- The crude oil markets continue to be very strong, as it looks like we are doing everything we can to breakout on Thursday.

- That being said, you should begin to start to look for opportunities on a breakout, but you should also be aware of the fact that false breakouts occur.

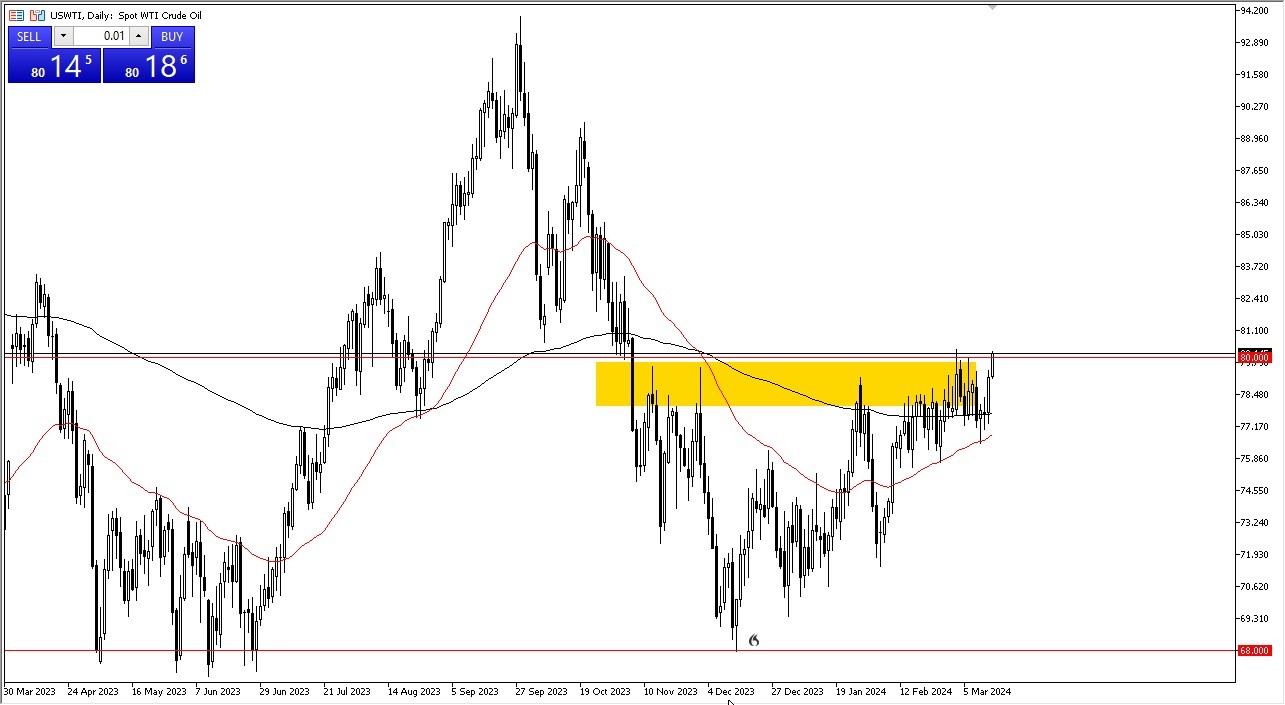

WTI Crude Oil

The West Texas Intermediate Crude Oil market looks very strong at the moment, and it certainly looks as if we could go much higher. Ultimately, this is a market that will try to break above the $80 level for a sustainable move to the $85 level. It does make a certain amount of sense considering that supply is somewhat dwindling, and of course we have a situation where traders will be looking at this through the prism of trying to find value on every dip. That’s been the case for some time, and the pressure finally seems as if it is making some type of headway into the selling pressure.

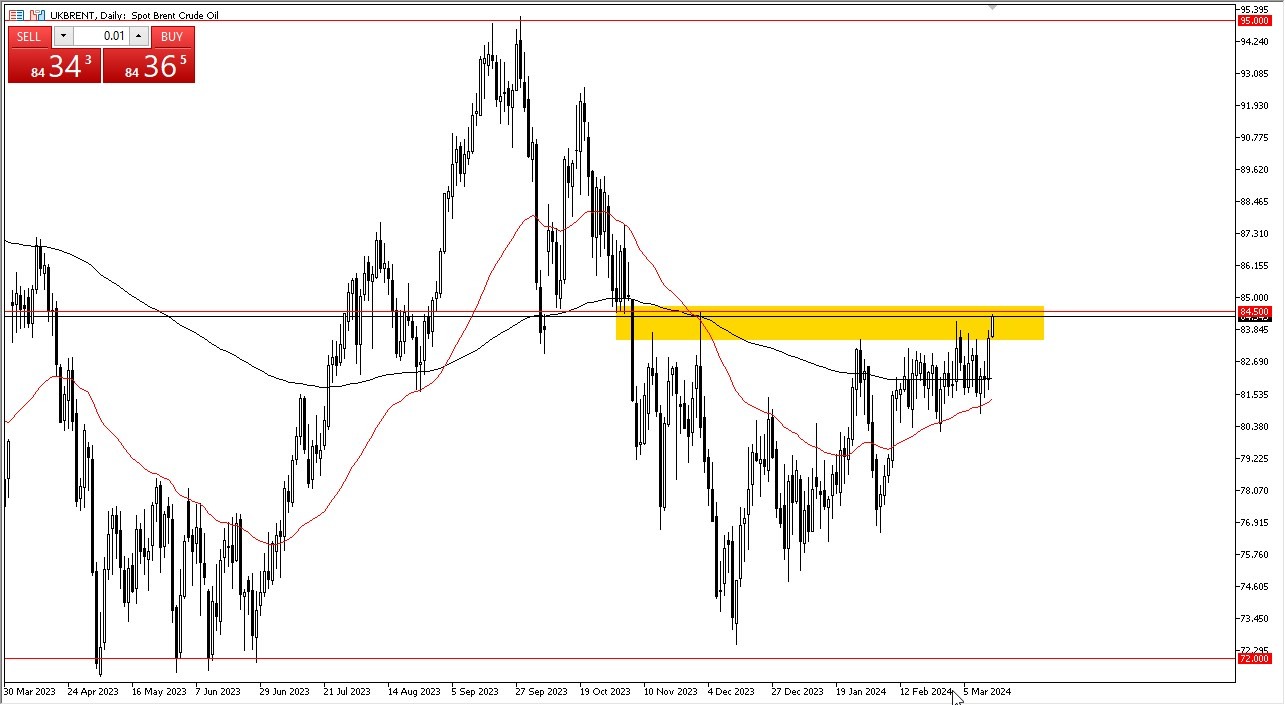

Brent

The Brent market, or UK Oil, is doing very much the same. The $84.50 level is an area that has been significant resistance previously and I think you got a situation where traders will continue to look at this through the prism of trying to find value. If and when we get a pullback, traders continue to jump back into it as the market has the moving averages underneath offering a significant amount of support, and of course we have all of the geopolitical tension out there that will drive crude oil higher.

Top Forex Brokers

If the US dollar starts to lose strength again, they could also have crude oil but at this point in time I think it has more to do with the supply and the fact that the time of year is sickly the very strong as we begin the travel season, and of course that drives aboard to me and globally, especially as air travel picks up. All things being equal, this is a market that I have no interest in shorting and I do think that it is probably only a matter of time before we get an explosive move toward the $90 level.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading platforms to check out.