- The euro keeps fluctuating, and there is a lot of volatility as the jobs report was slightly lower than expected.

- Given this, traders will likely continue to notice noisy behavior above all else in this scenario.

- So, because of this, you need to be cautious about your sizing.

Expect Sideways Noise Overall

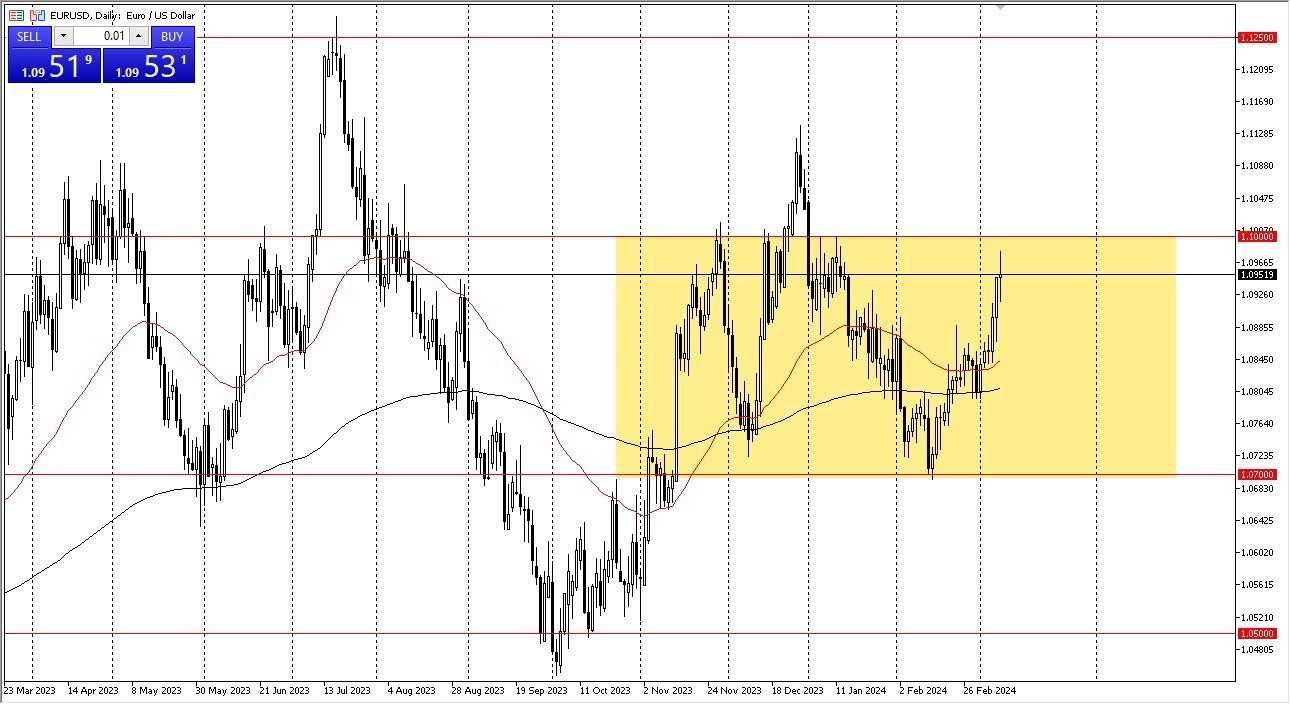

As we continue to see noise from the jobs number, you can see that the euro has been moving both forward and in bank during the trading session. Having said that, a lot of people will likely continue to view this through the lenses of the longer-term chart, where the 1.07 level is the primary support level and the 1.10 level represents a significant resistance barrier.

Having said that, a slight retreat would not surprise me because we are almost at the top. Remember that people will primarily focus on the total difference between the two central banks, and that the non-farm payroll announcement usually generates a lot of false noise. However, a break above the 1.10 mark would be extremely bullish and could lead the market to look for support near the 1.0850 level at 1.1150, which is below the 50-day EMA.

Top Forex Brokers

Naturally, there is also the 200-day EMA. This pair may wind up being somewhat rangebound for the majority of the year, in my opinion. And given that, you have a situation where we might be overextending ourselves. Although I'm not sure if I would short this market just yet, I would not buy it.

positioned slightly below a considerable degree of selling pressure. Given the German recession, the ECB is expected to follow the Federal Reserve in reducing interest rates later this year, as the former has already made this very clear. However, they haven't stated that outright yet. Most likely, the ECB will address that at its upcoming meeting. Having said that, I believe that this pair will be fairly rangebound over the course of the year, and we are approaching the upper end of that range.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Europe to check out.