- The price of crude oil continues to decline from time to time, but each time it does, buyers are eager to jump in and seize the opportunity.

- Ultimately, I believe that the market's eventual breakout is probably just a matter of time.

- I think this lines up nicely with not only central banks, but also supply and the seasonal effect as well.

WTI Crude Oil

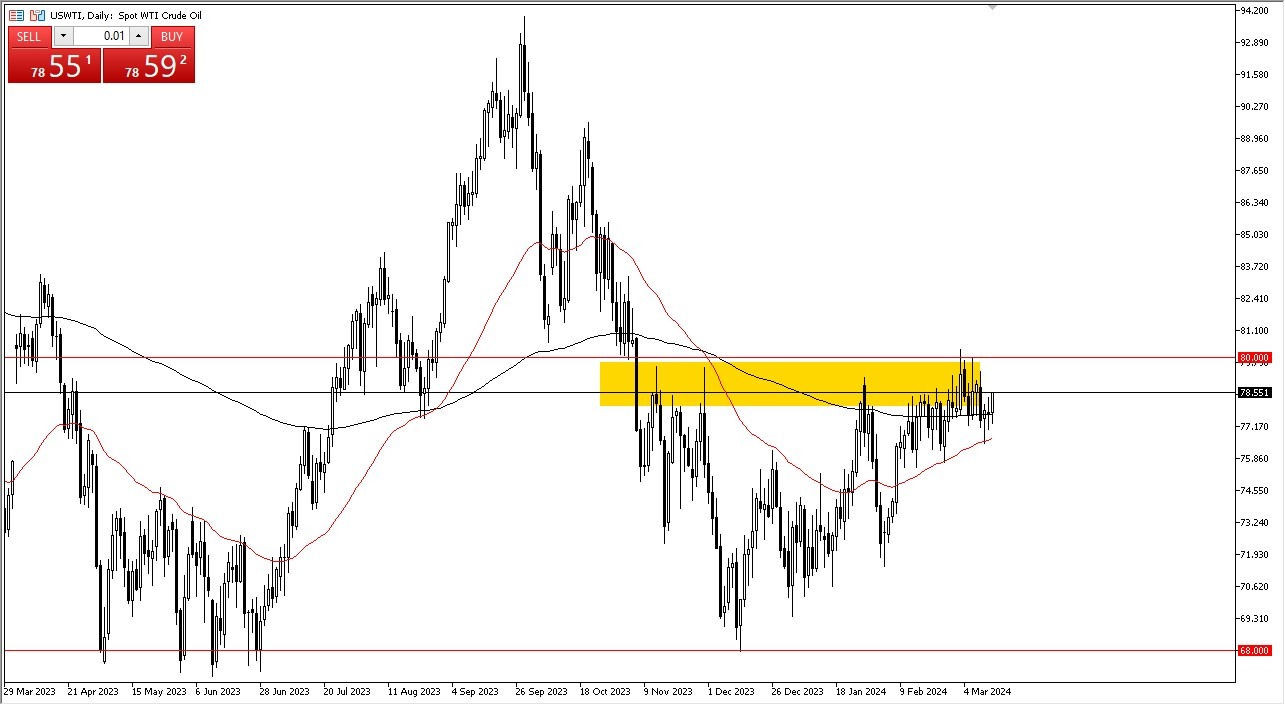

Early on Wednesday morning, crude oil slightly declined before making a turnaround and exhibiting signs of life. In the end, this is a scenario where we perceive the $80 level above ours as a kind of ceiling, and as I have said before, the dips present buying opportunities.

All that remains to be seen is if we can exert enough pressure to ultimately remove the ceiling at the $80 level. It is likely that the $85 level will be the target if we manage to break above that. Alongside the 50 day EMA, there is still a lot of support provided by the 200 day EMA.

Top Forex Brokers

Brent Crude

After breaking through the 200-day EMA, Brent remains largely unchanged. However, we now need to monitor the possibility that the $84.50 level above will act as a significant resistance barrier. This should come as no great surprise as this has been tested numerous times.

And we can actually start to take off if we can remove it. There will be plenty of support for short-term pullbacks in the vicinity of the 50-day and 200-day moving averages. I'm not sure what will need to happen to push this market higher at this moment, but it appears that there is enough resilience that it will eventually do so.

Your ultimate goal will be $95 if we break out, and we'll most likely see that during the summer. After all, most traders closely monitor the fact that we are approaching a cyclically bullish period of the year. Moreover, availability is a little limited. Naturally, there is a great deal of tension in the Middle East, and it appears that the US dollar is beginning to weaken. Thus, everything points toward the possibility of stabilizing the oil markets. I trade in both grades, and I have no interest in selling either.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading platforms to check out.