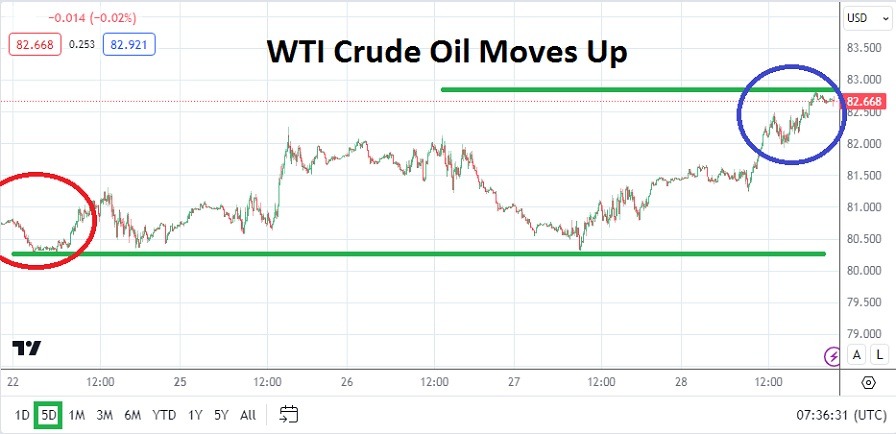

- Proving again that WTI Crude Oil should be watched not only by speculators but by economists, the commodity gathered force and reversed higher on Wednesday after hitting lows around the 80.330 ratio on earlier in the day.

- Not only did current technical support levels prove durable, but the reversal higher came after U.S inventories showed an increase in supply of WTI Crude Oil, which is counter-intuitive.

Holiday trading may have impacted some of the price action for WTI Crude Oil before this weekend because volumes were lighter than normal, but the ability of the commodity to go into the weekend around 82.668 is a signal buyers remain active. WTI Crude Oil finished slightly below the highs seen on the 19th of March when the 83.000 level was momentarily challenged.

Higher WTI Crude Oil Prices and Driving Season

The price of gasoline in the U.S has incrementally gone higher; the increase in WTI Crude Oil prices the past three months is a reflection of this trend. Inflation numbers in the U.S regarding energy is an important factor within logistics, but demand for WTI Crude Oil has shown signs of increasing too. While major economic spheres are within recessionary phases it appears demand may have seen its lower realms and is once again building.

The fact that WTI Crude Oil was battling resistance going into this weekend, this as spring is set to begin in the U.S which means more demand will come via driving season approaching should be considered too. Speculators should look at support levels and the notion that prices of WTI Crude Oil may be able to trader lower, but they may also simply reverse higher again as was displayed last week, and the beginning of the previous week when the 80.000 USD mark came into sight.

Top Forex Brokers

Technical Intrigue and the Price of WTI Crude Oil

In April of 2023 the price of WTI Crude Oil was slightly above 83.000 USD in the second week of the month. Highs were briefly challenged around 84.300 on the 17th of April, but then a downwards trend developed which took the commodity to a low of nearly 68.000 in early May 2023. Noteworthy in this acknowledgement is that WTI Crude Oil began to trade lower as global economic conditions were being called into question, traders may have been betting on recessionary data to flourish which did happen. Demand from the industrial sector certainly decreased.

- The ability of WTI Crude Oil to challenge important resistance needs to be watched early this week.

- Trading on Monday in Crude Oil may be lighter than normal due to the holiday, but speculators should be braced for Tuesday’s price action which could see increased price velocity.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 79.900 to 84.200

If WTI Crude Oil is able to sustain prices above the 82.000 level early this week, this may be a sign that buying sentiment remains in control of the marketplace. If support levels prove durable at the 81.600 and above ratios, speculators may be tempted to look for additional moves higher. If the 82.750 level is penetrated higher it likely means larger players are targeting the 83.000 mark. A sustained move above the 83.000 early this week which shows an ability to hold onto values, could be a sign that bullish behavior is wagering on a retest of August 2023 highs.

Any move above 84.000 will cause strong price action as technical traders start to consider September 2023 ratios which touched the 90.000 level, but that is likely a very ambitious height. Moves above 84.000 in the near-term may be quite speculative, and also bring the potential of strong reversals lower if profit taking starts to flourish. Support near the 81.000 mark should be given attention if downturns occur. Any moves that see price action below 80.000 that are sustained could be a warning sign that bullish behavior has run out of power for the moment.

Ready to trade our Crude Oil weekly forecast? Here’s a list of some of the best Oil trading platforms to check out.