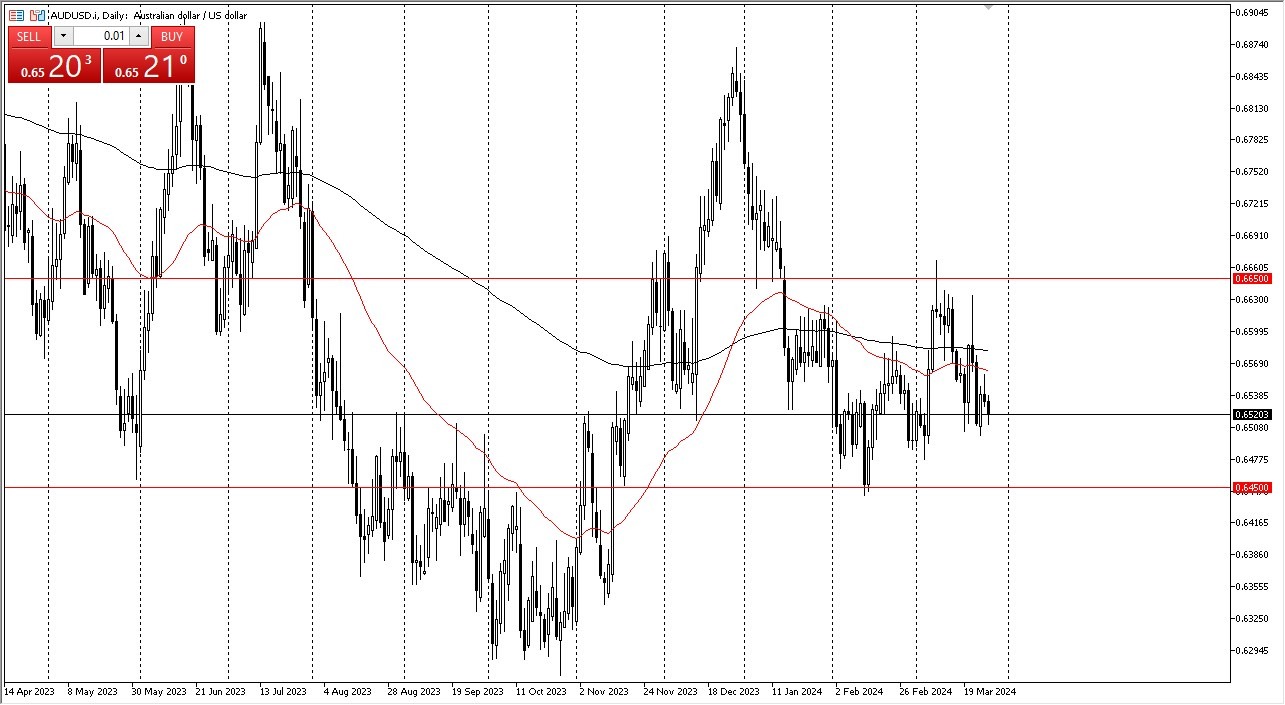

- The Aussie dollar has fallen a bit during the trading session on Wednesday, as we continue to drift toward the 0.65 level.

- The 0.65 level courses a large, round, psychologically significant figure and an area that we have seen some action at previously.

- That being said, we have sliced through it multiple times so I don’t necessarily know that it will hold the market up by itself.

Above, we have the 50-Day EMA, which of course is an indicator that a lot of people will be paying close attention to. In general, I think this is a market that will continue to be noisy and it does make a certain amount of sense that might be the case due to the fact that the Australian dollar is considered to be a “risk on currency”, and therefore we need to have a lot of risk-taking around the world to send it higher.

External Pressures

Keep in mind that the Australian dollar is highly sensitive to multiple external pressures, such as Asia, and of course risk appetite overall. Commodities also have a major influence on this market, so be aware that as well. Quite frankly, if you see major markets falling, typically that does not do well for the Aussie in that environment. In general, I think this is a market that will continue to see a lot of noisy volatility, but at the end of the day, I think we are essentially stuck in a major range.

Top Forex Brokers

The 0.6450 level underneath is a major support level from what I can see, and they will continue to look at it through that prism. If we were to break down below that level, then we will drop another hand or 2. On the upside, we have the 0.6650 level offering major resistance, and the same thing can be said for breaking through there, that it could open up 200 points rather quickly. Keep in mind that the 50-EMA on the daily chart is widely followed and it sits just above. The 200-EMA is also something that people will be paying close attention to, so be cognizant of what’s going on with those moving averages that are both flat, and in the middle of this range. In other words, I think you continue to just trade the Australian dollar back and forth.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.