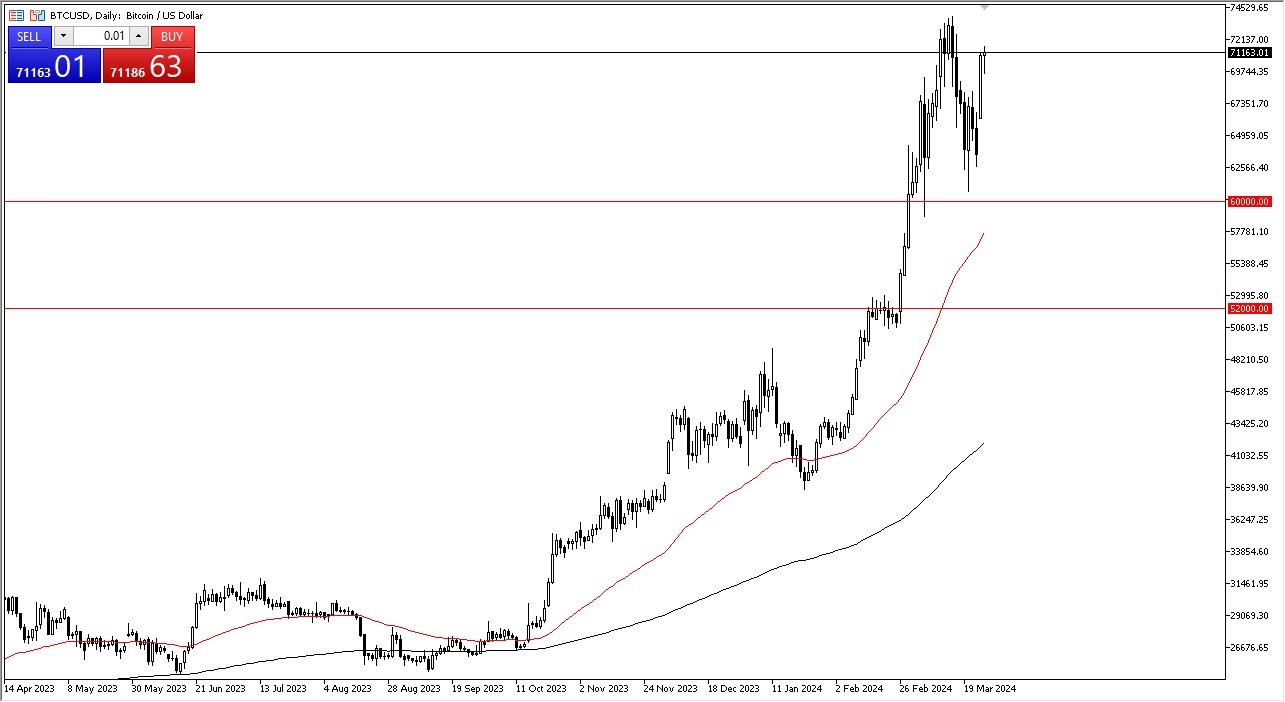

- Bitcoin seemed a bit stagnant during the early hours on Tuesday after shooting straight up in the air on Monday.

- Ultimately, this is a market that remains very bullish, and I think most traders look at each pullback as a potential buying opportunity.

- We have had massive inflows into the ETF from Wall Street, so we'll see how this behaves, but I think, although still a bullish market, I think it's becoming a little bit more mature in the sense that we will see more stable trading in general.

Massive Support Below in BTC

I think underneath the $60,000 level should be a massive support level, followed by the 50-day EMA, which is rapidly reaching towards that area. Above, we have the $75,000 level, which of course is a large round figure and will attract a certain amount of attention, but we're essentially in no man's land at the moment as we are basically at all-time highs.

Top Forex Brokers

BTC/USD continues to be attractive as the latest and newest asset that Wall Street wants to get involved in, which means they will manipulate it from time to time. It no longer is in the wild West and it's now going to be traded more or less like an index. Keep in mind it is still considered to be a asset that a lot of people use in times of risk on behavior. So, if we get some type of massive sell off on Wall Street, you could see Bitcoin fall right along with it. That's always somewhat been the case, but it's probably going to be magnified now that Wall Street has an ETF in which to short Bitcoin much easier than you could before.

So, I think we're going to see more of a balanced market. A lot of pundits out there calling for rallying, something like that. And it seems like every time we start to hear that, we're closer to the top than the bottom. So, with that being said, I think you're going to see a lot of churn in this area as we try to figure out what to do next. If you are long-term in your thinking, you probably aren’t doing much at this point in time.

Ready to trade Bitcoin USD? Here are the best MT4 crypto brokers to choose from.