- The crude oil markets are still exhibiting a lot of erratic behavior, but ultimately, both of the grades I monitor appear to be highly bullish, and at this point, I believe there will be a significant upside breakout.

- In addition to people joining the "FOMO rally," I believe you'll have a lot of people short covering when that occurs.

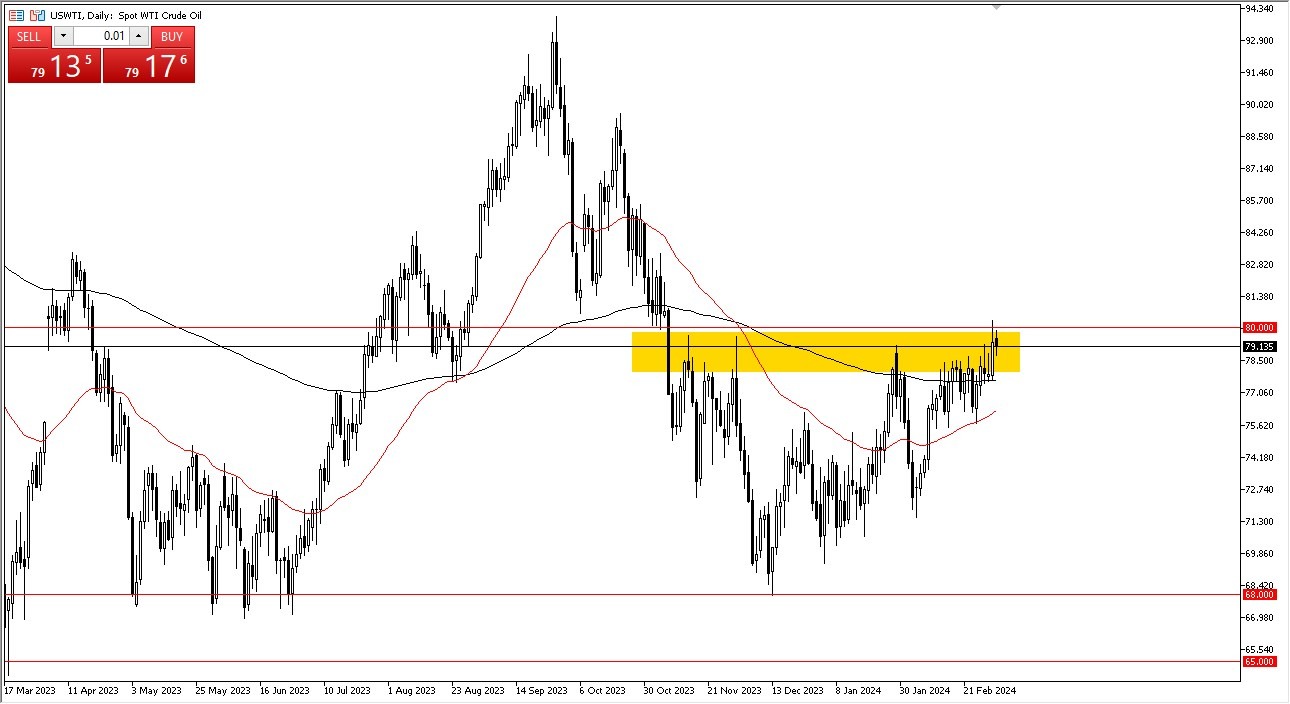

WTI Crude Oil

Although there was a small retreat in the crude oil market during Monday's trading session, the overall outlook remains favorable. The WTI crude oil market has been observed to encounter a noteworthy resistance level of $80. I believe that at this point, it will probably just be a matter of time until we emerge above that. It's likely going to be really violent when we do. The 200-day EMA could serve as possible support for any short-term decline, and a breakdown below it might lead to a move down to the 50-day EMA. However, I believe it will be quite challenging to break below both of those. Thus, I believe you are still in a buy-on-the-dip situation. In this market, that is most likely going to remain the case for some time to come.

