- Crude is still seeing a lot of noisy activity, and this is probably going to continue.

- Important resistance levels are being watched by the markets, so it's important to pay attention to both cyclical trade and overall momentum.

- Ultimately, I think the momentum trade is only part of the action, and I think that a lot of traders will eventually jump into any breakout.

WTI Crude Oil

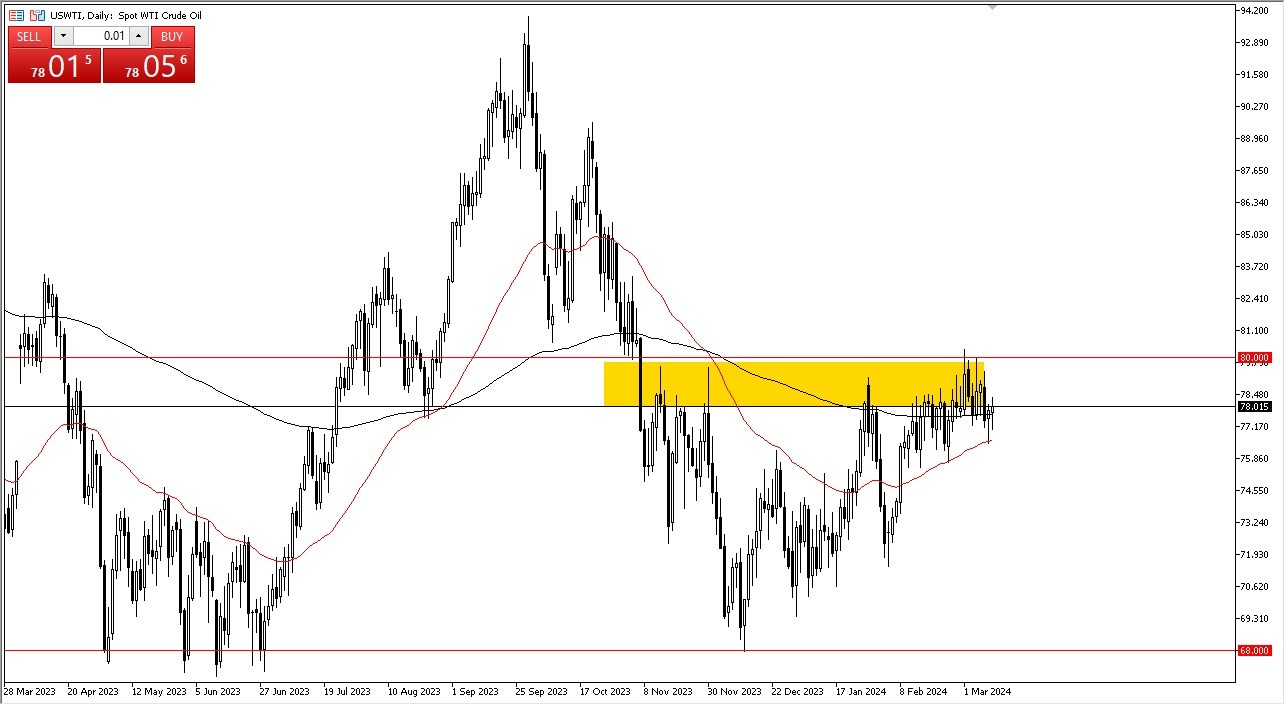

Looking at the crude oil markets, it is evident that we have been circling the 200-day EMA for the past few sessions, and Tuesday was no exception. Having said that, it seems reasonable that buyers will continue to enter the market on dips, given that WTI has found significant support at the 50-day EMA and has been attempting to break above and approach the $80 level for a number of weeks. This time of year has a significant impact, in my opinion. There is undoubtedly cyclical trade at play here, as more people travel by car and plane at this time of year. Of course, an even greater problem is the supply shortage that we are currently facing. Thus, I continue to buy this market every time it drops, and therefore I think that you will simply have to follow that plan of action.

Top Forex Brokers

Brent

In the previous session, the 50-day EMA provided support in a similar situation to what Brent is currently experiencing. Although there appears to be a lot of resistance above, particularly close to the $84.50 mark, we are making every effort to push the market higher. The $80 level, in my opinion, provides support if we do break down from here. However, if we can continue higher, the situation essentially shifts to one of an intermediate buy and hold. Given that the Federal Reserve and other major central banks will be cutting rates, which should boost economic activity and contribute to high oil prices, I do believe that both of these markets will eventually hit $90 this summer. I'm not interested in shorting anything. Every pullback is a potential opportunity for a value play, in my opinion. But, always exercise caution when sizing your positions. Given the likelihood of increased volatility in the future, this will undoubtedly remain a top concern for traders wishing to participate in this market.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.