- Bitcoin keeps rising as traders totally disregard gravity.

- At this point, the Wall Street inflows are driving the market much higher, so you have to view it through the lens of a mania.

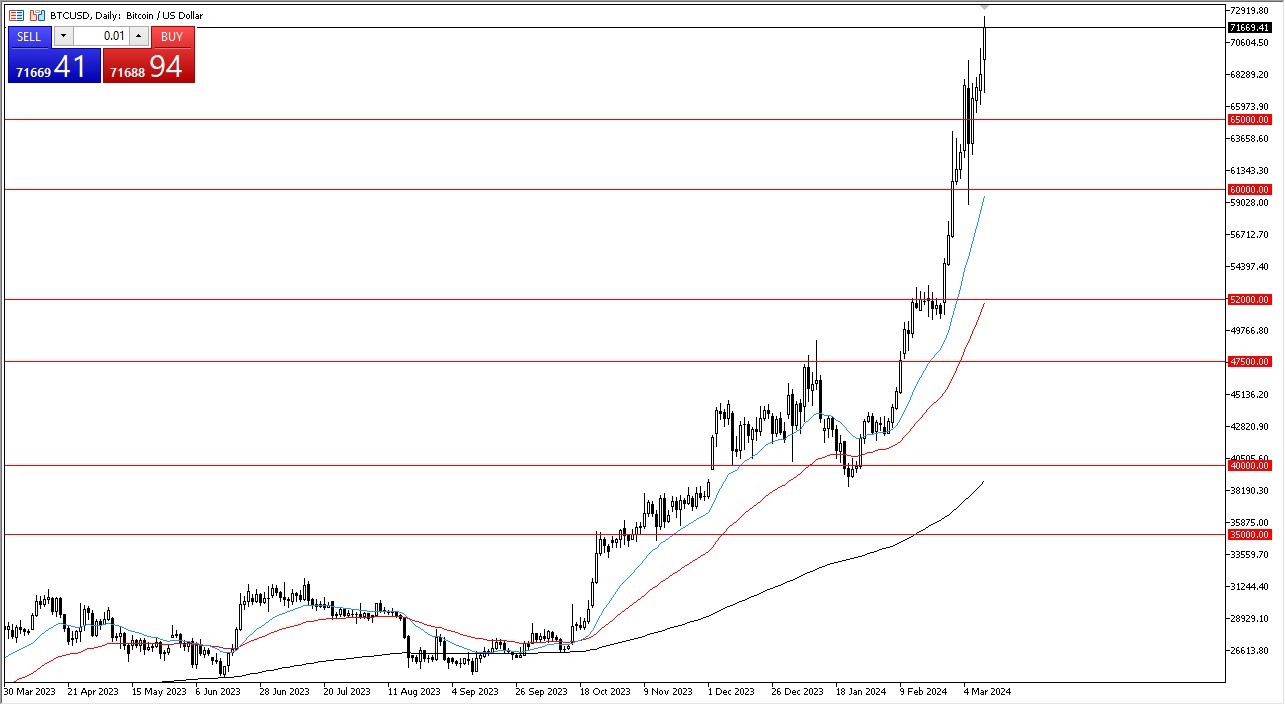

As you can see, on Monday, Bitcoin saw a brief spike higher before faltering and then finding buyers once more. Having said that, we are currently well over 70,000 and are essentially in uncharted territory. The main issue is that there isn't really anything to gauge against. Fibonacci extensions and other similar concepts may be used by some, but in reality, there is nothing more for us to measure. In a situation like this, your only option is to look at the overall trend, which is higher, and realize that when you pull back, there will be buyers ready to fill the void.

Top Forex Brokers

Crucial Support Below

As of right now, I believe that 65,000 will be a crucial support level. Because of the psychological impact and the fact that the 20-day EMA is still there, I am aware that 60,000 will occur, and then 52,000 again. In actuality, the market has increased by 190% since it reached its low in August of last year.

Although there are many factors outside of Bitcoin's sphere of influence, the most obvious being the Bitcoin ETF, that also raises a particular issue. The issue is that institutions can now short Bitcoin much more easily. It will also be dumped on retail public traders by them. Thus, I have some doubts about this. I know we could reach much higher. You never think that manias would last this long, but you don't want to lose money. And that's the main idea. You should not pursue it. You want to see some backtracking and become involved. Because this is what happened the last time we saw it. Don't forget that. We're probably not quite there yet, but it's likely that we'll witness something similar in the future. The speculative aspect of Bitcoin seems to be simply buy it, pump it up, dump it on gullible late cycle chasers, watch them blow up, then buy it again, cheap, pump it up. Really, it's just conjecture. Currently, Wall Street has entered the fray and is selling ETFs to individuals through their pension funds; it has no true utility, at least not in the real world. It's true that there is a lot of money coming in, but you should be aware that eventually someone will profit from you.

Ready to trade Bitcoin USD? Here are the best MT4 crypto brokers to choose from.