- As we attempt to determine the next course of action, the euro continues to see a lot of noise.

- It's important to remember that the 1.10 level above is significant and will receive a lot of attention.

- This continues to be the case, and as a result, I think the markets are going to be a bit of a messy affair.

The Euro Eyes the Same Level

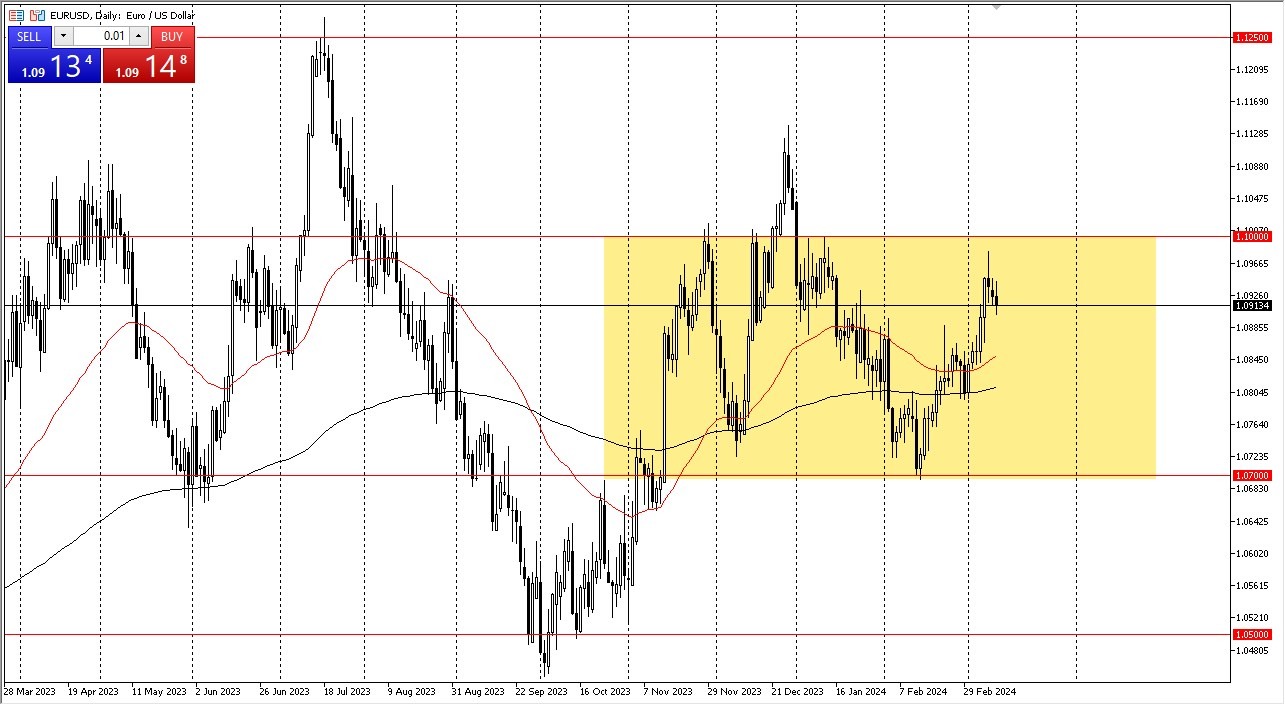

If you look at the euro, you can see that we are generally sideways and a little bit noisy while we wait for the CPI and the pie later this week. The 1.10 level above and substantial resistance are still visible in this market.

As a result, we must give it careful consideration. We have a good amount of support located at the 1.08 level if we were to break above that, especially on a daily close, and I believe the EUR/USD really starts to tick off towards 1.1150 underneath. Additionally, there is the 50-day EMA. Right now, it seems that traders are more worried than anything else about the Federal Reserve lowering rates later in the year.

Top Forex Brokers

In actuality, though, the Europeans will also be lowering rates since, quite simply, they won't have an option. It appears that they will eventually need to stimulate as well, since half of the continent is currently experiencing a recession. Since both of these central banks will be loosening, I do believe that the market will be more or less rangebound for the majority of the year. The pair is usually quite choppy anyhow, so none of this should come as a surprise.

But in the end, I believe that level 1.10 is the one you should focus on the most at this time. At 1.07, the overall chop's lowest point is reached. It is therefore feasible that we could go all the way down there and see very little change. In either case, you must maintain a reasonable position size. Furthermore, I believe that many traders will continue to view this through the lens of trying to find a tiny bit of value whenever and wherever they can. Thus, a brief decline in price usually draws some buying, but I don't think this will be one of the more active pairs this year.

But in the end, I believe that level 1.10 is the one you should focus on the most at this time. At 1.07, the overall chop's lowest point is reached. It is therefore feasible that we could go all the way down there and see very little change. In either case, you must maintain a reasonable position size. Furthermore, I believe that many traders will continue to view this through the lens of trying to find a tiny bit of value whenever and wherever they can. Thus, a brief decline in price usually draws some buying, but I don't think this will be one of the more active pairs this year.

Ready to trade our Forex daily forecast? We’ve shortlisted the top forex brokers in the industry for you.