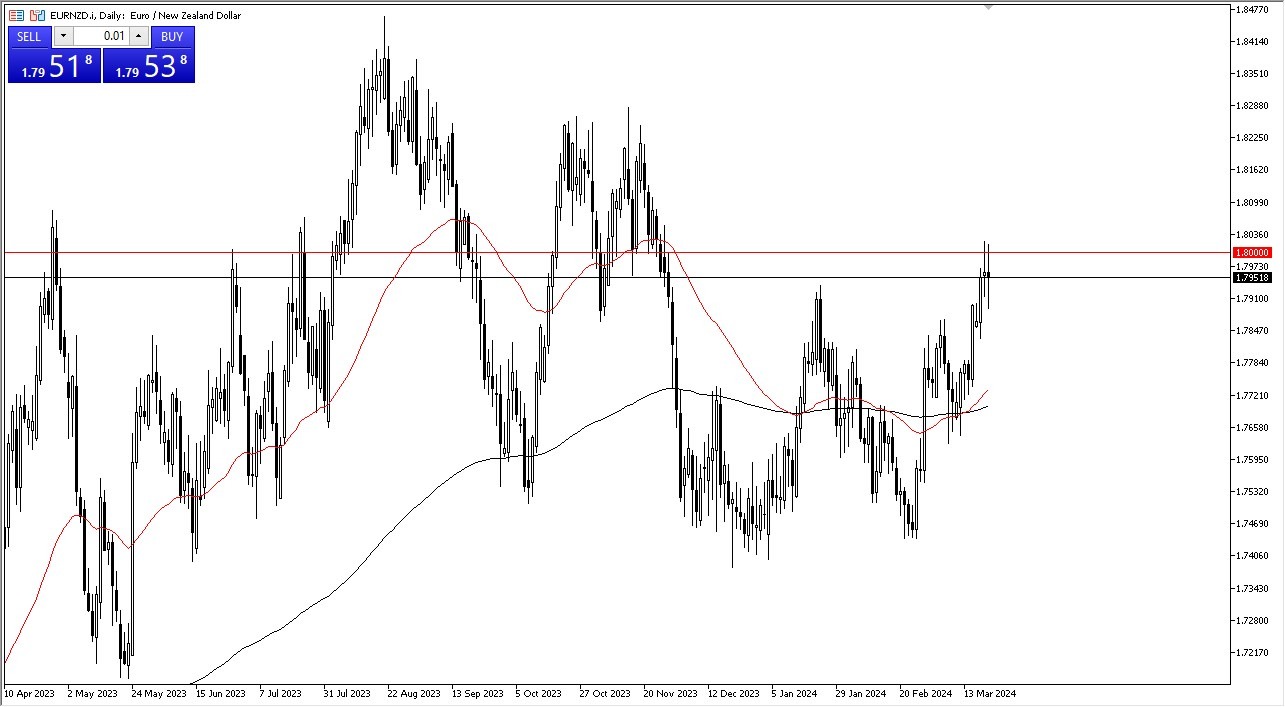

- The EUR/NZD continues to look a bit troubled in general, despite being somewhat stout in this pair.

- After all, the ECB has to deal with the idea of a German recession, and this is a major input to what we will see in not only the EUR/USD pair – but also other “EUR” pairs.

Choppiness Makes a Certain Amount of Sense

Top Forex Brokers

This pair has been rather choppy over the last couple of days and that does make a certain amount of sense considering we are hanging around the psychologically important 1.80 level. At this juncture, it does look like we're running into a bit of trouble and it's probably only a matter of time before we have to make a bigger move. The New Zealand Dollar, of course, is a higher yielding currency on the whole but recently we've seen the ECB suggest that perhaps they're at least open to the idea of cutting rates as Germany heads into a recession so this could set up for a nice shorting opportunity only time will tell with that being the case I like the idea of shorting here at least for the moment but I would not get overly aggressive. We are obviously at a major decision point and therefore when we finally do break out, it will more likely than not end up being rather aggressive.

That aggressive move could be something worth paying close attention to as traders will try to take advantage of momentum. Keep in mind that central banks around the world are likely to continue cutting rates as the Swiss got everything kicked off in the morning. The question now is whether or not the ECB or the New Zealand Central Bank will move first because that's essentially going to be the argument here. I suspect it will be the ECB because if the Swiss are having issues the Europeans more likely than not fare as well. Nonetheless pay close attention to the 1.80 level, this could be important for a bigger move.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.