- We are still seeing some hesitation in this pair, and early in Monday's trading session, the Euro saw the formation of a slightly negative candlestick.

- Ultimately, it is probable that both central banks will adopt a dovish and lenient monetary policy later in the year.

- Put differently, it will ultimately amount to a "race to the bottom."

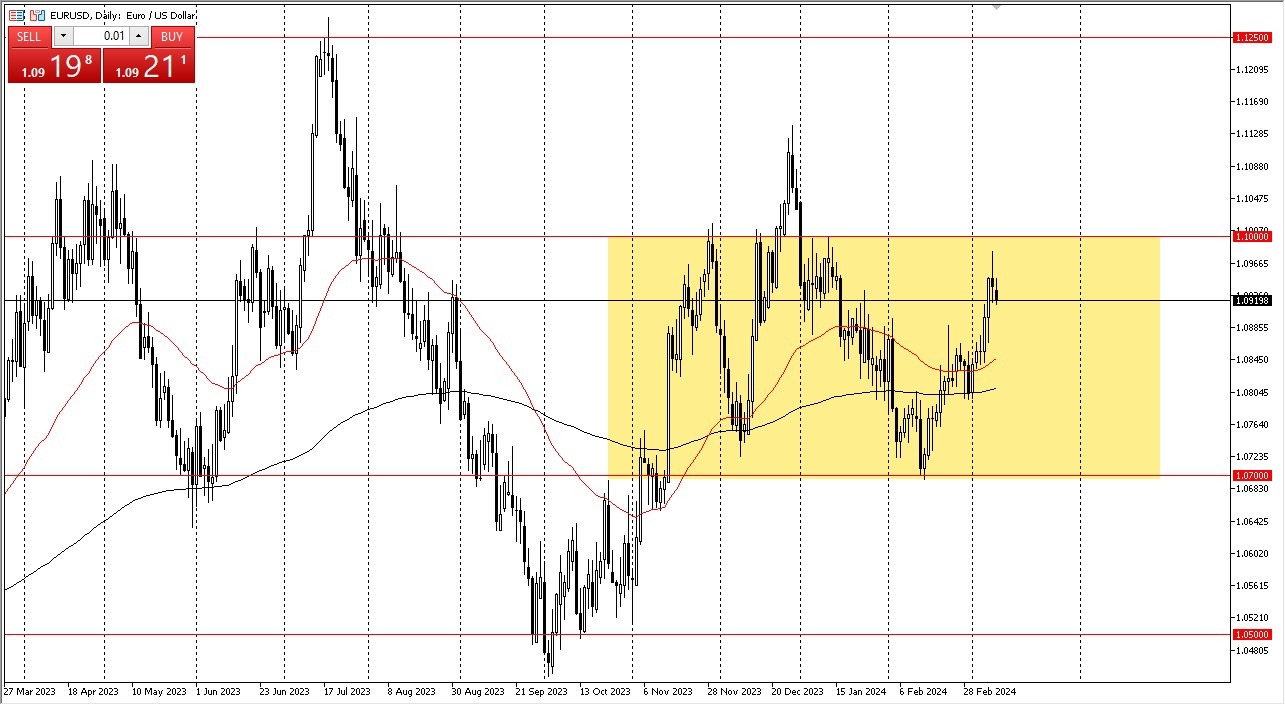

On Monday morning, the EUR/USD gapped lower against the greenback to indicate weakness, but we have since turned around and are showing signs of life again. Right now, the question is whether we can reverse course entirely, climb higher, and possibly remove the main obstacle. Going forward, that might be the case, but for the time being, I believe there is a good chance that we will see a lot of noisy behavior.

Top Forex Brokers

Still Watching 1.10 Above

At the 1.10 level, I believe there is a significant resistance barrier that would be very challenging to overcome. Therefore, I wouldn't consider the Euro to be a bullish currency to own at this time unless we break above that level. Even though we have rallied over the past few weeks, the fact remains that we are at the top of a very well-defined area and, naturally, we are close to an area that has recently seen a lot of negativity, which suggests that we may retreat. If we pull back from here, we might see a move underneath to the 50-day EMA and then maybe all the way down to the 200-day EMA. Since 1.07 is the bottom of the consolidation range, it is more likely to represent the absolute floor in the market.

Since the Europeans and Americans are almost certainly going to be cutting rates this year, I believe that most of this year will likely be spent trading in this range. This will result in two central banks once more racing to the bottom. Having said that, if we do see a daily close above the 1.10 mark, I do think it makes sense to buy rather than fade rallies in this general area. It is, nevertheless, the less desirable of the two options. In light of this, I have mixed feelings about this pair and a slight prejudice against them.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.