Top Forex Brokers

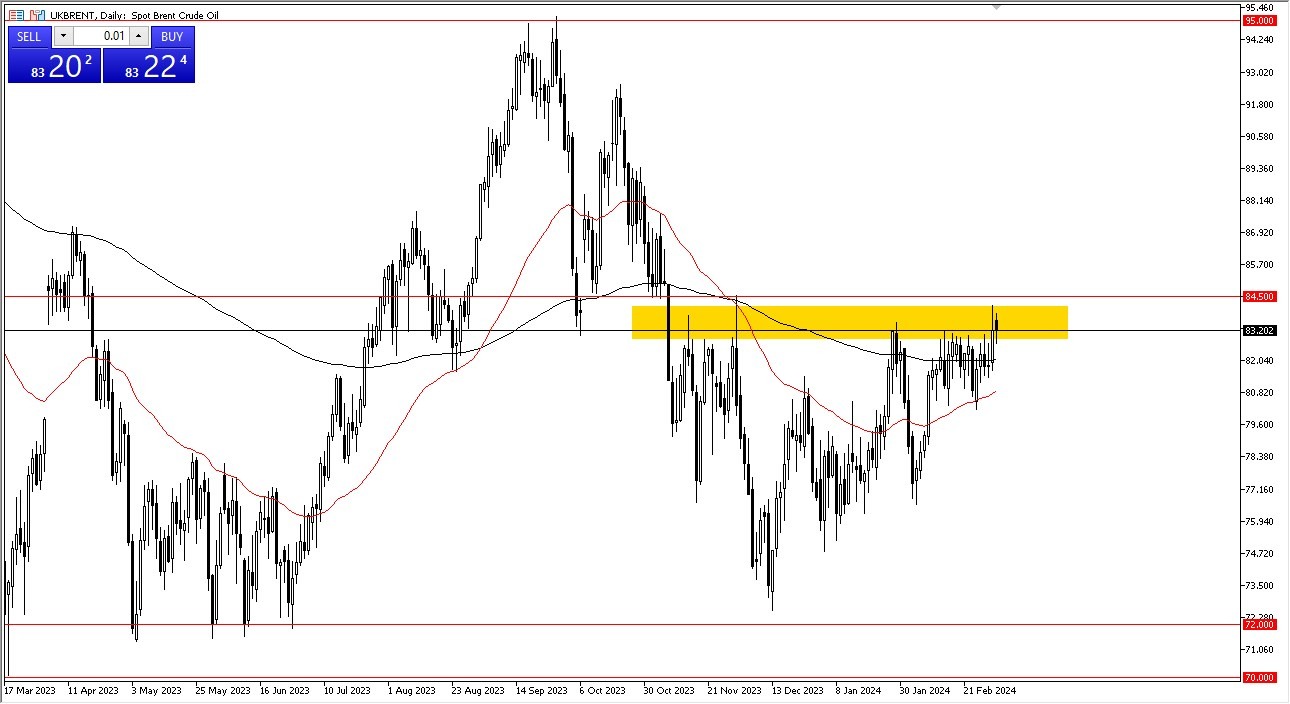

Brent

With $84.50 serving as its barrier, the Brent market remains mostly unchanged. We have seen a lot of volatility near the $84.50 level, but a break above it would allow the Brent market to move substantially higher. Both of the 200-day and 50-day EMAs are currently positioned beneath end offer and support, but they also appear to be creating an inverted head and shoulders pattern, or possibly a rounded bottom pattern, for the crude oil grades that we track. Remember that the season is about to peak for demand, and supply has, of course, been extremely limited lately. In addition, we need to remember that the Middle East's numerous problems may keep prices in the higher range. Having said that, demand should increase over the next several months due to central banks' efforts to lower interest rates, and I believe the market is beginning to reflect this.

Ready to trade our free trading signals? We’ve made a list of the best brokers to trade Forex worth using.