- Crude oil markets are attempting to generate enough pressure for a Friday breakout once more.

- I remain very interested in these markets going forward.

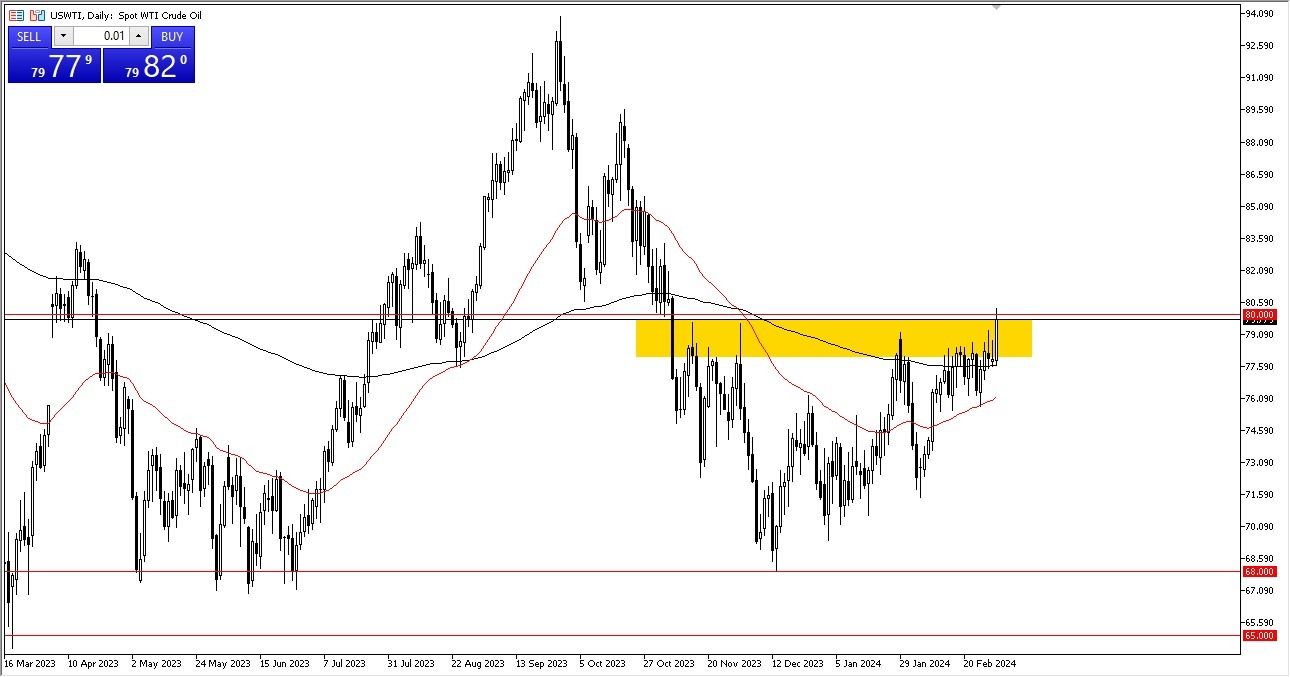

WTI Petroleum

The WTI grade crude oil market saw a notable early trading session rally on Friday, as it appears that the $80 level is still a threat. Naturally, a lot of people will be closely monitoring the $80 level because it is a big round number, but it has also emerged as a clear resistance level. I believe that a lot of people are waiting for the activity to settle in this area before investing, so when it does, they will flood the market.

A move above $80 is almost guaranteed to trigger a significant amount of short covering and FOMO trading in this market. That's when a lot of folks will be heading for the hills. For this reason, I find it appealing to purchase both breakouts and pullbacks simultaneously. It is noteworthy that the 200-day EMA has provided support for the last three days in a row.

Top Forex Brokers

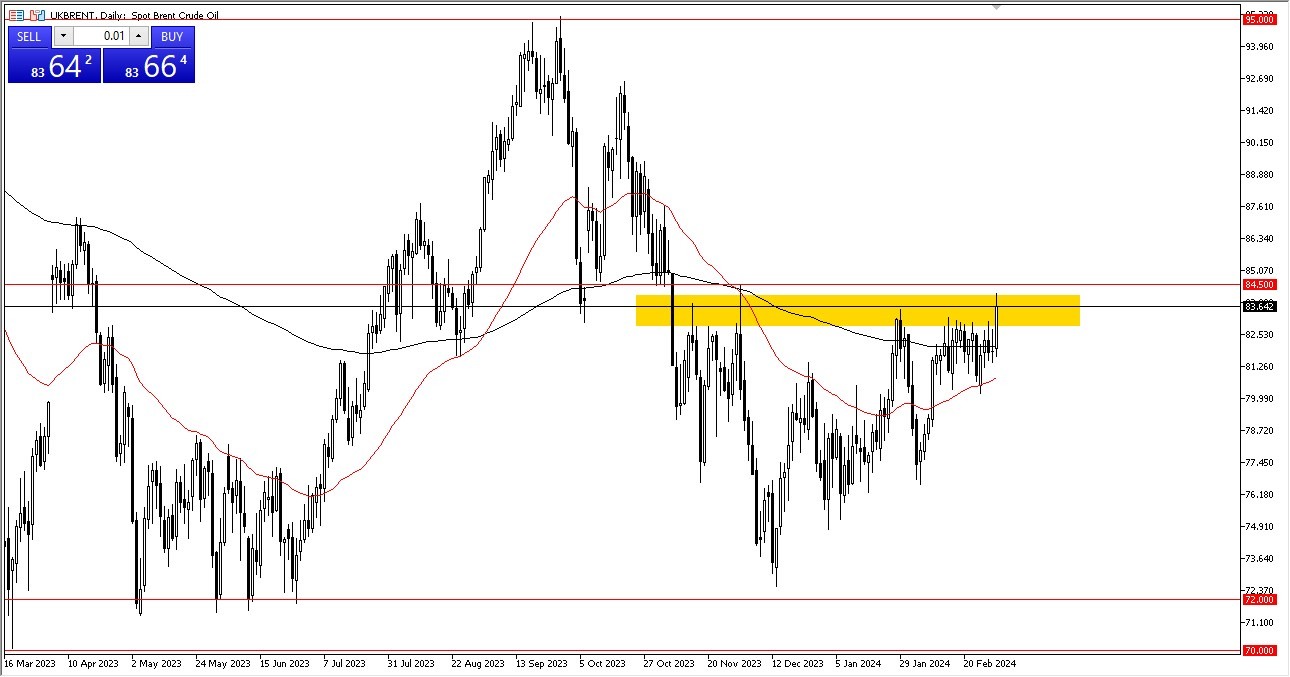

Brent

While we are attempting to break out here, the Brent market appears to be pretty similar, albeit a little hazier on the precise location of the resistance. I think the $84.50 level is still a critical area to watch, and if we break through it, it will be clear that Brent will rise and most likely reach $90 very soon. The 200-day EMA is now providing support and price in the area. Additionally, I think it makes sense to purchase temporary declines in this market.

Remember that there's a bigger picture that needs our attention as well. One that implies that oil will remain a contentious subject due to the unrest in the Middle East. Furthermore, it's highly possible that oil demand will increase if central banks throughout the world keep lowering interest rates. It's also important to keep in mind that there has been a slight decrease in the real physical supply, which has some bearing on this market, and will only get exacerbated in the future due to issues in the Red Sea, and of course the transport time that will only increase.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading brokers to check out.