- The market is still consolidating, and the euro performed virtually little in the early hours of Thursday.

- This could be a microcosm of the different financial markets we will witness globally.

- Later in the year, both central banks are probably going to be loose overall.

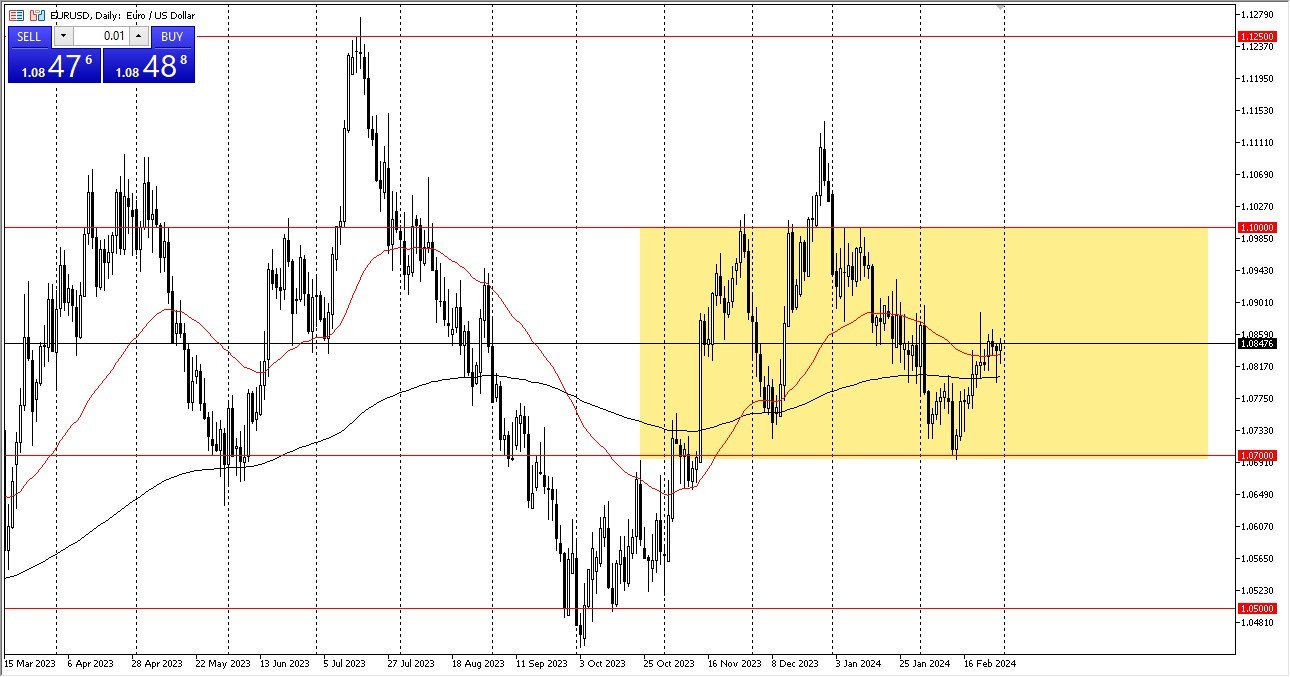

As you can see, the entire week has been somewhat turbulent. Naturally, Thursday was the same as well. Both the 200-day and the 50-day EMAs are in our vicinity. I believe that many systematic traders are consequently unsure about how to proceed with this. You can see that there is a possible consolidation area when you look at this, and I believe that we are currently in the middle of it. There is a potential bottom at 1.07 levels below, and a potential ceiling at 1.10 levels above. This year, the central banks that support both of these currencies are probably going to lower interest rates. Furthermore, it is evident that the European Central Bank (ECB) has numerous concerns regarding a possible slowdown, despite not having the same level of organization as the Federal Reserve. Given that Germany accounts for around 80% of the GDP of the European Union, the country is already experiencing a recession.

Top Forex Brokers

Euro Probably Somewhat Trapped

Therefore, as long as that remains the case, I do believe that the Euro will not necessarily take off, regardless of what the Federal Reserve does. This combination, in my opinion, will be representative of the erratic behavior we will likely witness in all financial markets globally. I believe that for the remainder of the year, the EUR/USD pair will eventually settle inside this range or a comparable one. We might be able to move down to the 1.05 level if we were to break below the 1.07 level. However, the 1.11 level and the 1.1250 level could be our next targets if we rebound from here and break above the 1.10 level.

I simply don't get enthusiastic about significant moves at this stage until we leave the consolidation range that we are attempting to construct. For the time being, scalping will continue to be most suitable to the daily action that is likely to be what we have on our hands. I think at this point the markets continue to be a messy affair to say the least.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.