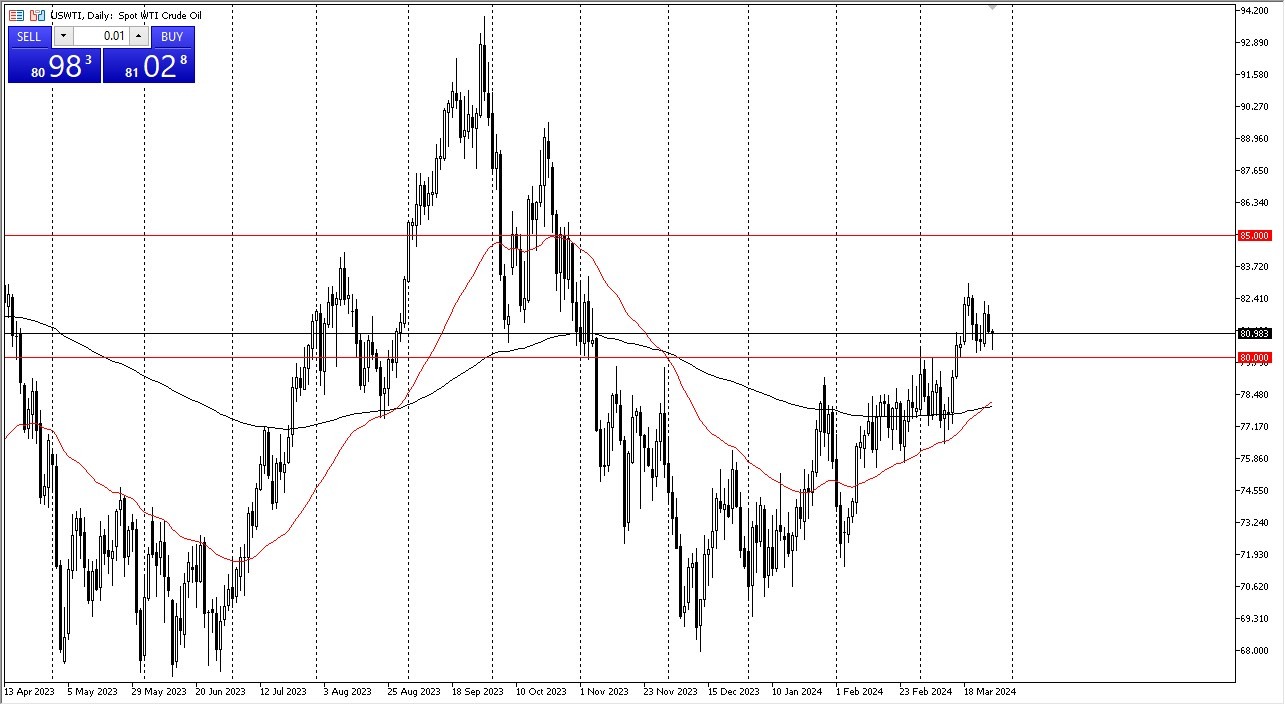

- The WTI crude oil market has initially fallen during the trading session on Wednesday but found plenty of support at a major support level in the form of $80.

- With that being the case, I think you've got a situation where as long as the $80 level holds as support, you have to be looking at this as a buy on the dip market.

The market breaking above the recent high does suggest that we are going to go looking to the $85 level. The $85 level is a large round figure and an area where we have seen a lot of noise previously. We also have the Golden Cross underneath where the 50-day EMA breaks above the 200-day EMA and a lot of longer term algorithmic traders are interested in that for more of a buy and hold market in general. I like the idea of taking advantage of cheap oil in this market. This is probably how we will be looking at this market for the next several months, as the market will continue to see a lot of demand over the next few months, due to travel season, etc.

Top Forex Brokers

Brent

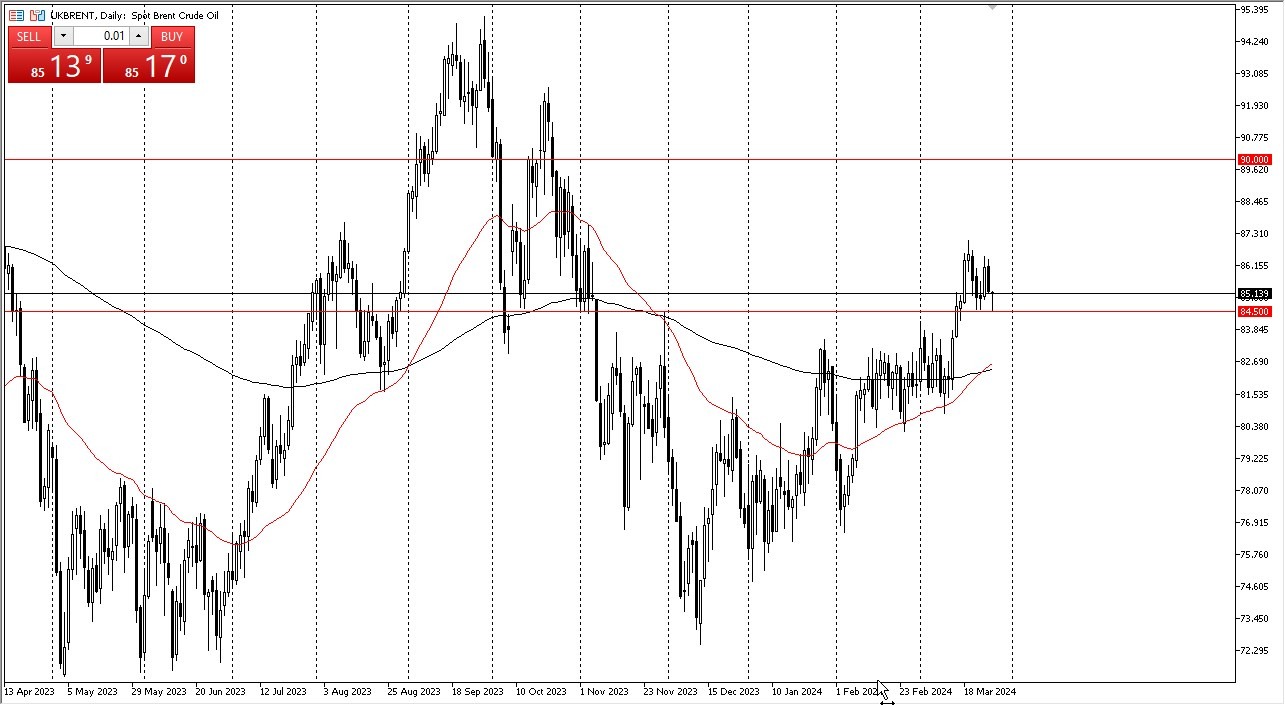

The Brent market also fell only to turn right back around at the crucial $84.50 level the $84.50 level is an area that previously has been very important, and therefore I don't think you can fight it. Ultimately, I like the idea of getting long, basically now, and trying to aim towards 90, but recognizing that we will have the occasional pullback. Those pullbacks should continue to be buying opportunities and I will continue to look at them as such.

Keep in mind that crude oil does and therefore it should not be a huge surprise if we rally into the spring and summer. Beyond that, we also have plenty of geopolitical events that need to be paid close attention to as well that can also have a major influence on the price of oil. With all of that being the case, I would remain bullish, but I also understand that volatility will continue to be an issue at times.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading platforms to check out.