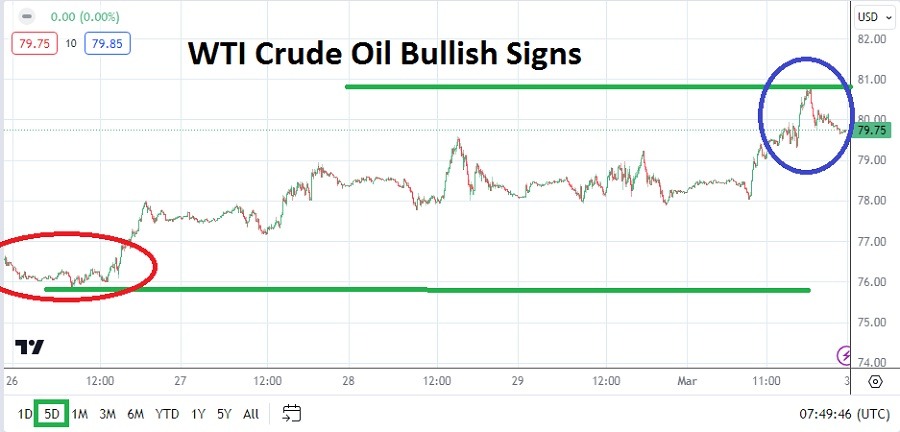

- After starting last week languishing near the important support level of 76.000 USD, WTI Crude Oil began to rise in value in a steady manner.

- The commodity was trading politely near the 77.900 level on Wednesday when U.S Crude Oil Inventories data was released and showed an increase over 4 million barrels in supply than the previous week, and then something interesting happened.

- The price of WTI Crude Oil actually jumped.

Suddenly WTI Crude Oil was touching the 79.500 ratio and the commodity’s volatility was not done yet. After reversing lower and challenging the 78.000 value below on Thursday, WTI Crude Oil began to rise again in price. And then on Friday it happened, the 80.000 level not only looked vulnerable but it was surpassed, and the commodity touched a high around the 80.850 USD mark before starting to ebb lower.

Volatility and Supply Might not be Correlated in WTI Crude Oil

Speculators who have held onto bullish notions in WTI Crude Oil were likely rewarded last week. The commodity has been showing signs of incremental bullishness over the mid-term. In the middle of December WTI Crude Oil was trading near the 68.000 ratio briefly. But yes, technical traders may be quick to point out that on the 26th of January the commodity was trading near the 79.250 mark. The volatility of WTI Crude Oil has been known for a long time – decades.

Since a reversal lower from the late January high, followed by a low on the 5th February near the 71.500 mark, WTI Crude Oil has shown rather sustained demand by buyers, who took the commodity above the 80.000 ratio last Friday for the first time since the first week of November. The question for traders this coming week is if the highs displayed before the weekend ensued were a flash of speculatively demand, or a signal a change in the perspective of WTI Crude Oil prices is really developing.

Top Forex Brokers

The 80.000 USD WTI Crude Oil Price and Behavioral Sentiment

While many will certainly point to the Middle East crisis in the shipping lanes of the Red Sea as a cause for the sudden rise in prices last week, this may be an inflated notion – simply put, wrong. The conflict in the Red and Arabian Seas have been newsworthy for a handful of months, last week’s ‘developing’ news was not extreme. Some speculators may believe the rise in price may be due more to strong ‘buyers’ catching folks who were holding selling positions in a weaker position and the ability to squeeze them. Early trading this week will be crucial regarding insights regarding the price of WTI Crude Oil.

- If the 80.000 USD level is tested and proven vulnerable early this week, this may be a bullish signal and ignite additional buying speculation in WTI Crude Oil.

- Sustained trading above the 80.000 USD mark would be noteworthy, but if WTI Crude Oil is not able to top the ratio early on Monday or on Tuesday, this may be a sign speculative buying may run out of power.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 76.200 to 82.100

WTI Crude Oil appears to be in an interesting trading mode. The ability since the first week of February to show a rather steady climb and higher support levels emerging is noteworthy. Because 80.000 USD is within clear sight, traders will have an easy barometer to test speculative zeal early this week.

If the commodity does trade above 80.000 and is able to penetrate Friday values and challenge the 81.000 USD level, this might set off alarm bells and start to get the attention of more speculative elements. Crude Oil appears to be well supplied for the moment and a move higher in the commodity would be newsworthy and signal speculative bulls may be in control of the market for the time being. Day traders should be particularly cautious this week as WTI Crude Oil tests its higher price range, because additional volatility is almost a certainty.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.