- Crude oil markets continue to show plenty of strength during the trading session on Monday, as it looks like we are ready to go ripping even higher.

WTI Crude Oil

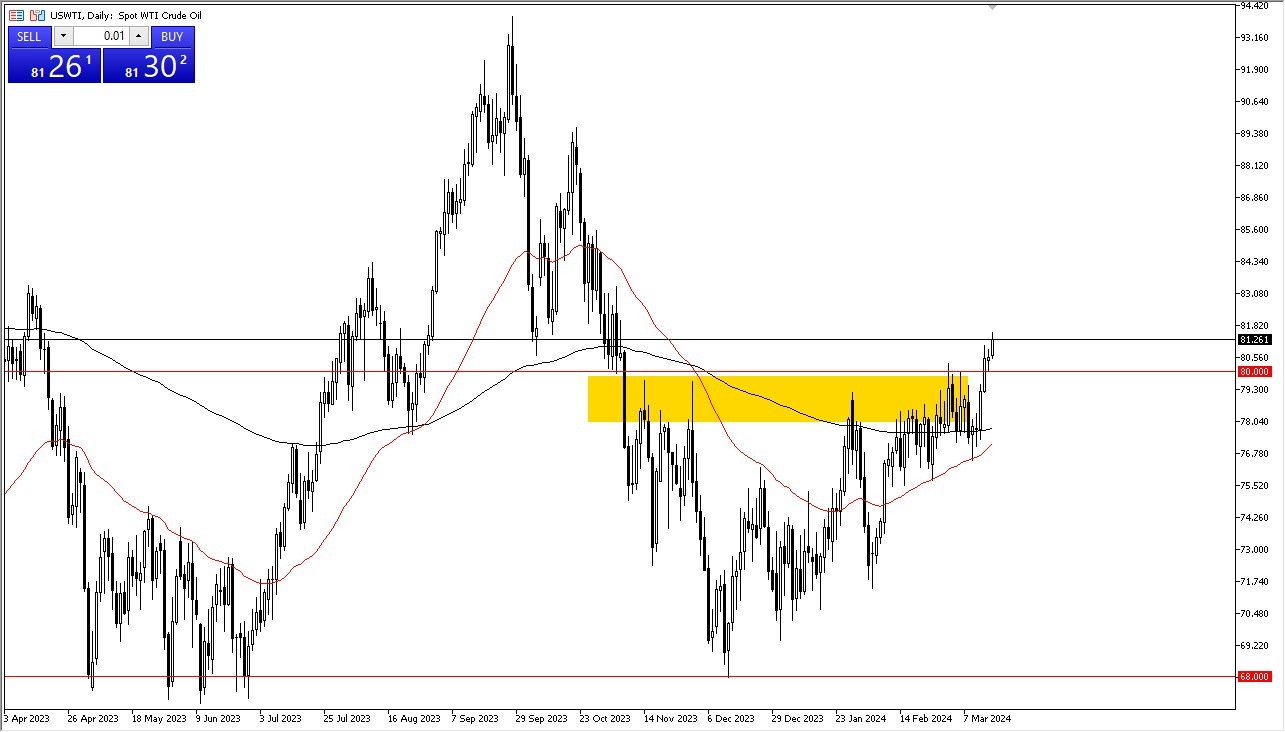

The West Texas Intermediate Crude Oil market broke above the $81 level early during trading on Monday, as we continue to see a lot of upward pressure. Ultimately, I think this is a scenario where traders will continue to look at this through the prism of a supply and demand problem. After all, we are seeing a lack of supply, and of course the recession that everybody’s waiting on still hasn’t shown up.

As we head into summer, demand for crude oil will continue to pick up, and it does make quite a bit of sense that price sickle really rises this time a year anyway. With that being the case, I think it’s probably only a matter of time before we see a lot of “buy on the dip” attitude come back into the market, which has been the case previously. I currently believe that the West Texas Intermediate market will go looking to the $85 level over the next couple of months.

Top Forex Brokers

Brent

The bread markets have broken above the $85 level during the trading session on Monday, and that of course is also a very bullish sign. Underneath, the $84.50 level is an area that a lot of people will be closely monitoring, as it was previous resistance. There should be a significant amount of “market memory” in that general vicinity, and of course just as we have seen in the WTI grade, we also have the 50-Day EMA reaching to break back above the 200-Day EMA, in the so-called “golden cross”. This is a longer term “buy-and-hold” type of signal.

There are plenty of geopolitical concerns out there that could drive oil higher as well, so it all ties together between cycles and geopolitics to drive this market much higher over the next couple of months. I have no interest in shorting crude oil, and I do believe that it will be one of the better trades between now and the end of summer for those who remain bullish and can be patient enough to look for value.

Ready to trade WTI/USD? Here are the best Oil trading brokers to choose from.