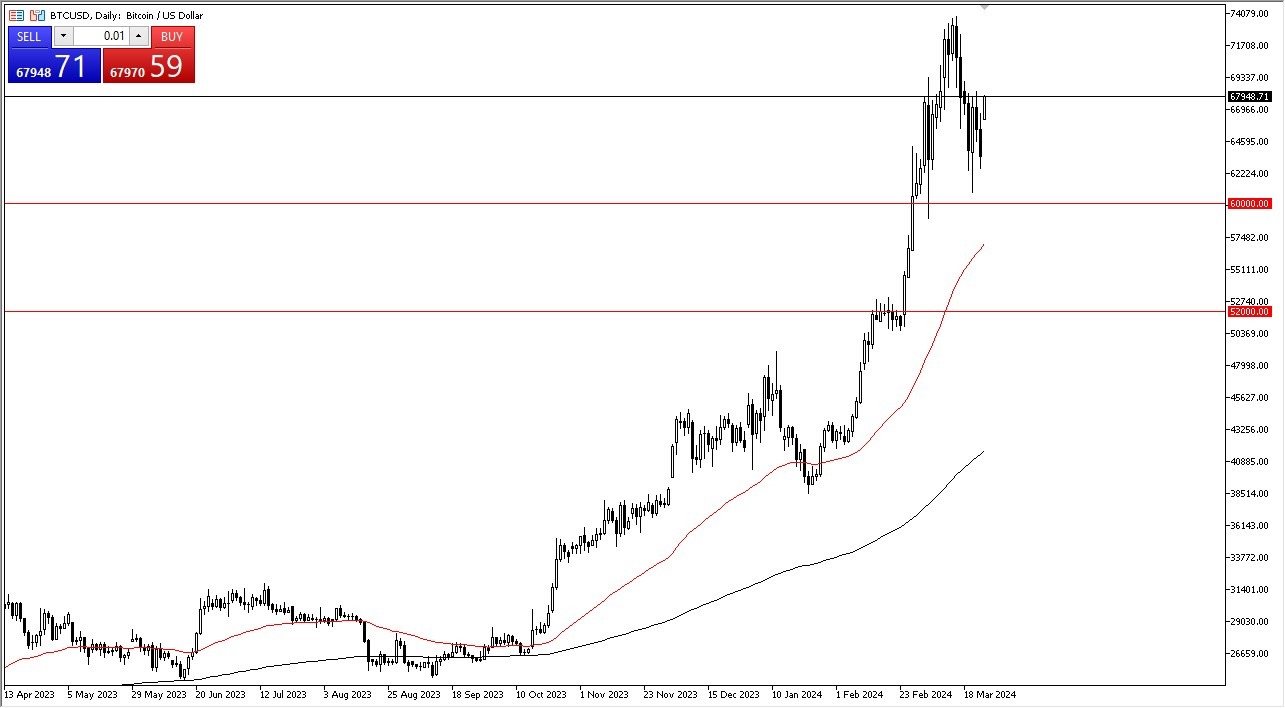

- Bitcoin, as you can see, has been rallying for a significant amount of time, but in the last couple of days, we have gone back and forth to show signs of noisy trading.

- I think the $60 level underneath is an area that a lot of people will be paying attention to as support, and we have turned around to show signs of life.

In general, I think we will eventually go looking to the $75 level. In general, Bitcoin is a market that had recently seen a lot of money flow into the ETF, and that drove prices higher. But having said that, we are now through that, and I think we will more likely than not continue to have an upward trajectory, but it won't be like the 90% rally that we had in the first couple months of the year.

Top Forex Brokers

Either way, you have to look at pullbacks as buying opportunities, and it certainly looks like that's been the case here on Monday, as traders have started to buy into this market. I think we will go looking to the $75,000 level next. If we can break above the $75 level, the market is likely to continue to go much higher, perhaps reaching the $80,000 level. In general, I think you continue to look at every dip as a buying opportunity. The 50-day EMA underneath is starting to race towards the $60,000 level, only solidifying that as a floor going forward. Bitcoin remains bullish, but you also have to realize that a little bit of sideways action is probably the best thing that could happen to this market after that ridiculous move.

The Trend Continues…

Overall, I expect this market to be bullish over the next year, but the massive inflows from the ETF are done at this point. The markets will be a lot of stable to the upside, and therefore I think you have a lot of people out there that are willing to buy this market on each pullback, as there are a lot of people that missed out on the big move higher.

Ready to trade BTC/USD? Here’s a list of some of the best crypto brokers to check out.