- Since speculators continue to believe that rate cuts from the Federal Reserve and the European Central Bank are probable this year, the euro has been extremely erratic.

- As a result, there doesn't appear to be much movement in favor of the pair.

- The market is one that I use more or less for a secondary indicator for potential US dollar movement.

Euro Against the Dollar is “meh.”

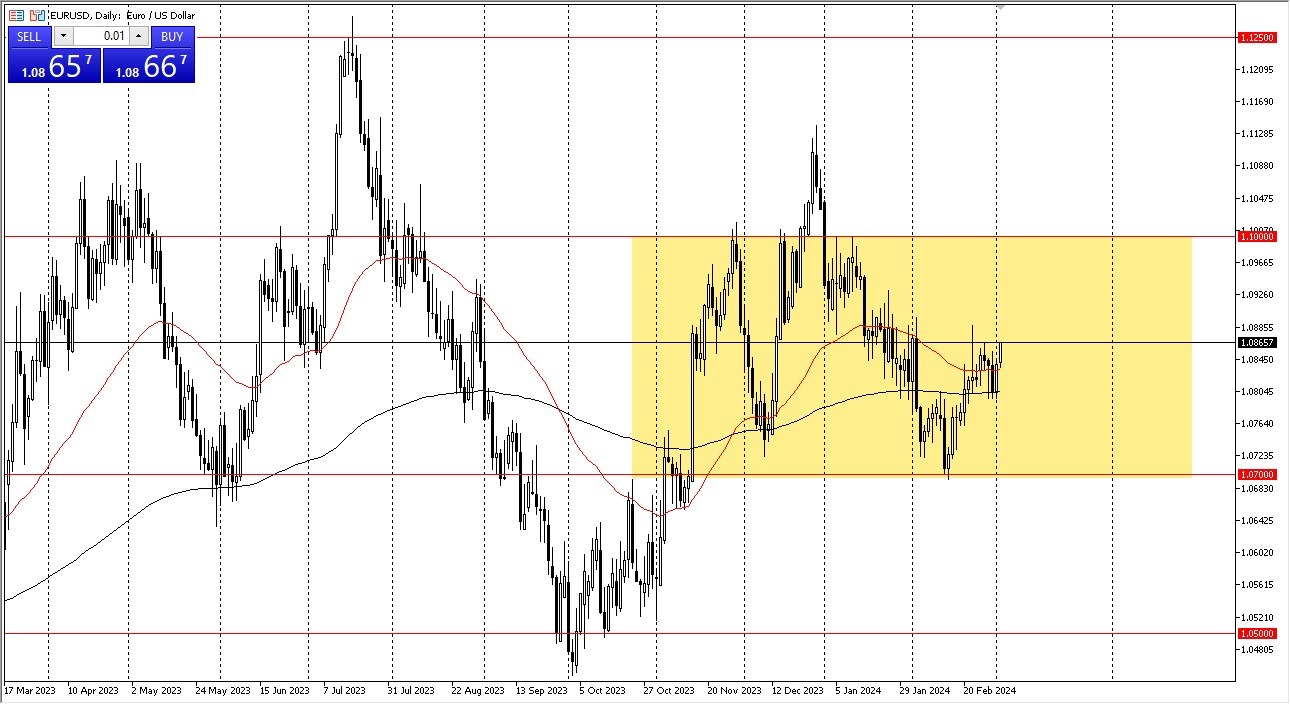

Looking at the Euro, we can see that, despite some upward movement during Monday's trading session, we are still seeing essentially sideways movement. I'm not sure if I would interpret that too literally. The 200-day EMA is beneath us and we are just above the 50-day EMA. This is an indicator that a lot of people will pay attention to.

Top Forex Brokers

Breaking 1.09 will allow us to go on to 1.10. However, depending on either way we break out or down, if we break below the 200 day EMA, it might lead to a move down to 1.07, or about 1% in either direction. Naturally, the euro will need to continue accounting for the possibility of ECB rate cuts. Germany's recession is undoubtedly a serious problem.

This year, rate cuts from the Federal Reserve are anticipated to occur concurrently. Thus, in my opinion, we are having a battle between two currencies that are fundamentally predicted to behave similarly given that we are situated in the center of a broader consolidation area. As a result, I believe the only useful thing to do in this situation is to utilize this currency pair as a barometer for the strength or weakness of the US dollar.

Many short-term scalpers may be drawn to this market as we continue to drift sideways, but if you're seeking to trade here with ease, you're going to struggle unless it's on a five, 10, or 15 minute chart. Generally speaking, I believe that before investing any significant capital in this market, you should wait until it reaches the periphery of the consolidation area. And with that, I'm quite neutral on this pair and simply use it as a barometer for the US dollar's performance in the wider Forex markets because it's the most readily available indicator of strength or weakness.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Europe to check out.