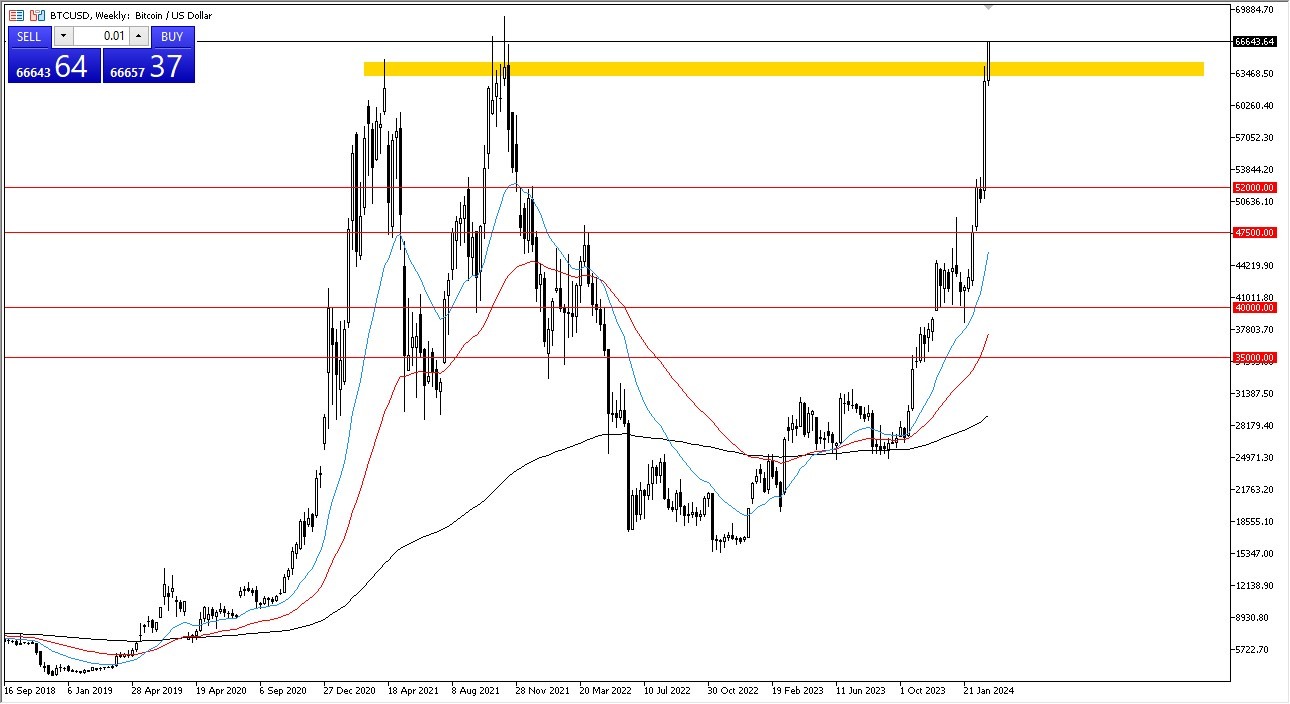

- Early on Monday, the bitcoin market smashed through yet another barrier as ETF inflows continued to support the market.

- Having said that, we need exercise extreme caution when pursuing the market at this time because we are also extremely overextended.

Monday's trading session saw Bitcoin continue to gain significant traction due to the large number of purchasers who were eager to enter and take advantage of this market. Given this, I believe there will be a lot of traders out there chasing, and regrettably, I believe that this is how people will perceive it going forward.

Somebody Will Get Hurt

Having said that, there is a good likelihood that someone will suffer harm, but it is obvious that you cannot be a short seller right now. To be honest, it would be a terrific way to lose money. Given that, I believe you should consider any downturn to be a possible opportunity to buy. Additionally, I believe that traders will keep participating whenever they can.

Top Forex Brokers

Having said that, see dips as a chance to participate in the current meltdown that is occurring. It seems probable that the Bitcoin market will aim for the $70,000 mark before everything is said and done. And things are just the way they are. If we manage to reach $62,000, there will be a good number of people there whenever we retreat.

Then there are 52,000 following that. Nevertheless, it's very difficult to conclude from this chart that we are not experiencing a melt-up bubble of some kind. This indicates that Wall Street is participating, and you need to be aware that a lot of this is driven by ETF inflows. Thus, a significant sum of money will be invested in this. When it's time to give your baggage to other people, a lot of money will also come out of it. Therefore, even though I enjoy purchasing dips, I am aware of how risky this is. Unless it's for a fast smash and grab setup, chasing it all the way up here is just playing with fire.

Ready to trade Bitcoin to the dollar? We’ve made a list of the best Forex crypto brokers worth trading with.