude Oil also tested lows on Wednesday of last week before the brief run higher it should be noted.

- If WTI Crude Oil opens tomorrow’s trading with tranquil results and a lack of a sudden run higher, it may indicate sentiment believes the commodity is near an accepted equilibrium, but it also may be a sign that bearish undertones remain strong within the energy sector.

- A fresh move lower in WTI Crude Oil on Monday which begins to challenge the 76.000 price level may ignite additional selling from speculators who want to test the short-term trend.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 74.690 to 79.100

WTI Crude Oil has traded within a higher price range the past couple of weeks without any significant selling storms which have proven long lasting. The ability of the 76.000 ratio to become durable is of interest. The test of low water marks twice this past week may have some speculators under the impression a run higher will develop. However, the perception technically that WTI Crude Oil went into the weekend within sight of lows opens the door to another move lower that could break below current support.

The 76.000 to 79.000 price range in WTI Crude Oil has been rather durable the past couple of weeks. Traders may be content to simply test this range with wagers that pursue technical perceptions. Trading on early Monday into Tuesday should give a rather good demonstration regarding behavioral sentiment within the commodity.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.