As we continue to pound a few major moving averages in an attempt to ascertain whether or not we have enough momentum to break out to the upside, the merciless markets remain extremely erratic.

WTI (US Oil)

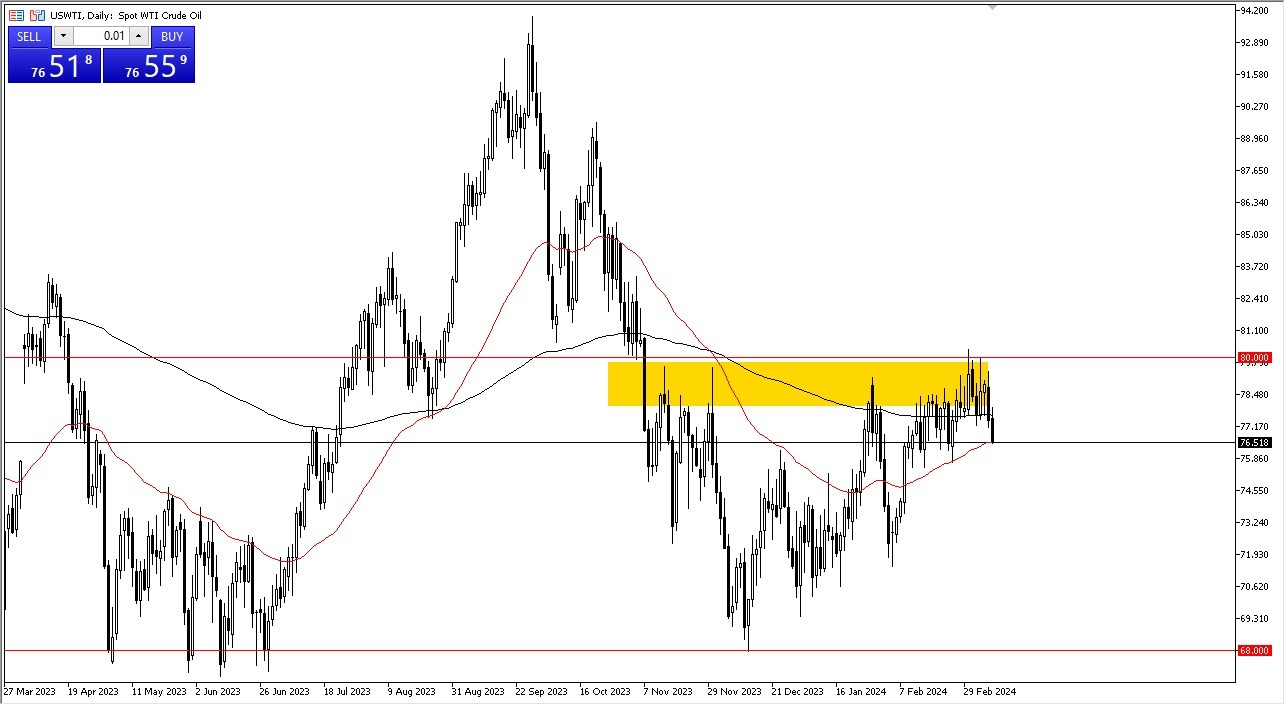

- The WTI Crude Oil Market is being tested, and as you can see, we're hanging around the 200-day EMA and the 50-day EMA in an effort to show some life.

- I do think that the market is still a buy on the dip at this time. It seems inevitable that we will eventually break higher and target the $80 level.

- We do need to keep a close eye on the $80 level as it represents a significant amount of resistance.

- If we break above it, I believe the market will behave similarly to a beach ball that has been submerged. It takes off upside down as soon as it breaks the plane.

While short-term pullbacks remain highly problematic, I don't believe they will pose a significant long-term problem. There are many reasons for this market to rise, not the least of which is the geopolitical unrest in the Middle East. However, we also have a higher cyclical drive because of the increased energy needs of summer travel, cars, jets, and other vehicles. Additionally, industry will get involved if central banks around the world decide to quickly reduce interest rates.

Top Forex Brokers

Brent

You can see that this is pretty much the same as what happens with UK or Brent oil. I've marked the resistance above at $84.50. It would be encouraging if we could resolve that, in my opinion. From this point on, I believe the market will likely reach a hard floor at $80, but overall, I believe the market will continue to oscillate with a greater inclination toward the upside. I'm therefore more likely to purchase short-term dips on days like today. Although I'm not sure if I would marry the job, I believe we can start to really take off here as well if we can break above $84.50. I am not interested in shorting oil at this time.

Ready to trade WTI/USD? Here are the best Oil trading brokers to choose from.